Holiday Inn 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

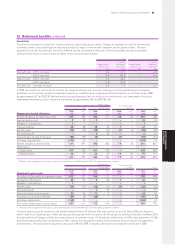

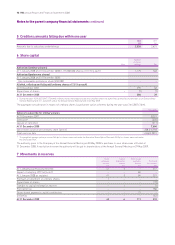

29 Minority equity interest

2008 2007

$m $m

At 1 January 616

Disposal of hotels (note 11) –(12)

Exchange and other adjustments 12

At 31 December 76

30 Operating leases

During the year ended 31 December 2008, $61m (2007 $64m) was recognised as an expense in the Group income statement in respect

of operating leases, net of amounts borne by the system funds.

Total commitments under non-cancellable operating leases are as follows:

2008 2007

$m $m

Due within one year 56 58

One to two years 50 38

Two to three years 47 32

Three to four years 40 30

Four to five years 33 22

More than five years 322 218

548 398

Included above, are commitments of $11m (2007 $9m) which will be borne by the system funds.

The average remaining term of these leases, which generally contain renewal options, is approximately 18 years (2007 17 years).

No material restrictions or guarantees exist in the Group’s lease obligations.

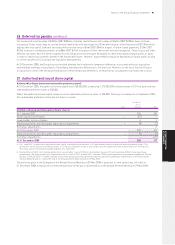

31 Capital and other commitments

2008 2007

$m $m

Contracts placed for expenditure on property, plant and equipment not provided for in the Group

financial statements 40 20

On 24 October 2007, the Group announced a worldwide relaunch of its Holiday Inn brand family. In support of this relaunch, IHG will make

a non-recurring revenue investment of $60m which will be charged to the Group income statement as an exceptional item. $35m has been

charged in 2008.

32 Contingencies

2008 2007

$m $m

Contingent liabilities not provided for in the Group financial statements relating to guarantees 12 10

In limited cases, the Group may provide performance guarantees to third-party owners to secure management contracts. The maximum

exposure under such guarantees is $249m (2007 $243m). It is the view of the Directors that, other than to the extent that liabilities have

been provided for in these financial statements, such guarantees are not expected to result in material financial loss to the Group.

The Group has given warranties in respect of the disposal of certain of its former subsidiaries and hotels. It is the view of the Directors that,

other than to the extent that liabilities have been provided for in these financial statements, such warranties are not expected to result in

material financial loss to the Group.

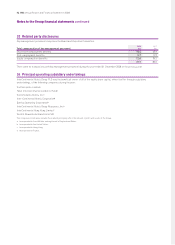

Notes to the Group financial statements 93

GROUP FINANCIAL

STATEMENTS