IBM 2001 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

96

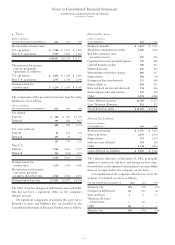

of retirement eligibility with at least one year of service, or

who were at least forty years of age with at least ten years of

service as of June 30, 1999, could elect to participate under

the new formula or to have their service and earnings credit

accrue under the preexisting benefit formula. Benefits

become vested on the completion of five years of service

under either formula.

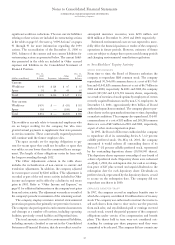

The number of individuals receiving benefits from the

PPP at December 31, 2001 and 2000, was 131,071 and

129,290, respectively. Net periodic pension income for this

plan for the years ended December 31, 2001, 2000 and 1999,

was $1,025 million, $896 million and $638 million, respec-

tively. Although these pension income amounts represent a

contribution to the company’s income before income taxes,

these amounts are partially offset by the costs of the com-

pany’s other retirement-related plans (see table above).

Moreover, these amounts have positive implications for the

company’s employees, retirees and shareholders. The

returns that the fund has experienced over time have

resulted in these benefits. Therefore, despite the recent

downturn in the equity and financial markets, the trust funds

continued to provide the capacity to meet their obligations

to current and future retirees.

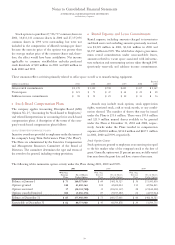

U.S. regular, full-time and part-time employees are eligible

to participate in the Tax Deferred Savings Plan 401(k) (TDSP),

which is a qualified voluntary defined contribution plan. The

company matches 50 percent of the employee’s contribution

up to the first 6 percent of the employee’s compensation. All

contributions, including the company match, are made in cash

in accordance with the participants’ investment elections.

There are no minimum amounts that must be invested in

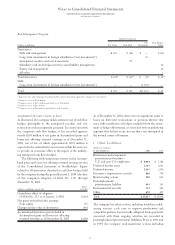

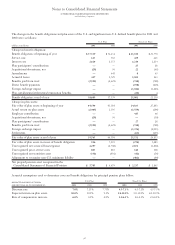

uRetirement-Related Benefits

IBM offers defined benefit pension plans, defined contribution pension plans and nonpension postretirement plans, primarily

consisting of retiree medical benefits. These benefits form an important part of the company’s total compensation and bene-

fits program that is designed to attract and retain highly skilled and talented employees. The following table provides the total

retirement-related benefit plans impact on income before income taxes.

U.S. Non-U.S. Total

(dollars in millions) 2001 2000 1999 2001 2000 1999 2001 2000 1999

Total retirement-related

plans

—

(income)/cost $«(256) $«(156) $««««47 $«(181) $«(171) $«36 $«(437) $«(327) $««««83

Comprises:

Defined benefit and

contribution pension plans $«(632) $«(530) $«(295) $«(209) $«(198) $«««7 $«(841) $«(728) $«(288)

Nonpension postretirement

benefits 376 374 342 28 27 29 404 401 371

See Management Discussion on pages 62 and 63 for addi-

tional discussion regarding the company’s retirement-related

benefits. Also see note a, “Significant Accounting Policies,”

pages 76 and 77 for the company’s accounting policy regard-

ing retirement-related benefits.

DEFINED BENEFIT AND DEFINED CONTRIBUTION PLANS

The company and its subsidiaries have defined benefit and

defined contribution pension plans that cover substantially

all regular employees, and supplemental retirement plans

that cover certain executives.

U.S. Plans

IBM provides U.S. regular, full-time and part-time employ-

ees with a noncontributory plan that is funded by company

contributions to an irrevocable trust fund, which is held for

the sole benefit of participants.

Effective January 1, 2001, the company increased pension

benefits to certain recipients who retired before January 1,

1997. The increases range from 2.5 percent to 25 percent,

and are based on the year of retirement and the pension

benefit currently being received. This improvement resulted

in an additional cost to the company of approximately

$100 million in 2001.

Effective July 1, 1999, the company amended the IBM

Retirement Plan to establish the IBM Personal Pension Plan

(PPP). The new plan establishes a new formula for deter-

mining pension benefits for many of the company’s

employees. Under the amended PPP, a new formula was

created whereby retirement benefits are credited to each

employee’s cash balance account monthly based on a per-

centage of the employee’s pensionable compensation.

Employees who were retirement eligible or within five years