Holiday Inn 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BUSINESS REVIEW

Business review 17

Central

Central results

System funds

System fund results

12 months ended 31 December

2008 2007 %

$m $m change

Revenue 126 117 7.7

Gross central costs (281) (280) (0.4)

Net central costs (155) (163) 4.9

During 2008, net central costs reduced by 4.9% from $163m

to $155m due to the receipt of a favourable $3m insurance

settlement and the impact of weaker sterling.

12 months ended 31 December

2008 2007 %

$m $m change

Assessments 990 930 6.5 Hotels operated under IHG brands are, pursuant to terms within

their contracts, subject to cash assessments for brand marketing,

reservations systems and Priority Club membership stays. These

assessments, typically based upon room revenue, are pooled within

the system funds for the collective benefit of all hotels by brand or

geography. The assessments are used for revenue generating

activities including the costs of call centres, frequency program

points, websites, sales teams, advertising and brand development

and affiliate marketing programmes.

The Company acts on behalf of hotel owners with regard to the funds

and all assessments are designated for specific purposes and result

in no profit for the Group. Accordingly, the revenues, expenses and

cash flows of the funds are not included in the Consolidated Income

Statement or Consolidated Cash Flow Statement. The funds are

planned to operate at breakeven with any short-term timing surplus

or deficit carried on IHG’s balance sheet within working capital.

The Owners’ Association, the IAHI, endorses the budgeted spend

of the funds and provides a governance overview of the operation

of the funds.

In the year to 31 December 2008, system fund assessments

increased by 6.5% to $990m primarily as a result of the growth

in system size and affiliate marketing programmes.

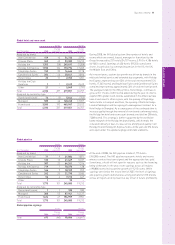

Asia Pacific pipeline

Hotels Rooms

Change Change

At 31 December 2008 over 2007 2008 over 2007

Analysed by brand

InterContinental 36 612,529 2,198

Crowne Plaza 65 924,535 3,507

Holiday Inn 74 25 21,205 6,835

Holiday Inn Express 23 16,015 (82)

Hotel Indigo 11180 180

Total 199 42 64,464 12,638

Analysed by ownership type

Managed 197 41 64,137 12,487

Franchised 21327 151

Total 199 42 64,464 12,638

The pipeline in Asia Pacific increased by 42 hotels (12,638 rooms)

to 199 hotels (64,464 rooms). Pipeline growth was again centred

on the Greater China market with 70% of the region’s room

signings. There was also significant demand in India, where

signings more than doubled compared to 2007. From a brand

perspective, Holiday Inn was the largest contributor to signings,

with 39% of the region’s room signings.