IBM 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ibm annual report 2001

dear fellow investor,

This is my last annual letter to you.

By the time you read this, Sam Palmisano will be our new

Chief Executive Officer, the eighth in IBM’s history. He will

be responsible for shaping our strategic direction, as well as

leading our operations. For a discussion of IBM’s performance

in 2001, I invite you to read Sam’s first letter to shareholders,

starting on page 45.

I want to use this occasion to offer a perspective on what lies

ahead for our industry. To many observers today, its future

is unclear, following perhaps the worst year in its history.

Alot of people chalk that up to the recession and the “dot-com

bubble.” They seem to believe that when the economies of the

world recover, life in the information technology industry will

get back to normal.

In my view, nothing could be further from the truth.

Table of contents

-

Page 1

dear fellow investor, This is my last annual letter to you. By the time you read this, Sam Palmisano will be our new Chief Executive Ofï¬cer, the eighth in IBM's history. He will be responsible for shaping our strategic direction, as well as ibm annual report 2001 leading our operations. For a ... -

Page 2

chairman's letter 1 financial charts 6 sixteen decisions that transformed ibm 9 seven shifts that will transform the future 42 ceo's letter 45 financial highlights 48 financial report 53 stockholder information 107 board of directors and senior management 108 -

Page 3

... and institutions. For most of that era, the applications of the technology were fairly limited - focused on the automation of back-office processes like accounting and payroll, or desktop applications such as word processing and e-mail. Then, starting in the early 1990s, businesspeople began... -

Page 4

... it okay for IBM Global Services to recommend competitors' hardware or software? Should the IBM software business develop solutions for Sun or HP servers? How about letting our hardware units support Oracle or Microsoft products? In every case, the answer was: We'll do what customers want. Once we... -

Page 5

..., but also the utility-like delivery of computing - from applications, to processing, to storage. We see the beginnings of this trend in Web hosting and our own "e-business on demand" offerings, where customers don't buy computers, but acquire computing services over the Net, on a pay-for-use basis... -

Page 6

...ve years ago - middleware. It stood to reason that, in a distributed model, profitability would be distributed, too. So we zeroed in on three sweet spots of the new computing "stack": enterprise systems, integrating middleware, and the specialized, high-value components (such as custom chips) that... -

Page 7

SAM U E L J. PALM I SANO JOH N M. THOM P SON LOU I S V. G E R STN E R, J R. President and Chief Executive Ofï¬cer Vice Chairman of the Board Chairman of the Board 5 -

Page 8

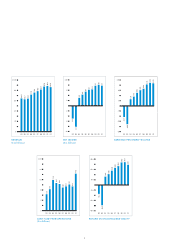

... 00 01 -10 92 93 94 95 96 97 98 99 00 01 -8.1 -5 92 93 94 95 96 97 98 99 00 01 R EVE N U E N ET I NC OM E EAR N I NG S P E R S HAR E - DI LUTE D ($ in billions) ($ in billions) 39.0 45% 32.6 39.7 $ 20 16 14.3 27% 14.3 18.5 10.7 12 11.8 10.3 9% 10.1 8.9 9.3 9.3 8 6.3 8.3 -9% -15... -

Page 9

... and marketing self-sufï¬cient systems - toward reimagining and rebuilding them for open platforms. We now share our emerging software products with the developer community; license our technology and patents; and champion common standards at all levels, from Linux, to Java, to Web services. Most... -

Page 10

... change. With e-business, we caught the wave early. We bet the company on the networked world, and that will serve IBM well for years. But I'm sure that Sam will face, during Thanks to a smart, committed board of directors, who provided wisdom, guidance and support for an agenda full of risk... -

Page 11

Sixteen decisions that transformed IBM -

Page 12

The Wall Street Journal, Tuesday, November 10, 1992 -

Page 13

... spring of 1993, new leadership brought a new vision - and a surprising decision. IBM would stay together. We believed niche players weren't the future. In fact, breaking up the company would have been the end of everything IBM stood for. We made a big bet that customers needed a partner who could... -

Page 14

Chess Grandmaster Garry Kasparov versus IBM supercomputer Deep Blue, May 11, 1997 -

Page 15

.... (In 2001, we became the ï¬rst company to receive more than 3,000 U.S. patent awards in one year. It was also the ninth straight year we were awarded more patents than any enterprise in any industry.) Nor is it mostly a function of the discoveries in new fields that are pouring out of our labs, as... -

Page 16

... for IBM e-business Innovation sydney, australia Monitors the I/T systems for more than 80 customers simultaneously from the IBM Global Services command center. chicago, illinois Spends 40% of his time in customer locations, the rest in the IBM multimedia center solving complex e-business problems... -

Page 17

... managed, in the ways that ideas are shared. In order to deliver on our value proposition, we had to change the very nature of work. Speed since 1993, cycle time for large systems development has been slashed 56 months to 16 months today. for low-end systems , it's seven months-down from two years... -

Page 18

-

Page 19

... the time, it was billed as the largest software acquisition ever. It was actually much bigger than that. It was the moment that signaled we were out of survival and turnaround mode; when we asserted the will to lead again. In acquiring Lotus and its elegant collaborative software program, Notes, we... -

Page 20

With its debut in 1964, the IBM System/360 deï¬ned an era in high-end computing. And the name was no accident. The 360, as in the perfect circle, was the paradigm of proprietary systems architecture - its own self-contained world of hardware, software and peripheral equipment. -

Page 21

... tried to impose closed technology on customers would be standing on the wrong side of history. Getting to the right side wasn't easy. It involved opening up our software to run on all the industry-leading platforms, and supporting non-IBM software on our hardware. Even our services business had to... -

Page 22

... Software Engineer IBM Fellow RAVI AR I M I LLI IBM Fellow and Chief Architect, eServer Microprocessors & Systems N E LSON M. MAT TOS S USAN CAU NT DAVE BOUTCH E R Distinguished Engineer and Director, Information Integration - Data Management Hardware Management Console Project Manager, pSeries... -

Page 23

.... Today, we are the number 1 or number 2 company in servers; collaborative software; custom logic; middleware; I/T services; maintenance; Web software; high-end disk storage; distributed application software; and total software. It's remarkable how much more you win when you're in the right game. -

Page 24

... IBM forms Integrated Systems Solutions Corporation, ISSC - the precursor to IBM Global Services - and the IBM Consulting Group. 1992 IBM North America's services business grows 38 percent to $4 billion. IBM becomes the largest services provider in Europe with revenues of $2.3 billion. 1993 IBM... -

Page 25

...I/T consulting, to systems architecture, to Web services. We used our ï¬nancial strength to fund the expensive push into outsourcing. And we placed informed bets on the future - in areas such as I/T utility services ("e-business on demand") and hosted storage. But most important, the success of IBM... -

Page 26

...IBM jointly form a new solutions company and enter into a strategic outsourcing partnership. IBM and Shanghai Telecom form a strategic alliance to provide e-business hosting services. IBM and The Bank of China's Jiangsu Branch celebrate the installation of the 100th Shark Enterprise Storage Server... -

Page 27

... values and principles. strategic outsourcing revenue in asia went from nothing in 1995 to $2.6 billion in 2001 , with 47 percent growth at constant currency last year in japan , services revenue in 2001 increased 25 percent in a very difficult economy our staff in the people 's republic of china... -

Page 28

... that integrate architecture, furniture design and advanced I/T to increase creativity, improve comfort and provide more personalization. Product Lifecycle Management IBM and Dassault Systèmes: advanced solutions that enable product innovation, design collaboration and the sharing of product... -

Page 29

... OM M U N IT Y "IBM products aren't launched. They escape." During the early 1990s, we heard that frequently, both from customers and from our own scientists, engineers and developers. So we set to work reinventing the way we create, develop and deploy new technologies. We got innovations to market... -

Page 30

N I NTE N D O CANON e.DIG ITAL DE LL GameCube PowerShot S30 Digital Camera Treo 10 Digital Music Jukebox Inspiron 8200 Notebook Computer -

Page 31

... kind of chip design. This is a good time to have the largest custom chip business in the world. We do. In 2001, IBM was one of only two top-30 chip makers that grew revenue. C OM PAQ N I KON F RONTI E R LAB S e.DIG ITAL KYO CE RA M ITA iPAQ Pocket PC Coolpix 5000 Digital Camera Nex II... -

Page 32

January 2002 -

Page 33

... of mainframe computing capacity have increased more than 30 percent annually. And in the years since the last one was to have been unplugged, our mainframe business has generated revenues in excess of $19 billion. " it 's clear that corporate customers still like to have centrally controlled... -

Page 34

... our business with a new e-business infrastructure- powered by IBM database, communications, application and system management software. For customers, this means new and better services. For employees, it means our intranet, e-Spacio, can simplify and speed up how we work." JOS E MAN U E L AG... -

Page 35

.... It's also what we bet our software business on in 1995, when we were looking for IBM's next growth opportunities. Middleware is the collection of products - databases, transaction management systems, messaging, systems management - that lets customers do things they care about. Things like... -

Page 36

...people with PCs anywhere could order our products...and that was all tied together with inventory, billing, vendors. You know, the works. Then, that would change everything. Web Guy (perplexed): I don't know how to do that. Closing title shot: IBM helps thousands of companies do real business on the... -

Page 37

... us, and to them. This wasn't about cranking up the volume, issuing more press releases, or producing memorable TV commercials. It was about rediscovering our conï¬dence and articulating what we believe. Things like: • we are entering a post-pc era. • the dot-coms are fireflies before the storm... -

Page 38

...HOB B S LU BA M. LAB U N KA I/T Specialist Certified Sales Specialist, Personal Computing Director, Corporate Brand Strategy Senior Project Manager, Emerging Market Finance G E R I AR R IGO K I M B E R LY NAS UTA LAR RY R IC CIAR DI G RACE S U H Administrative Assistant Systems Management... -

Page 39

... middle of the decade, the company was no longer on life-support. But there was one more hill to climb. In order to deliver on IBM's value proposition - uniting business knowledge and technology to provide integrated solutions for our customers- we had to change something even tougher. Ourselves. We... -

Page 40

-

Page 41

..., when we were taking a consultative approach to transforming customers' back-ofï¬ce processes like accounting and payroll. In the late 1980s, however, we lapsed. We forgot that the commitment to business solutions - not technology for technology's sake - is what separates IBM from the ï¬eld. That... -

Page 42

-

Page 43

... throughout the world with its $70 million reinventing education grant program u.s. environmental protection agency presented ibm the 2001 energy star® "excellence in corporate commitment" award during the past six years , ibm has increased its number of women executives worldwide by 246 percent -

Page 44

...like heart rate, digestion and breathing), this will make our systems more reliable, self-managing, self-protecting and even self-healing- freeing up enterprises to focus on more creative things, like new uses for those very systems. 3. Enterprises will dismantle industrial age workplaces. Once, we... -

Page 45

..., user names and customer proï¬les that multiply every time we surf a new website - and as a result, fragment the image we present any time we enter a physical store, classroom, website, bank, or government office. The solution? Technologies being developed today by IBM and others can make possible... -

Page 46

-

Page 47

... investor , Last year at this time, Lou Gerstner said 2001 would be a "show me" year for IBM. We knew heading into 2001 that global economies were decelerating, and that IBM wouldn't be immune from the slowdown. We also knew that a tight economy would provide an acid test of our competitive position... -

Page 48

... message of 2001. We won a lot more than we lost, and based on that record alone, IBM enters 2002 far stronger and better positioned than when last year began. In an environment in which revenue growth was hard to come by, our two principal growth businesses- software and services - delivered the... -

Page 49

...that point to continued strength this year. The positives start with a dramatically improved services proï¬t performance, contributing nearly half of all IBM pre-tax proï¬t for the year. We increased revenues from services associated with e-business and strategic outsourcing; and revenues from Web... -

Page 50

...HTS International Business Machines Corporation and Subsidiary Companies (dollars in millions except per share amounts) FOR THE YEAR 2001 2000 Revenue Net income Per share of common stock: Assuming dilution Basic Net cash provided from operating activities Investment in plant, rental machines and... -

Page 51

... - in other words, the kinds of computing systems that have defined IBM's franchise. We gained share in every key segment of hardware and software infrastructure last year. B US I N E S S I N S IG HT Customer investment decisions increasingly are being made in favor of partners who can provide... -

Page 52

... the world's largest servers and storage systems.) Fulï¬lling that demand is a proposition far different from stamping out millions of look-alike microprocessors for personal computers. Every kind of device will require a slightly different chip design. Our custom logic business is the largest in... -

Page 53

... hard to remember an IBM whose culture wasn't grounded in simple-but-vital work to restructure our PC business - it is that we have the smarts, the agility and the guts to seize a new direction and to lead change. Together, we're going to build on everything we've done to this point, and make IBM... -

Page 54

... of the industry 's most advanced information technologies, including computer systems, software, networking systems, storage devices and microelectronics. we translate these advanced technologies into value for our customers through our professional solutions and services businesses worldwide. -

Page 55

...-Based Compensation Plans Retirement-Related Beneï¬ts Segment Information 75 79 81 83 83 83 83 84 84 84 85 87 88 89 90 91 91 93 94 94 96 100 106 106 107 108 Five-Year Comparison of Selected Financial Data Selected Quarterly Data Stockholder Information Board of Directors and Senior Management 53 -

Page 56

... position of International Business Machines Corporation and subsidiary companies at December 31, 2001 and 2000, and the results of their operations and their cash ï¬,ows for each of the three years in the period ended December 31, 2001, in conformity with accounting principles generally accepted... -

Page 57

... business and the rest. Certain employee data is located at the end of this section. It is useful to read the Management Discussion in conjunction with note v, "Segment Information," on pages 100 through 105. IBM follows generally accepted accounting principles. It is important for investors... -

Page 58

.... Both inventories and accounts receivable were lower versus the prior year. The company's balance sheet remains strong. uncertain global business environment in 2001. In addition, the company gained market share in the key business segments of services, software, storage and servers. Notably... -

Page 59

.... The average number of common shares outstanding assuming dilution was lower by 40.9 million shares in 2001 versus 2000 and 59.0 million shares in 2000 versus 1999, primarily as a result of the company's common share repurchase program. The average number of common shares outstanding assuming... -

Page 60

... increased more than 30 percent as measured in MIPS (millions of instructions per second) versus 2000. In addition, revenue growth in storage products was driven by high-end products ("Shark"). pSeries revenue decreased in 2001 as the market for UNIXbased servers declined substantially, but the new... -

Page 61

...-end pSeries Web servers. In addition, revenue from the company's storage products, which include "Shark," increased in 2000. These increases were partially offset by revenue declines for the mid-range iSeries servers and the zSeries servers in 2000 as compared to 1999. Personal and Printing Systems... -

Page 62

... both IBM and non-IBM platforms. Middleware revenue increases in 2001 and 2000 were driven by strong growth in WebSphere (Web application server software), DB2 (data management) and MQSeries (business integration software) offerings. Revenue from the acquisition of the Informix database business in... -

Page 63

...of e-procurement, ibm.com, e-Care for customer support and other actions related to the company's ongoing e-business transformation resulted in substantial productivity improvements in 2001. In addition, the company continued to reduce discretionary spending such as travel and consulting in 2001 and... -

Page 64

... from 2000 and 1.4 percent in 2000 versus 1999. The declines were primarily due to lower average interest rates and a decline in average debt outstanding in the periods. The following table provides the total pre-tax (income)/ cost for retirement-related plans for 2001, 2000 and 1999. (Income)/cost... -

Page 65

... an additional $195 million of net retirement plan income for the year ended December 31, 2000. The company annually sets its discount rate assumption for retirement-related beneï¬ts accounting to reï¬,ect the rates available on high-quality, ï¬xed-income debt instruments. Using this process, the... -

Page 66

... the prior year's quarter, principally due to price pressures in personal computers and an ongoing downturn affecting the worldwide semiconductor and OEM markets. Revenue from the company's high-end storage product "Shark" grew in a declining market. Software revenue increased 6.0 percent (8 percent... -

Page 67

... of lower inventory levels within the Personal and Printing Systems segment. The company's inventory turnover ratio declined to 5.8 in 2001 from 6.3 in 2000. Current liabilities declined $1,287 million from year-end 2000, primarily due to decreases of $1,145 million in Accounts payable, $644 million... -

Page 68

...business, and supported almost 42 percent of the company's total assets. In 2001, Global Financing debt to equity ratio increased to 6.8x, which is within management's acceptable target range. The company's Global Financing business provides funding predominantly for the company's external customers... -

Page 69

... operations are these businesses' primary source of funds for future investments. The increase in the non-global ï¬nancing debt is consistent with the company's cash and debt arrangement strategies and should be considered in conjunction with the increase in cash in the same period. A review of the... -

Page 70

.... In addition to the market risk associated with interest rate and currency movements on outstanding debt and non-U.S. dollar denominated assets and liabilities, other examples of risk include collectibility of accounts receivable and recoverability of residual values on leased assets. The company... -

Page 71

..., particularly the Informix database business, added to the 2001 workforce as well. In less than wholly owned subsidiaries, the number of employees increased from last year, particularly in Europe and China. This growth reï¬,ects a new subsidiary in Europe related to a major services venture with... -

Page 72

..., general and administrative Research, development and engineering Intellectual property and custom development income Other (income) and expense Interest expense TOTAL E X P E N S E AN D OTH E R I NC OM E I NC OM E B E FOR E I NC OM E TAX E S p p p p j&k Provision for income taxes N ET I NC OM... -

Page 73

... except per share amounts) AT DECEMB ER 31: Notes 2001 2000 AS S ETS Current assets: Cash and cash equivalents Marketable securities Notes and accounts receivable - trade, net of allowances Short-term ï¬nancing receivables Other accounts receivable Inventories Deferred taxes Prepaid expenses... -

Page 74

...,975 shares) and sales (6,606,223 shares) of treasury stock under employee plans - net Other treasury shares purchased, not retired (70,711,971 shares) Fair value adjustment of employee beneï¬ts trust Increase due to shares issued by subsidiary Tax effect - stock transactions Stockholders' equity... -

Page 75

... sales (11,801,053 shares) of treasury stock under employee plans - net Other treasury shares purchased, not retired (48,841,196 shares) Dissolution of employee beneï¬ts trust (20,000,000 shares) Decrease in shares remaining to be issued in acquisition Tax effect - stock transactions Stockholders... -

Page 76

... from operating activities: Depreciation Amortization of software Deferred income taxes Gain on asset sales Write-down of impaired investment assets Other changes that provided/(used) cash: Receivables Inventories Other assets Accounts payable Other liabilities N ET CAS H P ROVI DE D F ROM OP E RATI... -

Page 77

... 31, 2001 and 2000, respectively, included in Notes and accounts receivable - trade on the Consolidated Statement of Financial Position. In these circumstances, billings usually occur shortly after the company performs the services and can range up to six months later. Unbilled receivables are... -

Page 78

... are amortized for periods up to 5 years. See "New Standards to Be Implemented" on pages 80 and 81 for additional information on goodwill. Retirement-Related Benefits The company accounts for its deï¬ned beneï¬t pension plans and its nonpension postretirement beneï¬t plans using actuarial models... -

Page 79

... closely matches the pattern of the services provided by the employees. Differences between actual and expected returns are recognized in the net periodic pension calculation over ï¬ve years. The company uses long-term historical actual return information, the mix of investments that comprise plan... -

Page 80

... alliance investments, are considered available for sale and are reported at fair value with changes in unrealized gains and losses, net of applicable taxes, recorded in Accumulated gains and losses not affecting retained earnings within Stockholders' equity. Realized gains and losses are calculated... -

Page 81

...be the expected fair market value of the assets at the end of the lease term. On a quarterly basis, the company reassesses the realizable value of its lease residual values. In accordance with generally accepted accounting principles, anticipated increases in speciï¬c future residual values are not... -

Page 82

... also requires new disclosures which were not applicable to the company. Pursuant to the Securities and Exchange Commission's Staff Accounting Bulletin (SAB) No. 102, "Selected Loan Loss Allowance Methodology and Documentation Issues," the company has reviewed its policies related to methodologies... -

Page 83

... the purchase price for the 2001 acquisitions is presented in the following table in the required SFAS No. 141 format. (dollars in millions) Amortization Life (in years) Informix* Other Current assets Fixed/long-term assets Intangible assets: Customer lists Completed technology Trademarks Goodwill... -

Page 84

... period or at the immediately preceding period. The tangible net assets comprise primarily cash, accounts receivable, land, buildings and leasehold improvements. The identiï¬able intangible assets comprise primarily patents, trademarks, customer lists, assembled workforce, employee agreements... -

Page 85

... receivables Customer loans receivable Installment payment receivables Net investment in sales-type leases Total long-term ï¬nancing receivables $«««5,452 $«««6,851 4,297 871 6,036 $«16,656 4,065 1,221 6,568 $«18,705 Fair Value 2001 2000 Current marketable securities: Time deposits... -

Page 86

...trade receivables through this facility in 2001. In addition, the company sold $278 million of loans receivable due from state and local government customers through a securitization program established in 1990. No receivables were sold in 2000 under this program. Net gains and losses on these sales... -

Page 87

...the underlying exposure. A brief description of the major hedging programs follows: Debt Risk Management The company issues debt on the global capital markets, principally to fund its ï¬nancing lease and loan portfolio. Access to cost-effective ï¬nancing can result in interest rate and/or currency... -

Page 88

... since they contain net share settlement clauses. During the year, the company recorded the change in the fair value of these warrants in net income. The following table summarizes the net fair value of the company's derivative and other risk management instruments at December 31, 2001, included in... -

Page 89

... as of December 31, 2001, net of tax, of which approximately $276 million is expected to be reclassiï¬ed to net income within the next year to provide an economic offset to the impact of the underlying anticipated cash ï¬,ows hedged. The following table summarizes activity in the Accumulated... -

Page 90

... created an employee beneï¬ts trust to which the company contributed 10 million shares of treasury stock. The company was authorized to instruct the trustee to sell such shares from time to time and to use the proceeds from such sales, and any dividends paid or earnings received on such stock... -

Page 91

...company dissolved the trust, effective May 31, 2001, and all of the shares (20 million on a split-adjusted basis) were returned to the company as treasury shares. Dissolution of the trust will not affect the company's obligations related to any of its compensation and employee beneï¬t plans or its... -

Page 92

... provision for income taxes by taxing jurisdiction are as follows: (dollars in millions) FOR TH E YEAR E N DE D DECE MB E R 31: Employee beneï¬ts Alternative minimum tax credits Bad debt, inventory and warranty reserves Capitalized research and development General business credits Deferred income... -

Page 93

... rate will change year to year based on nonrecurring events (such as the sale of the Global Network business and various other actions in 1999) as well as recurring factors including the geographical mix of income before taxes, the timing and amount of foreign dividends, state and local taxes... -

Page 94

...effectively manage a partnership agreement that was formed to produce complementary metal oxide semiconductor (CMOS) based logic components. The company reduced its internal dynamic random access memory (DRAM) capacity by converting its manufacturing facility in Essonnes, France, from DRAM to custom... -

Page 95

... the net book value and the appraised fair value of test equipment that is subject to sale-leaseback agreements and that is being used and appropriately expensed. Workforce reductions that affected approximately 790 employees (455 direct manufacturing and 335 indirect manufacturing) in France. The... -

Page 96

... average market price of the common shares and, therefore, the effect would have been antidilutive. Net income applicable to common stockholders excludes preferred stock dividends of $10 million in 2001 and $20 million in both 2000 and 1999. s Rental Expense and Lease Commitments Rental expense... -

Page 97

... or fractional shares of IBM common stock through payroll deductions of up to 10 percent of eligible compensation. Effective July 1, 2000, ESPP was amended whereby the share price paid by an employee changed from 85 percent of the average market price on the last business day of each pay period, to... -

Page 98

... before income taxes, these amounts are partially offset by the costs of the company's other retirement-related plans (see table above). Moreover, these amounts have positive implications for the company's employees, retirees and shareholders. The returns that the fund has experienced over time have... -

Page 99

...funds under various fiduciary-type arrangements, purchases annuities under group contracts or provides reserves. Beneï¬ts under the deï¬ned beneï¬t plans are typically based on years of service and the employee's compensation, generally during a fixed number of years immediately before retirement... -

Page 100

... trust Direct beneï¬t payments Foreign exchange impact Plan curtailments/settlements/termination beneï¬ts Beneï¬t obligation at end of year Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Employer contribution Acquisitions/divestitures, net Plan... -

Page 101

..."Employers' Accounting for Pensions." The change in the discount rate for the 2001 U.S. plan year had an effect of an additional $9 million of net retirement plan cost for the year ended December 31, 2001. The change in expected return on plan assets and the discount rate for the 2000 U.S. plan year... -

Page 102

...106, "Employers' Accounting for Postretirement Beneï¬ts Other Than Pensions." The discount rate changes did not have a material effect on net postretirement beneï¬t cost for the years ended December 31, 2001, 2000 and 1999. The health care cost trend rate has an insigniï¬cant effect on plan costs... -

Page 103

... and systems. BIS provides business/industry consulting and endto-end e-business implementation of such offerings as Supply Chain Management, Customer Relationship Management, Enterprise Resource Planning and Business Intelligence. Integrated Technology Services offers customers a single I/T partner... -

Page 104

... View Global Services Enterprise Systems The following tables reï¬,ect the results of the segments consistent with the company's management system. These results are not necessarily a depiction that is in conformity with generally accepted accounting principles; e.g., employee retirement plan costs... -

Page 105

...576) $«85,866 (34) (7,940) $«88,396 391 (8,644) $«87,548 2001 2000 1999 P R E-TAX I NC OM E: Total reportable segments Elimination of internal transactions Sale of Global Network 1999 actions Unallocated corporate amounts Total IBM consolidated I M MATE R IAL ITE M S $«10,458 $«10,891... -

Page 106

... in millions) 2001 2000 1999 Assets: Total reportable segments Elimination of internal transactions Unallocated amounts: Cash and marketable securities Notes and accounts receivable Deferred tax assets Plant, other property and equipment Pension assets Other Total IBM consolidated $«64,720... -

Page 107

... revenue primarily from the sale of HDD storage ï¬les, semiconductors and display devices. Other technology is primarily design services for OEM customers. The Enterprise Systems segment's storage comprises revenue from the Enterprise Storage Server ("Shark"), other disk storage products and tape... -

Page 108

... is computed using the weighted-average number of shares outstanding during the year. Thus, the sum of the four quarters' EPS does not equal the full-year EPS. †The stock prices reflect the high and low prices for IBM's common stock on the New York Stock Exchange composite tape for the last two... -

Page 109

... write to: IBM Corporation Stockholder Relations New Orchard Road Armonk, New York 10504 I B M STO CK "Valuing Diversity: An Ongoing Commitment" communicates to the company's entire community of employees, customers, stockholders, vendors, suppliers, business partners and employment applicants the... -

Page 110

... Louis J. D'Ambrosio General Manager Worldwide Sales and Marketing Robert J. LeBlanc General Manager Tivoli Systems Janet Perna General Manager Database Management Solutions John A. Swainson General Manager Application and Integration Middleware Al W. Zollar General Manager Lotus STORAG E SYSTE... -

Page 111

design: vsa partners, inc. printing: anderson lithograph www.ibm.com/annualreport/2001 -

Page 112

annual report 2001