Holiday Inn 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 IHG Annual Report and Financial Statements 2008

Business review continued

Europe, Middle East and Africa

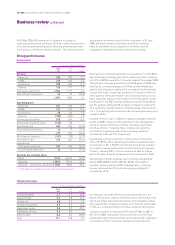

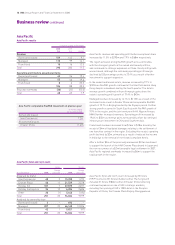

EMEA results

12 months ended 31 December

2008 2007 %

$m $m change

Revenue

Owned and leased 240 244 (1.6)

Managed 168 167 0.6

Franchised 110 81 35.8

Continuing operations 518 492 5.3

Discontinued operations* –17 –

Total 518 509 1.8

Operating profit before exceptional items

Owned and leased 45 33 36.4

Managed 95 87 9.2

Franchised 75 58 29.3

215 178 20.8

Regional overheads (44) (44) –

Continuing operations 171 134 27.6

Discontinued operations* –1–

Total 171 135 26.7

* Discontinued operations are all owned and leased.

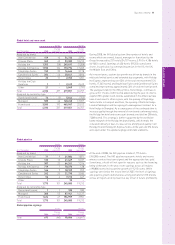

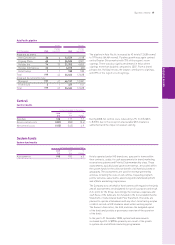

EMEA comparable RevPAR movement on previous year

12 months ended

31 December 2008

Owned and leased

InterContinental (7.8)%

All ownership types

UK 1.2%

Continental Europe 1.6%

Middle East 20.2%

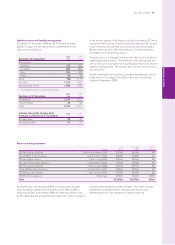

Revenue and operating profit before exceptional items from

continuing operations increased by 5.3% to $518m and 27.6% to

$171m respectively. Including discontinued operations, revenue

increased by 1.8% whilst operating profit before exceptional items

increased by 26.7%. Included in these results were liquidated

damages of $9m relating to one management contract and $7m

for a portfolio of franchised hotels settled during the year.

During the year, the region achieved RevPAR growth of 3.6%

driven by gains across all brands operated under managed and

franchise contracts. From a regional perspective, RevPAR growth

in the Middle East was extremely strong at 20.2%, whilst smaller

growth was experienced in Continental Europe. The region’s

continuing operating profit margin increased by 5.8 percentage

points to 33.0%. Excluding the two liquidated damages

settlements, the margin on continuing operations grew

3.7 percentage points reflecting economies of scale in the

managed business and strong revenue conversion at the

InterContinental London Park Lane.

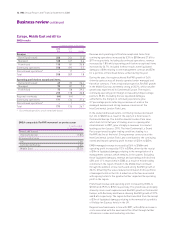

In the owned and leased estate, continuing revenue decreased

by 1.6% to $240m as a result of the expiry of a hotel lease in

Continental Europe. The InterContinental London Park Lane,

which had its first full year of trading since re-opening after

refurbishment in 2007, grew strongly in revenues to a market

leading position (source: STR). The InterContinental Le Grand

Paris experienced tougher trading conditions leading to a

RevPAR decline at the hotel. Strong revenue conversion at the

InterContinental London Park Lane contributed to the continuing

owned and leased operating profit increase of $12m to $45m.

EMEA managed revenue increased by 0.6% to $168m and

operating profit increased by 9.2% to $95m, driven by the receipt

of $9m in liquidated damages relating to the renegotiation of a

management contract, which remains in the system. Excluding

these liquidated damages, revenue and operating profit declined

4.8% and 1.1% respectively in 2008, as a result of mixed trading

conditions in the region. Growth in the Middle East continued

through the addition of new rooms and strong RevPAR growth of

20.2%. Offsetting this was a reduced contribution from a portfolio

of managed hotels in the UK. A reduction in the fees associated

with signing hotels to the pipeline further impacted the operating

profit in the region.

Franchised revenue and operating profit increased by 35.8% to

$110m and 29.3% to $75m respectively. The growth was principally

driven by room count expansion and RevPAR growth in Continental

Europe, with Germany and Russia showing RevPAR growth of 3.9%

and 8.6% respectively. The region further benefited from the receipt

of $7m of liquidated damages relating to the removal of a portfolio

of Holiday Inn Express hotels in the UK.

Regional overheads were in line with 2007, with a $2m increase in

costs associated with the new head office offset through further

efficiencies in sales and marketing activities.