Holiday Inn 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

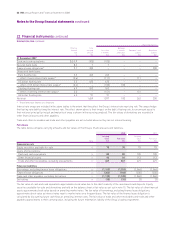

26 Deferred tax payable continued

Tax losses with a net tax value of $553m (2007 $384m), including capital losses with a value of $160m (2007 $220m), have not been

recognised. These losses may be carried forward indefinitely with the exception of $1m which expires after three years (2007 $1m which

expires after four years). Deferred tax assets with a net tax value of $4m (2007 $9m) in respect of share-based payments, $13m (2007

$13m) in respect of employee benefits and $8m (2007 $27m) in respect of other items have not been recognised. These losses and other

deferred tax assets have not been recognised as the Group does not anticipate being able to offset these against future profits or gains

in order to realise any economic benefit in the foreseeable future. However, future benefits may arise depending on future profits arising

or on the outcome of EU case law and legislative developments.

At 31 December 2008, the Group has not provided deferred tax in relation to temporary differences associated with post-acquisition

undistributed earnings of subsidiaries. Quantifying the temporary differences is not practical. However, on the basis that the Group is

in a position to control the timing and realisation of these temporary differences, no material tax consequences are expected to arise.

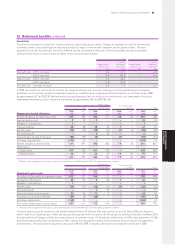

27 Authorised and issued share capital

Authorised (ordinary shares and redeemable preference share)

At 31 December 2008, the authorised share capital was £160,050,000, comprising 1,175,000,000 ordinary shares of 13 29⁄47p each and one

redeemable preference share of £50,000.

Whilst the authorised share capital comprises one redeemable preference share of £50,000, following its redemption in September 2005,

this redeemable preference share has not been re-issued.

Number of

shares

Note millions $m

Allotted, called up and fully paid (ordinary shares)

At 1 January 2007 356 80

Share capital consolidation a(57) –

Issued under option schemes 41

Repurchased and cancelled under repurchase programmes b(8) (2)

Exchange adjustments –2

At 31 December 2007 295 81

Repurchased and cancelled under repurchase programmes b(9) (3)

Exchange adjustments – (21)

At 31 December 2008 286 57

a On 1 June 2007, shareholders approved a share capital consolidation on the basis of 47 new ordinary shares for every 56 existing ordinary shares. This

provided for all the authorised ordinary shares of 11 3⁄7p each (whether issued or unissued) to be consolidated into new ordinary shares of 13 29⁄47p each.

The share capital consolidation became effective on 4 June 2007.

b During 2004 and 2005, the Company undertook to return funds of up to £750m to shareholders by way of three consecutive £250m share repurchase

programmes, the third of which was completed in the first half of 2007. In June 2007, a further £150m share repurchase programme commenced. During

the year, 9,219,325 (2007 7,724,844) ordinary shares were repurchased and cancelled under the authorities granted by shareholders at an Extraordinary

General Meeting held on 1 June 2007 and at the Annual General Meeting held on 30 May 2008.

The authority given to the Company at the Annual General Meeting on 30 May 2008 to purchase its own shares was still valid at

31 December 2008. A resolution to renew the authority will be put to shareholders at the Annual General Meeting on 29 May 2009.

Notes to the Group financial statements 91

GROUP FINANCIAL

STATEMENTS