Holiday Inn 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 IHG Annual Report and Financial Statements 2008

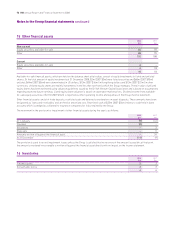

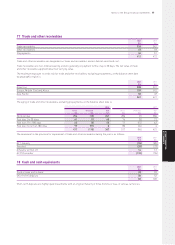

21 Financial risk management policies continued

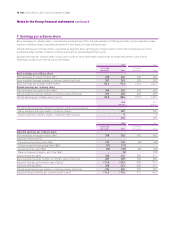

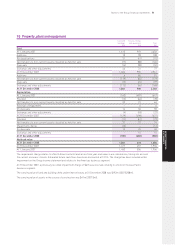

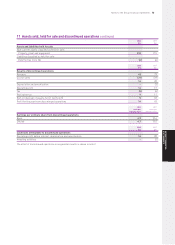

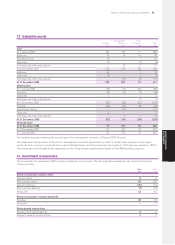

Notes to the Group financial statements continued

At the year end, the Group had surplus cash of $82m which is

held in short-term deposits and cash funds which allow daily

withdrawals of cash. Most of the Group’s surplus funds are held

in the UK or US and there are no material funds where repatriation

is restricted as a result of foreign exchange regulations.

Credit risk exposure

Credit risk on treasury transactions is minimised by operating a

policy on the investment of surplus cash that generally restricts

counterparties to those with an A credit rating or better or those

providing adequate security.

Notwithstanding that counterparties must have an A credit rating

or better, during periods of significant financial market turmoil,

counterparty exposure limits are significantly reduced and

counterparty credit exposure reviews are broadened to include

the relative placing of credit default swap pricings.

The Group trades only with recognised, creditworthy third parties.

It is the Group’s policy that all customers who wish to trade on

credit terms are subject to credit verification procedures.

In respect of credit risk arising from financial assets, the Group’s

exposure to credit risk arises from default of the counterparty,

with a maximum exposure equal to the carrying amount of

these instruments.

Capital risk management

The Group manages its capital to ensure that it will be able to

continue as a going concern. The capital structure consists of net

debt, issued share capital and reserves. The structure is managed

to minimise the Group’s cost of capital, to provide ongoing returns

to shareholders and to service debt obligations, whilst maintaining

maximum operational flexibility. Surplus cash is either reinvested

in the business, used to repay debt or returned to shareholders.

The Group maintains a conservative level of debt. The level of debt

is monitored on the basis of a cash flow leverage ratio, which is net

debt divided by EBITDA.

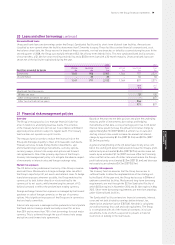

Hedging

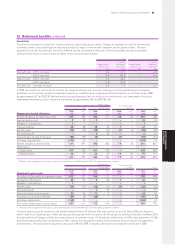

Interest rate risk

The Group hedges its interest rate risk by taking out interest rate

swaps to fix the interest flows on between 25% and 75% of its net

borrowings in major currencies. At 31 December 2008, the Group

held interest rate swaps (swapping floating for fixed) with notional

principals of USD250m, GBP75m and EUR75m (2007 USD100m,

GBP150m and EUR75m). The Group also held forward-starting

interest rate swaps with notional principals of USD100m, GBP75m

and EUR75m (2007 GBP150m and EUR75m). These swaps will

replace current swaps with the same notional principals when they

mature in 2009. The interest rate swaps are designated as cash

flow hedges of borrowings under the Syndicated Facility and they

are held on the balance sheet at fair value in other financial assets

and other payables.

Changes in the fair value of cash flow hedges are recognised in the

unrealised gains and losses reserve to the extent that the hedges

are effective. When the hedged item is recognised, the cumulative

gains and losses on the hedging instrument are recycled to the

income statement. No ineffectiveness was recognised during the

current or prior year.

Foreign currency risk

The Group is exposed to foreign currency risk on income streams

denominated in foreign currencies. When appropriate, the Group

hedges a portion of forecast foreign currency income by taking

out forward exchange contracts. The designated risk is the spot

foreign exchange risk. Forward contracts are held at fair value on

the balance sheet as other financial assets and other payables.

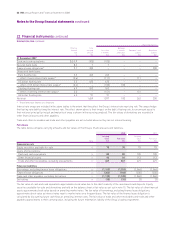

Hedge of net investment in foreign operations

The Group designates its foreign currency bank borrowings and

currency derivatives as net investment hedges of foreign operations.

The designated risk is the spot foreign exchange risk; the interest

on these financial instruments is taken through financial income

or expense and the derivatives are held on the balance sheet at

fair value in other financial assets and other payables.

Hedge effectiveness is measured at calendar quarter ends.

Variations in fair value due to changes in the underlying exchange

rates are taken to the currency translation reserve until an operation

is sold, at which point the cumulative currency gains and losses

are recycled against the gain or loss on sale. No ineffectiveness

was recognised on net investment hedges during the current or

prior year.

At 31 December 2008, the Group held foreign exchange derivatives

with a principal of $nil (2007 $12m) and a fair value of $nil

(2007 $nil). The maximum amount of foreign exchange derivatives

held during the year as net investment hedges and measured at

calendar quarter ends had a principal of $70m (2007 $533m) and

a fair value of $(4.2)m (2007 $3.1m).