Holiday Inn 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

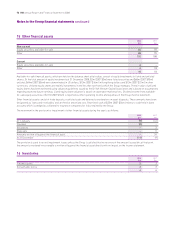

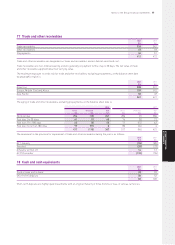

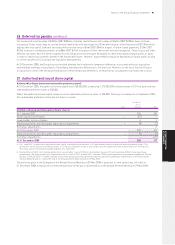

Notes to the Group financial statements 83

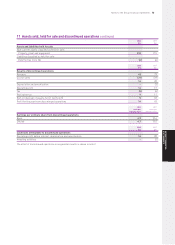

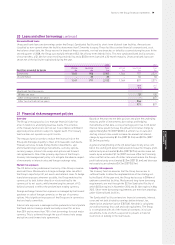

23 Net debt

2008 2007

$m $m

Cash and cash equivalents 82 105

Loans and other borrowings – current (21) (16)

– non-current (1,334) (1,748)

Net debt (1,273) (1,659)

Movement in net debt

Net increase/(decrease) in cash and cash equivalents 25 (237)

Add back cash flows in respect of other components of net debt:

Decrease/(increase) in borrowings 316 (1,108)

Decrease/(increase) in net debt arising from cash flows 341 (1,345)

Non-cash movements:

Finance lease liability (2) (18)

Exchange and other adjustments 47 (33)

Decrease/(increase) in net debt 386 (1,396)

Net debt at beginning of the year (1,659) (263)

Net debt at end of the year (1,273) (1,659)

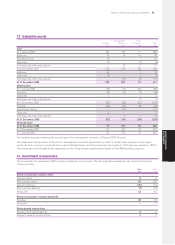

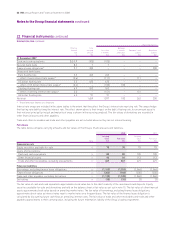

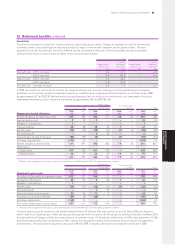

24 Retirement benefits

Retirement and death in service benefits are provided for eligible Group employees in the UK principally by the InterContinental Hotels

UK Pension Plan. The plan, which is funded and HM Revenue & Customs registered, covers approximately 460 (2007 440) employees,

of which 170 (2007 200) are in the defined benefit section which provides pensions based on final salaries and 290 (2007 240) are in the

defined contribution section. The defined benefit section of the plan closed to new entrants during 2002 with new members provided with

defined contribution arrangements. The assets of the plan are held in self-administered trust funds separate from the Group’s assets.

In addition, there are unfunded UK pension arrangements for certain members affected by the lifetime allowance. The Group also

maintains the following US-based defined benefit plans; the funded InterContinental Hotels Pension Plan, unfunded InterContinental

Hotels non-qualified pension plans and post-employment benefits schemes. These plans are now closed to new members. The Group

also operates a number of minor pension schemes outside the UK, the most significant of which is a defined contribution scheme in

the US; there is no material difference between the pension costs of, and contributions to, these schemes.

The amounts recognised in the Group income statement in respect of the defined benefit plans are:

Pension plans Post-employment

UK US and other benefits Total

2008 2007 2008 2007 2008 2007 2008 2007

$m $m $m $m $m $m $m $m

Recognised in administrative expenses

Current service cost 910 1–––10 10

Interest cost on benefit obligation 30 30 10 10 1141 41

Expected return on plan assets (32) (34) (11) (9) ––(43) (43)

76–11188

The amounts recognised in the Group statement of recognised income and expense are:

Pension plans Post-employment

UK US and other benefits Total

2007 2007

2008 restated* 2008 2007 2008 2007 2008 restated*

$m $m $m $m $m $m $m $m

Actual return on plan assets (25) 28 (27) 9––(52) 37

Less: expected return on plan assets (32) (34) (11) (9) ––(43) (43)

(57) (6) (38) –––(95) (6)

Other actuarial gains and losses 55 31 3–1–59 31

Total actuarial gains and losses (2) 25 (35) –1–(36) 25

Asset restriction** (14) (17) ––––(14) (17)

(16) 8(35) –1–(50) 8

* Restated for IFRIC 14 (see page 56).

** Relates to tax that would be deducted at source in respect of a refund of the surplus.

GROUP FINANCIAL

STATEMENTS