Holiday Inn 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 IHG Annual Report and Financial Statements 2008

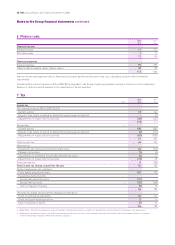

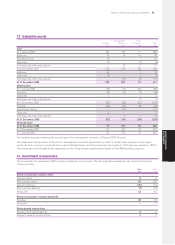

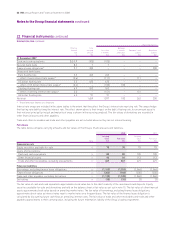

19 Trade and other payables

2008 2007

$m $m

Current

Trade payables 111 100

Other tax and social security payable 31 39

Other payables 322 345

Accruals 272 297

Derivatives 10 3

746 784

Non-current

Other payables 392 279

Trade payables are non-interest-bearing and are normally settled within 45 days.

Other payables include $471m (2007 $426m) relating to the future redemption liability of the Group’s loyalty programme,

of which $96m (2007 $169m) is classified as current and $375m (2007 $257m) as non-current.

Derivatives are held on the Group balance sheet at fair value. Fair value is estimated using discounted future cash flows taking

into consideration interest and exchange rates prevailing at the balance sheet date.

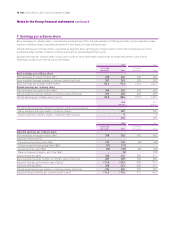

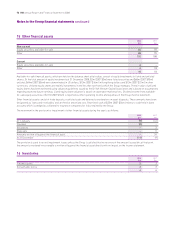

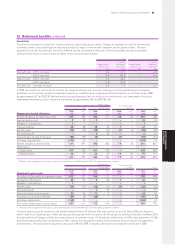

20 Loans and other borrowings

2008 2007

Current Non-current Total Current Non-current Total

$m $m $m $m $m $m

Secured bank loans 527–77

Finance leases 16 186 202 16 184 200

Unsecured bank loans – 1,146 1,146 – 1,557 1,557

Total borrowings 21 1,334 1,355 16 1,748 1,764

Denominated in the following currencies:

Sterling – 152 152 – 553 553

US dollars 16 873 889 16 854 870

Euro – 224 224 – 243 243

Other 58590 –9898

21 1,334 1,355 16 1,748 1,764

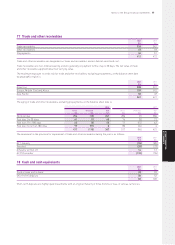

Secured bank loans

These mortgages are secured on the hotel properties to which they relate. The rates of interest and currencies of these loans vary.

Finance leases

Finance lease obligations, which relate to the 99 year lease on the InterContinental Boston, are payable as follows:

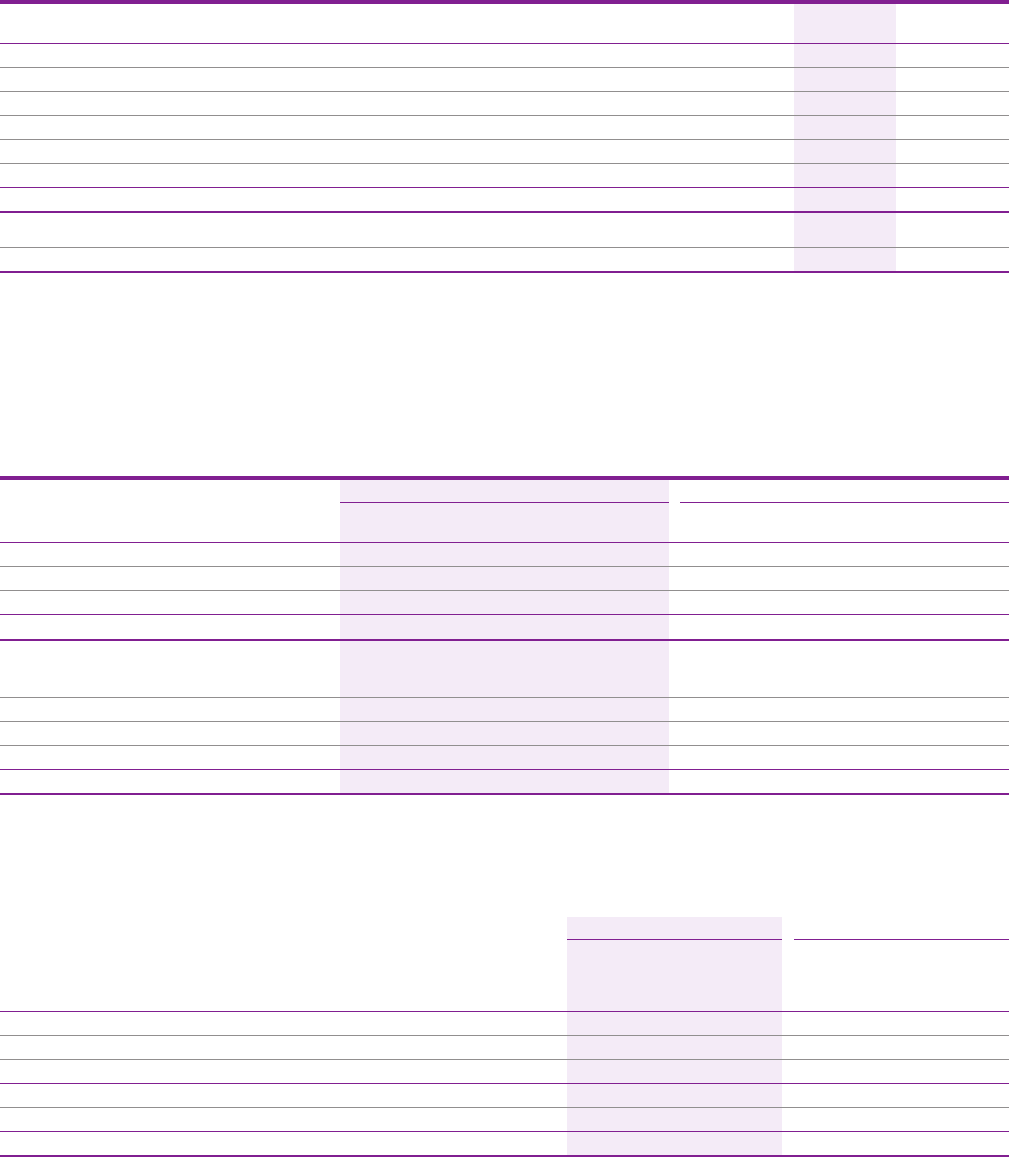

2008 2007

Minimum Present Minimum Present

lease value of lease value of

payments payments payments payments

$m $m $m $m

Less than one year 16 16 16 16

Between one and five years 64 48 64 47

More than five years 3,380 138 3,396 137

3,460 202 3,476 200

Less: amount representing finance charges (3,258) – (3,276) –

202 202 200 200

The Group has the option to extend the term of the lease for two additional 20 year terms. Payments under the lease step up at regular

intervals over the lease term.

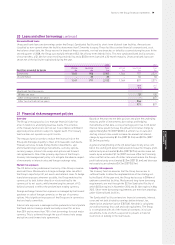

Notes to the Group financial statements continued