Holiday Inn 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group financial statements 79

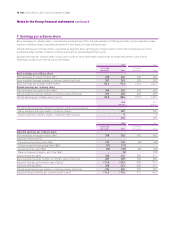

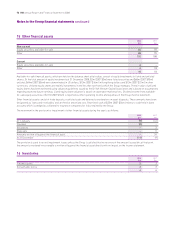

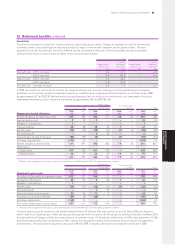

20 Loans and other borrowings continued

Unsecured bank loans

Unsecured bank loans are borrowings under the Group’s Syndicated Facility and its short-term bilateral loan facilities. Amounts are

classified as non-current when the facilities have more than 12 months to expiry. These facilities contain financial covenants and, as at

the balance sheet date, the Group was not in breach of these covenants, nor had any breaches or defaults occurred during the year. In the

second quarter of 2008, the Group successfully refinanced $2.1bn of long-term debt facilities. This new syndicated bank facility consists

of two tranches; a $1.6bn five-year revolving credit facility and a $0.5bn term loan with a 30-month maturity. Unsecured bank loans are

shown net of the facility fee capitalised during the year.

2008 2007

Utilised Unutilised Total Utilised Unutilised Total

Facilities provided by banks $m $m $m $m $m $m

Committed 1,161 946 2,107 1,564 757 2,321

Uncommitted –2525 –5050

1,161 971 2,132 1,564 807 2,371

2008 2007

$m $m

Unutilised facilities expire:

Within one year 25 150

After one but before two years –657

After two but before five years 946 –

971 807

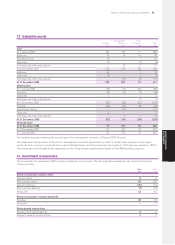

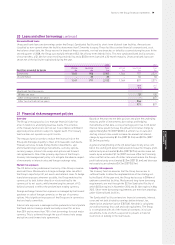

21 Financial risk management policies

Overview

The Group’s treasury policy is to manage financial risks that

arise in relation to underlying business needs. The activities

of the treasury function are carried out in accordance with Board

approved policies and are subject to regular audit. The treasury

function does not operate as a profit centre.

The treasury function seeks to reduce the financial risk of the

Group and manages liquidity to meet all foreseeable cash needs.

Treasury activities include money market investments, spot

and forward foreign exchange instruments, currency options,

currency swaps, interest rate swaps and options and forward

rate agreements. One of the primary objectives of the Group’s

treasury risk management policy is to mitigate the adverse impact

of movements in interest rates and foreign exchange rates.

Market risk exposure

The US dollar is the predominant currency of the Group’s revenue

and cash flows. Movements in foreign exchange rates can affect

the Group’s reported profit, net assets and interest cover. To hedge

translation exposure, wherever possible, the Group matches the

currency of its debt (either directly or via derivatives) to the

currency of its net assets, whilst maximising the amount of US

dollars borrowed to reflect the predominant trading currency.

Foreign exchange transaction exposure is managed by the forward

purchase or sale of foreign currencies or the use of currency

options. Most significant exposures of the Group are in currencies

that are freely convertible.

Interest rate exposure is managed within parameters that stipulate

that fixed rate borrowings should normally account for no less

than 25% and no more than 75% of net borrowings for each major

currency. This is achieved through the use of interest rate swaps

and options and forward rate agreements.

Based on the year end net debt position and given the underlying

maturity profile of investments, borrowings and hedging

instruments at that date, a one percentage point rise in US dollar

interest rates would increase the annual net interest charge by

approximately $4.7m (2007 $5.8m). A similar rise in euro and

sterling interest rates would increase the annual net interest

charge by approximately $1.2m (2007 $1.2m) and $0.9m (2007

$3.2m) respectively.

A general strengthening of the US dollar (specifically a five cent

fall in the sterling:US dollar rate) would increase the Group’s profit

before tax by an estimated $4.0m (2007 $2.9m) and decrease net

assets by an estimated $1.1m (2007 increase of $6.1m). Similarly,

a five cent fall in the euro:US dollar rate would reduce the Group’s

profit before tax by an estimated $2.0m (2007 $1.6m) and decrease

net assets by an estimated $4.3m (2007 $5.9m).

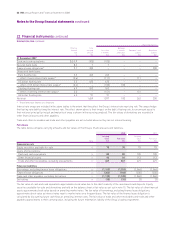

Liquidity risk exposure

The treasury function ensures that the Group has access to

sufficient funds to allow the implementation of the strategy set

by the Board. At the year end, the Group had access to $946m of

undrawn committed facilities. Medium and long-term borrowing

requirements are met through the $2.1bn Syndicated Facility of

which $0.5bn expires in November 2010 and $1.6bn expires in May

2013. Short-term borrowing requirements are met from drawings

under bilateral bank facilities.

The Syndicated Facility contains two financial covenants; interest

cover and net debt divided by earnings before interest, tax,

depreciation and amortisation (EBITDA). Net debt is calculated

as total borrowings less cash and cash equivalents. The Group

is in compliance with all of the financial covenants in its loan

documents, none of which is expected to present a material

restriction on funding in the near future.

GROUP FINANCIAL

STATEMENTS