IBM 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

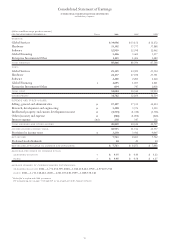

Software revenue increased 2.7 percent (7 percent at con-

stant currency) in 2001, following a decline of 0.5 percent

(up 4 percent at constant currency) in 2000 from 1999. The

company’s middleware products grew revenue 5 percent

(9 percent at constant currency) in 2001 and 3 percent (8 per-

cent at constant currency) in 2000. Middleware comprises

data management, transaction processing, Tivoli systems

management and Lotus Notes messaging and collaboration

for both IBM and non-IBM platforms. Middleware revenue

increases in 2001 and 2000 were driven by strong growth in

WebSphere (Web application server software), DB2 (data

management) and MQSeries (business integration software)

offerings. Revenue from the acquisition of the Informix

database business in July 2001 contributed about 62 percent

of the middleware software growth in 2001. These increases

were partially offset by revenue declines in Tivoli and Lotus

products. Although revenue was down in both 2001 and

2000 in Tivoli and Lotus businesses, both units grew rev-

enue sequentially from quarter to quarter within 2001. The

company continues to focus on helping customers use IBM’s

software to transform businesses to e-businesses across all

platforms. To achieve this, the company uses its services

offerings, 74 strategic alliances, 56,000 business partners and

a 10,000-person dedicated software sales force. These pro-

vide the company with strong momentum in its Software

business as it enters 2002.

Operating systems software revenue declined 3 percent

(up 1 percent at constant currency) in 2001 and 9 percent

(5 percent at constant currency) in 2000 compared with the

prior year. The decline in 2001 resulted from lower revenue

associated with iSeries and pSeries server products. The

decline in 2000 was driven by lower revenue associated

with e-server products and legacy (S/390, AS/400 and

RS/6000) products.

Software gross profit dollars increased 3.5 percent in

2001 from 2000, following a decrease of 1.0 percent in 2000

from 1999. The Software gross profit margin improved

0.6 points in 2001 following a decline of 0.4 points in 2000

compared to 1999. The increase in gross profit dollars and

gross profit margin was primarily due to higher Software

revenue, lower service costs and purchased vendor software,

partially offset by higher amortization costs and vendor

royalty payments in 2001 versus 2000. The decline in gross

profit dollars and gross profit margin in 2000 was primarily

due to lower revenue, higher costs for purchased vendor

software and higher vendor royalty payments, partially offset

by lower amortization and services costs.

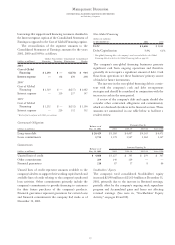

GLOBAL FINANCING

(dollars in millions) 2001 2000*1999*

Revenue $«3,426 $«3,465 $«3,137

Cost 1,693 1,965 1,821

Gross profit $«1,733 $«1,500 $«1,316

Gross profit margin 50.6% 43.3% 41.9%

*Reclassified to conform with 2001 presentation.

Global Financing revenue declined 1.1 percent (up 1 percent

at constant currency) in 2001 from 2000, following an

increase of 10.4 percent (13 percent at constant currency) in

2000 versus 1999. The decline in 2001 was primarily a result

of a lower earnings-generating asset base and lower used

equipment sales. The revenue increase in 2000 over 1999

was due to higher used equipment sales and commercial

financing activity.

Global Financing gross profit dollars increased 15.5 per-

cent in 2001 versus 2000, following an increase of 14.0

percent in 2000 versus 1999. The Global Financing gross

profit margin improved 7.3 points in 2001 following an

increase of 1.4 points in 2000 as compared to 1999. The

increases in 2001 gross profit dollars and gross profit margin

were primarily driven by lower borrowing costs related to the

current interest rate environment and increased margin in

used equipment sales. The increase in 2000 was primarily

driven by higher sales of used equipment and an improving

gross profit margin on these sales. See Management Discus-

sion on page 62 for additional information regarding Cost

of Global Financing reclassification effective in 2001. All

amounts displayed herein for all years presented have been

reclassified to conform with these changes. (Also see the “Debt

and Equity” section of Management Discussion on pages 66

and 67 for additional discussion of Global Financing debt.)

ENTERPRISE INVESTMENTS/OTHER

(dollars in millions) 2001 2000 1999

Revenue $«1,153 $«1,404 $«1,689

Cost 634 747 1,038

Gross profit $««««519 $««««657 $««««651

Gross profit margin 45.0% 46.8% 38.5%

As expected, Enterprise Investments/Other revenue decreased

17.9 percent (14 percent at constant currency) from 2000,

following a decrease of 16.9 percent (13 percent at constant

currency) in 2000 from 1999. The decreases in revenue were

a result of the company’s strategy to shift development

and distribution of custom-made products to third-party

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

60