Holiday Inn 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

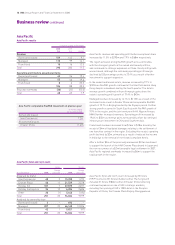

Employee engagement scores

(Engagement survey commenced

April 2007).

2007 2008

65% 68%

* CAGR – compound annual growth rate. ** Source: IHG analysis, STR and Deloitte.

BUSINESS REVIEW

Business review 9

How we win

Key performance indicators Current status and

Strategic priorities (KPIs) 2008 developments 2009 priorities

Responsible business

To take an active stance

on environment and

community issues in

order to drive increased

value for IHG, owners

and guests.

• As we roll out new systems, the

consumption of energy and water

as well as waste will be tracked

in all our owned and managed

hotels; we expect to report further

on this next year – see Corporate

Responsibility (CR) review on

pages 23 and 24 for further

information.

• Green Engage energy management

system developed (patent pending);

• Extensive consumer research

undertaken to quantify ‘green’

opportunity with consumers; and

• CR approach defined and agreed –

see

CR review on

pages 23 and 24

for additional details.

• Roll out the Green Engage energy

management system, including

improved hotel construction

techniques; and

• Focus on innovation within new

and existing brands to deliver

valued ‘green’ related hotels

and services to guests.

Our people

To create a more efficient

organisation with strong

core capabilities.

• Great Hotels Guests Love metrics

defined and cascaded;

• Requirement to add around

140,000 people in scale markets

quantified and sourcing strategy

in place;

• Senior recruitment and succession

planning accomplished, especially

at Executive Committee level; and

• General manager attraction

and retention programme

and systems launched.

• Ensure alignment at hotel level to

IHG’s core purpose of Great Hotels

Guests Love; and

• Increase investment in key

countries to compete for talent,

particularly for general managers.

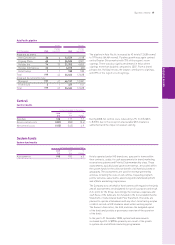

Guest experience

To operate a portfolio

of brands attractive

to both owners and

guests that have clear

market positions and

differentiation in the

eyes of the guest.

IC: InterContinental HIE: Holday Inn Express

CP: Crowne Plaza HI: Holiday Inn

RevPAR growth ahead of market (%pts)**

10.7%

All brands – CHINA

IC – EMEA 6.5%

IC – US 2.2%

HIE – US 1.8%

All brands – UK 1.6%

HI – US 0.5%

CP – US 1.0%

Global RevPAR growth

Comparable hotels, constant US$

2006 2007 2008

9.8%

6.9%

0.9%

• First 274 relaunched Holiday Inn

and Holiday Inn Express hotels

open around the world;

• InterContinental positioning

success as guest satisfaction

scores relating to InterContinental

concierges rise in all regions; and

• Industry-leading Priority Club

Rewards (PCR) loyalty programme

with 42 million members,

contributing $5.9bn of global

system room revenue, an increase

of 13% over 2007.

• Roll out the Holiday Inn

repositioning;

• Simplify brand standards process

to improve owner returns without

impairing guest experience; and

• Enhance experience for PCR

members in hotels and across

global reservations channels;

increase IHG business from

PCR members.

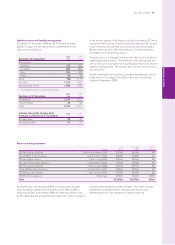

Financial returns

To generate higher

returns for owners and

IHG through revenue

delivery and improved

operating efficiency.

System contribution revenue

Actual US$bn

2006 2007 2008

CAGR*

10.1%

5.7

6.8 7.6

Total gross revenue (TGR)

Actual US$bn

2006 2007 2008

CAGR*

7.9%

15.2

17.8 19.1

• Increased revenue delivery through

IHG global reservations channels

by 10.6% to $7.6bn of global system

room revenue in 2008;

• Increased use of offshore

transaction processing; and

• Technology infrastructure

developed to support owner

management and loyalty

marketing.

• Increase global salesforce

effectiveness;

• Identify and achieve major

procurement savings;

• Begin migration to next generation

revenue management IT systems;

and

• Continue focus on our owned

and managed estate margins

and return on capital employed

(ROCE), especially in our key

InterContinental assets.