Holiday Inn 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review 19

BUSINESS REVIEW

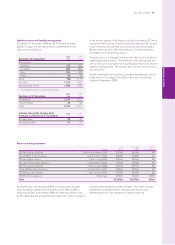

Capital structure and liquidity management

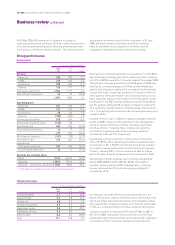

Net debt at 31 December 2008 was $1,273m and included

$202m in respect of the finance lease commitment for the

InterContinental Boston.

2008 2007*

Net debt at 31 December $m $m

Borrowings:

Sterling 152 553

US dollar 889 882

Euro 224 243

Other 90 98

Cash (82) (117)

Net debt 1,273 1,659

Average debt levels 1,498 1,075

* Including the impact of currency derivatives.

2008 2007

Facilities at 31 December $m $m

Committed 2,107 2,321

Uncommitted 25 50

Total 2,132 2,371

Interest risk profile of gross debt 2008 2007

for major currencies at 31 December %%

At fixed rates 53 45

At variable rates 47 55

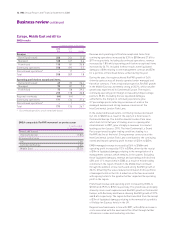

In the second quarter, the Group successfully refinanced $2.1bn of

long-term debt facilities. The new syndicated bank facility consists

of two tranches, a $1.6bn five-year revolving credit facility and a

$0.5bn term loan with a 30-month maturity. Terms are broadly

unchanged from the previous facility.

Treasury policy is to manage financial risks that arise in relation to

underlying business needs. The activities of the treasury function

are carried out in accordance with Board approved policies and are

subject to regular audit. The treasury function does not operate as

a profit centre.

Further information on the Group’s treasury management can be

found in note 21 on pages 79 and 80 in the notes to the Group

Financial Statements 2008.

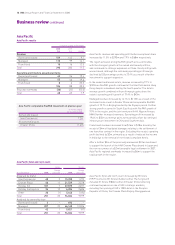

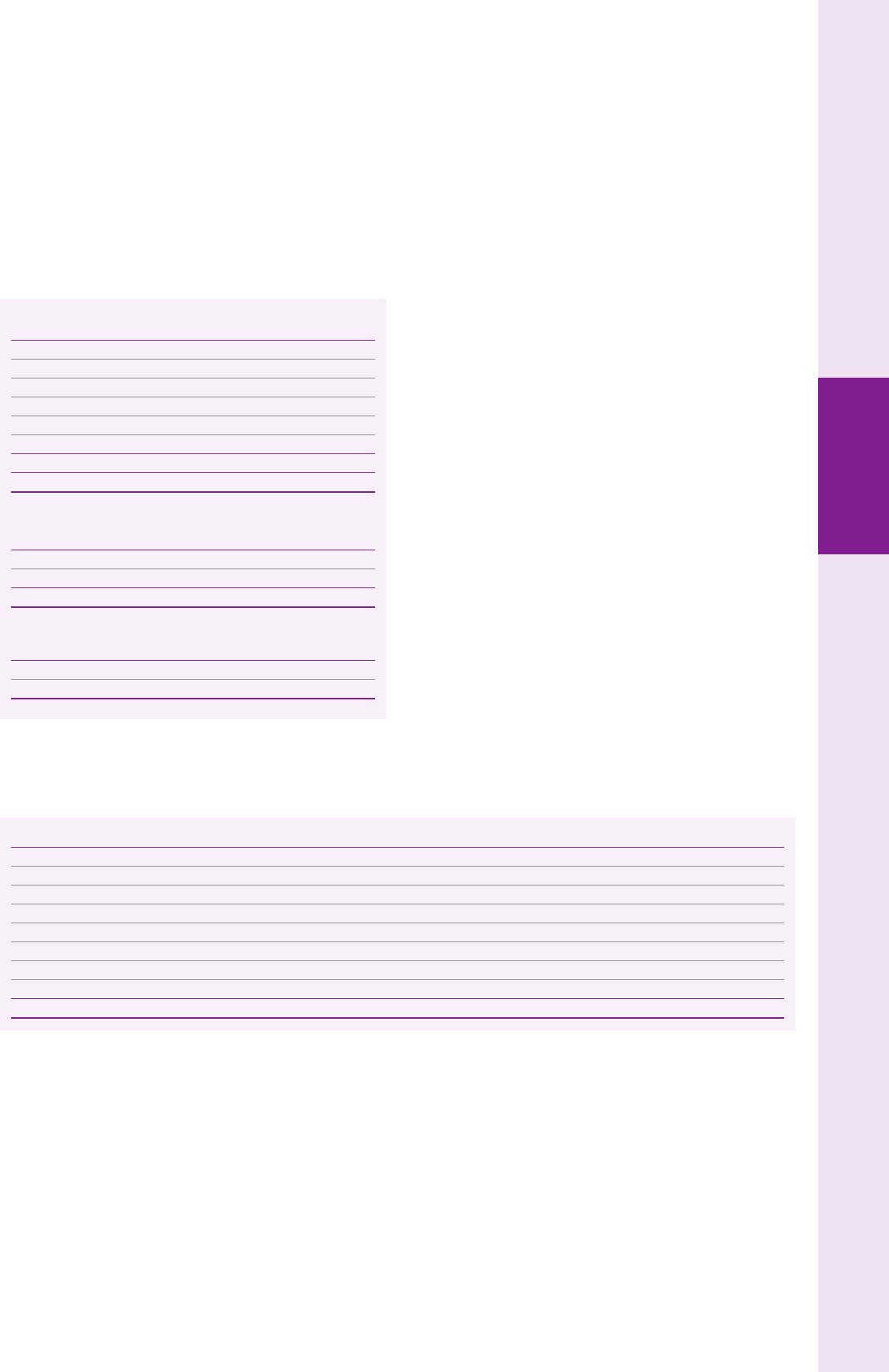

During the year, IHG returned $139m to shareholders through

share buybacks, taking the total returned since March 2004 to

more than £3.5bn. In November 2008 the remaining £30m of the

fourth share buyback programme was deferred in order to preserve

cash and maintain balance sheet strength. The return of funds

programme is denominated in sterling as all returns were

determined prior to the change to US dollar reporting.

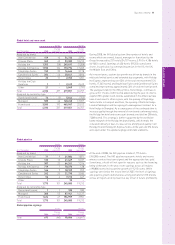

Return of funds programme

Total Returned Still to

Timing return to date be returned

£501m special dividend Paid in December 2004 £501m £501m Nil

First £250m share buyback Completed in 2004 £250m £250m Nil

£996m capital return Paid in July 2005 £996m £996m Nil

Second £250m share buyback Completed in 2006 £250m £250m Nil

£497m special dividend Paid in June 2006 £497m £497m Nil

Third £250m share buyback Completed in 2007 £250m £250m Nil

£709m special dividend Paid in June 2007 £709m £709m Nil

£150m share buyback Under way £150m £120m £30m

Total £3,603m £3,573m £30m