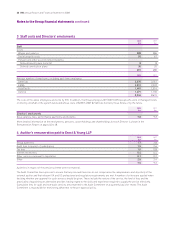

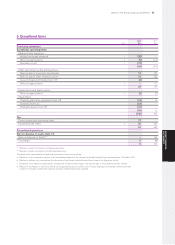

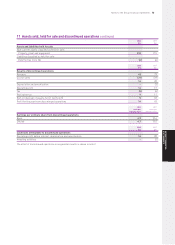

Holiday Inn 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

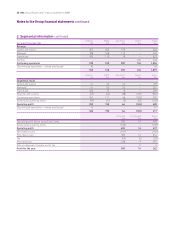

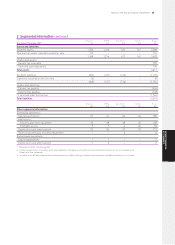

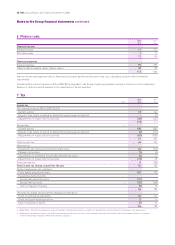

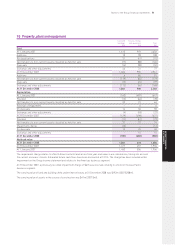

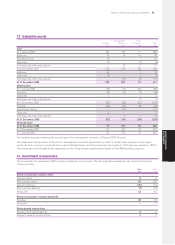

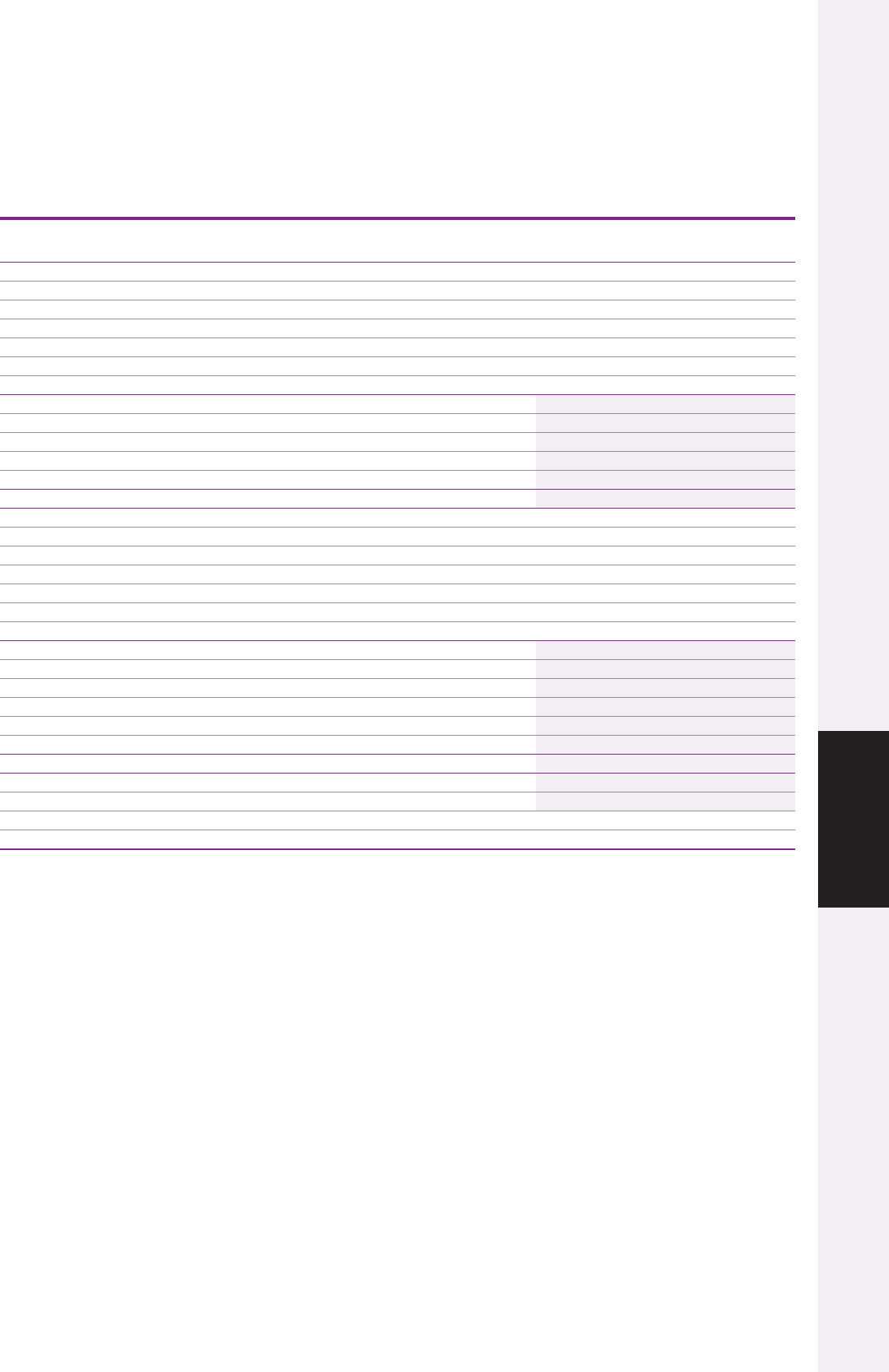

10 Property, plant and equipment

Land and Fixtures, fittings

buildings and equipment Total

$m $m $m

Cost

At 1 January 2007 1,610 993 2,603

Additions 10 98 108

Reclassifications 31 (41) (10)

Net transfers to non-current assets classified as held for sale (77) (88) (165)

Disposals (14) (38) (52)

Exchange and other adjustments 46 31 77

At 31 December 2007 1,606 955 2,561

Additions 68591

Net transfers to non-current assets classified as held for sale (119) (60) (179)

Disposals (15) (24) (39)

Exchange and other adjustments (112) (56) (168)

At 31 December 2008 1,366 900 2,266

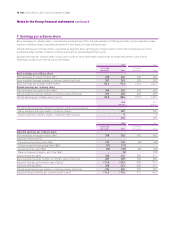

Depreciation

At 1 January 2007 (160) (487) (647)

Provided (12) (66) (78)

Net transfers to non-current assets classified as held for sale 33 31 64

Reversal of impairment –66

On disposals 14 36 50

Exchange and other adjustments (4) (18) (22)

At 31 December 2007 (129) (498) (627)

Provided (11) (61) (72)

Net transfers to non-current assets classified as held for sale 37 37 74

Impairment charge (12) – (12)

On disposals 15 25 40

Exchange and other adjustments – 15 15

At 31 December 2008 (100) (482) (582)

Net book value

At 31 December 2008 1,266 418 1,684

At 31 December 2007 1,477 457 1,934

At 1 January 2007 1,450 506 1,956

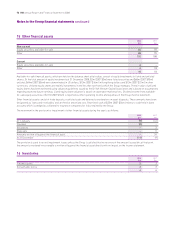

The impairment charge relates to a North American hotel and arises from year-end value in use calculations, taking into account

the current economic climate. Estimated future cash flows have been discounted at 13.5%. The charge has been included within

impairment on the Group income statement and relates to the Americas business segment.

At 31 December 2007, a previously recorded impairment charge of $6m was reversed, relating to a hotel in the Asia Pacific

business segment.

The carrying value of land and buildings held under finance leases at 31 December 2008 was $192m (2007 $208m).

The carrying value of assets in the course of construction was $41m (2007 $nil).

Notes to the Group financial statements 71

GROUP FINANCIAL

STATEMENTS