IBM 2001 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

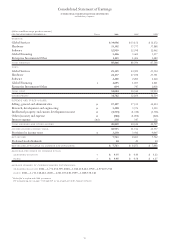

decreased 34.4 percent (33 percent at constant currency) to

$1.6 billion compared with the fourth quarter of 2000.

Revenue from Global Services, including maintenance,

declined 1.4 percent (up 1 percent at constant currency) in

the fourth quarter to $9.1 billion. Global Services revenue,

excluding maintenance, declined 1.6 percent (up 1 percent at

constant currency). The company’s annuity-like outsourcing

and maintenance businesses continued to perform well, but

the company felt the economic pressure in Consulting

Services and BIS during the quarter. In addition, a slowdown

in contract signings in the middle of the year, particularly in

short-term engagements, affected the company’s fourth

quarter revenue. New contract signings for Global Services

in the fourth quarter were approximately $15 billion.

Hardware revenue decreased 24.0 percent (21 percent at

constant currency) to $8.7 billion from the 2000 fourth quar-

ter. Mainframe computing capacity, however, grew 12 percent

in the fourth quarter, as measured in MIPS. Revenue from

the company’s UNIX-based pSeries declined, in large part

because of transition to the company’s new “Regatta” family

of UNIX servers, which began shipping on December 14,

2001. Personal computer and microelectronics revenue

decreased substantially over the prior year’s quarter, princi-

pally due to price pressures in personal computers and an

ongoing downturn affecting the worldwide semiconductor

and OEM markets. Revenue from the company’s high-end

storage product “Shark” grew in a declining market.

Software revenue increased 6.0 percent (8 percent at con-

stant currency) to $3.8 billion compared to the prior year’s

fourth quarter. Overall, the company’s middleware software

revenue grew 9 percent (10 percent at constant currency).

The company’s data management and WebSphere products

had strong growth versus the fourth quarter of 2000.

Although fourth-quarter revenue declined year to year in the

company’s Tivoli and Lotus businesses, both units had

strong revenue growth sequentially. Tivoli and Lotus are

benefiting from operational efficiencies gained as a result of

integrating their business processes into the company’s

Software business, which has improved profitability in both

units. Operating system revenue declined 4 percent (2 per-

cent at constant currency).

Global Financing revenue decreased 4.6 percent (4 percent

at constant currency) in the fourth quarter to $927 million

primarily due to a lower earnings-generating asset base and

lower sales of used equipment. As expected, revenue from

the Enterprise Investments/Other area, which includes

custom-made products to third-party companies, declined

20.0 percent (18 percent at constant currency) compared to

the fourth quarter of 2000 to $340 million. The company

has been consistently shifting development and distribution

of products in this segment to third-party companies.

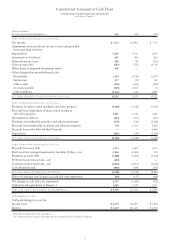

The company’s total gross profit margin improved to

38.3 percent in the 2001 fourth quarter from 37.3 percent in

the 2000 fourth quarter. Gross margins improved in each

revenue segment except for Hardware, which declined by

4.1 points, due to low volumes in the Technology segment

and pricing pressures in personal computers and HDDs.

Despite absorbing workforce-balancing actions and

write-downs of certain equity investments, the company’s

Total Expense and Other Income improved 5.6 percent to

$5.4 billion. The improvement came from each of the com-

pany’s two main expense categories: SG&A expense as well as

research and development expense. The company continued

to reduce its expense and improve operating efficiencies

through the use of electronic procurement, sales, education

and customer support systems. These systems, known

as e-procurement, ibm.com, e-learning and e-Care, have

resulted in substantial productivity improvements. The

company’s fourth quarter 2001 Intellectual property and

custom development income, which includes the transfer of

the company’s optical transceiver intellectual property, was

essentially flat compared to such income in 2000.

The company’s tax rate in the fourth quarter was 29.3 per-

cent compared with 29.5 percent in the fourth quarter of 2000.

The company spent approximately $1.0 billion on common

share repurchases in the fourth quarter. The average number

of common shares outstanding assuming dilution was lower

by 32.6 million shares in fourth quarter of 2001 versus the

fourth quarter of 2000, primarily as a result of the ongoing

common share repurchase program. The average number of

shares assuming dilution was 1,758.0 million in fourth quarter

2001 versus 1,790.6 million in fourth quarter 2000.

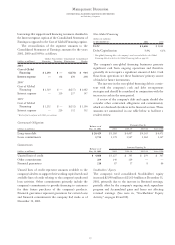

Financial Condition

During 2001, the company continued to demonstrate strong

financial performance, enabling it to make appropriate

investments to support future growth and increase share-

holder value. The company spent $5,844 million for research,

development and engineering, including software develop-

ment that was capitalized on the Consolidated Statement of

Financial Position, $4,483 million for plant and other prop-

erty, including machines used in strategic outsourcing

contracts; $1,177 million for machines on operating leases

with customers; and $5,293 million for the repurchase of the

company’s common shares. In addition, the company paid

cash totaling approximately $916 million of the aggregate

$1,082 million purchase price of the company’s two acquisi-

tions in 2001. The company had $6,393 million in Cash and

cash equivalents and current Marketable securities at

December 31, 2001. The company’s debt levels declined

$1,425 million in 2001 primarily due to a decline in Global

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

64