Holiday Inn 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 IHG Annual Report and Financial Statements 2008

24 Retirement benefits continued

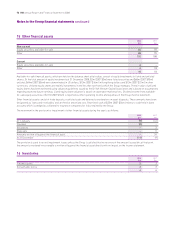

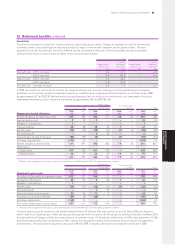

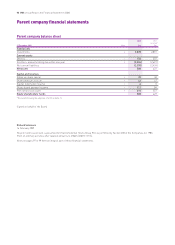

The combined assets of the principal plans and expected rate of return are:

2008 2007

Long-term Long-term

rate of return rate of return

expected Value expected Value

%$m %$m

UK pension plans

Liability matching investment funds 3.9 192 ––

Equities 7.9 87 7.9 219

Bonds 3.9 140 4.8 360

Other 7.9 18 7.9 32

Total market value of assets 437 611

US pension plans

Equities 9.5 37 9.5 77

Fixed income 5.5 55 5.5 52

Total market value of assets 92 129

The expected rate of return on assets has been determined following advice from the plans’ independent actuaries and is based on

the expected return on each asset class together with consideration of the long-term asset strategy. In conjunction with the Group,

the trustees have recently conducted an asset-liability matching study and this has resulted in the adoption of a revised asset allocation

strategy for the UK plan. This strategy, which was in the process of implementation at 31 December 2008, aims to have 61% of the plan’s

assets invested in liability matching assets and 39% in return seeking assets.

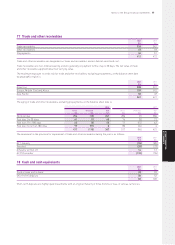

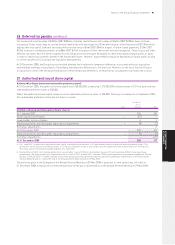

History of experience gains and losses

2008 2007 2006 2005 2004

$m $m $m $m $m

UK pension plans

Fair value of plan assets 437 611 527 431 907

Present value of benefit obligations (411) (597) (585) (473) (1,158)

Surplus/(deficit) in the plans 26 14 (58) (42) (251)

Experience adjustments arising on plan liabilities 55 31 (22) (122) (109)

Experience adjustments arising on plan assets (57) (6) 13 86 26

US and other pension plans

Fair value of plan assets 112 144 111 106 107

Present value of benefit obligations (185) (184) (175) (176) (172)

Deficit in the plans (73) (40) (64) (70) (65)

Experience adjustments arising on plan liabilities 3– – (5) (11)

Experience adjustments arising on plan assets (38) – 4 (2) 2

US post-employment benefits

Present value of benefit obligations (19) (20) (19) (20) (21)

Experience adjustments arising on plan liabilities 1–11(1)

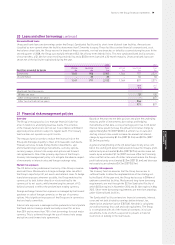

The cumulative amount of actuarial gains and losses recognised since 1 January 2004 in the Group statement of recognised income and

expense is $150m (2007 $114m). The Group is unable to determine how much of the pension scheme deficit recognised on transition to

IFRS of $298m and taken directly to total equity is attributable to actuarial gains and losses since inception of the schemes. Therefore,

the Group is unable to determine the amount of actuarial gains and losses that would have been recognised in the Group statement

of recognised income and expense before 1 January 2004.

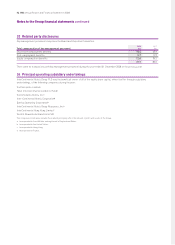

Post balance sheet event

Subsequent to the year end, approval was given for the payment of enhanced pension transfers to those deferred members of the

InterContinental Hotels UK Pension Plan who had accepted an offer to receive the enhancement either as a cash lump sum or as an

additional transfer value to an alternative pension provider. The payments, comprising lump sum amounts of £5.8m and additional

contributions of £4.2m, were made by the Company on 23 January 2009. The transfer values subsequently paid by the plan were £45m and

the corresponding IAS 19 liability extinguished was £38m. The settlement loss arising, together with the lump sum payment and costs

of arrangement, will be charged to the Group income statement as an exceptional item, estimated at $22m, in the first quarter of 2009.

Notes to the Group financial statements continued