Holiday Inn 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

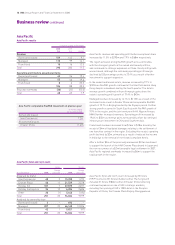

10 IHG Annual Report and Financial Statements 2008

Group performance

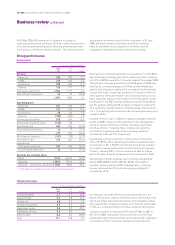

Group results

12 months ended 31 December

2008 2007 %

$m $m change

Revenue

Americas 920 902 2.0

EMEA 518 492 5.3

Asia Pacific 290 260 11.5

Central 126 117 7.7

Continuing operations 1,854 1,771 4.7

Discontinued operations 43 79 (45.6)

1,897 1,850 2.5

Operating profit

Americas 451 440 2.5

EMEA 171 134 27.6

Asia Pacific 68 63 7.9

Central (155) (163) 4.9

Continuing operations 535 474 12.9

Exceptional operating items (132) 60 –

Operating profit 403 534 (24.5)

Discontinued operations 14 17 (17.6)

417 551 (24.3)

Net financial expenses (101) (90) (12.2)

Profit before tax* 316 461 (31.5)

Analysed as:

Continuing operations 302 444 (32.0)

Discontinued operations 14 17 (17.6)

Earnings per ordinary share

Basic 91.3¢ 144.7¢ (36.9)

Adjusted 120.9¢ 97.2¢ 24.4

Adjusted – continuing operations 117.8¢ 93.8¢ 25.6

* Profit before tax includes the results of discontinued operations.

Revenue from continuing operations increased by 4.7% to $1,854m

and continuing operating profit before exceptional items increased

by 12.9% to $535m during the 12 months ended 31 December 2008.

The growth in revenues was driven by RevPAR gains in EMEA and

Asia Pacific, continued expansion in China and the Middle East

and the first full year of trading at the re-opened InterContinental

London Park Lane. Growth was achieved in all regions in the first

three quarters of the year however, the worldwide financial crisis

had a significant impact on the results for the final quarter. In the

fourth quarter, RevPAR declined sharply across the Group falling

by 6.5% globally, although IHG’s brands continued to outperform

their segments in all key markets. Strong revenue conversion led

to a 2.1 percentage point increase in the continuing operating profit

margin to 28.9%.

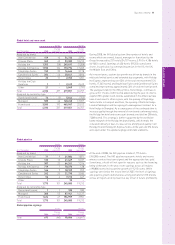

Included in these results is $33m of liquidated damages received

by IHG in 2008 in respect of the settlement of two management

contracts and two franchise contracts, including one portfolio

franchise contract. Excluding these, revenue and operating

profit before exceptional items from continuing operations

increased by 2.8% and 5.9% respectively.

Including discontinued operations, total revenue increased by

2.5% to $1,897m whilst operating profit before exceptional items

increased by 11.8% to $549m. Discontinued operations included

the results of owned and leased hotels that have been disposed

of since 1 January 2007, or those classified as held for sale as

part of the asset disposal programme that commenced in 2003.

The average US dollar exchange rate to sterling strengthened

during 2008 (2008 $1=£0.55, 2007 $1=£0.50). Translated at

constant currency, applying 2007 exchange rates, continuing

revenue increased by 4.3% and continuing operating profit

increased by 10.3%.

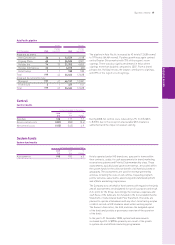

Total gross revenue

12 months ended 31 December

2008 2007 %

$bn $bn change

InterContinental 4.1 3.7 10.8

Crowne Plaza 3.2 2.8 14.3

Holiday Inn 6.8 6.7 1.5

Holiday Inn Express 3.9 3.5 11.4

Staybridge Suites 0.4 0.3 33.3

Candlewood Suites 0.3 0.3 –

Other brands 0.4 0.5 (20.0)

Total 19.1 17.8 7.3

One measure of overall IHG hotel system performance is the

growth in total gross revenue, defined as total room revenue from

franchised hotels and total hotel revenue from managed, owned

and leased hotels. Total gross revenue is not revenue attributable

to IHG, as it is derived mainly from hotels owned by third parties.

Total gross revenue increased by 7.3% from $17.8bn in 2007 to

$19.1bn in 2008, with growth levels achieved across IHG’s key

brands reflecting hotel performance and room growth. Translated

at constant currency, total gross revenue increased by 6.2%.

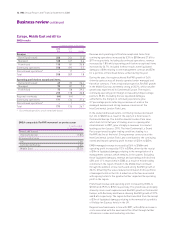

On 30 May 2008, IHG announced its intention to change its

reporting currency from sterling to US dollars reflecting the profile

of its revenue and operating profit, which are primarily generated

in US dollars or US dollar-linked currencies. This change was first

introduced in the interim results for the six months to 30 June

2008, and these financial statements are IHG’s first annual

financial statements to be presented in US dollars and all

comparative information has been restated accordingly.

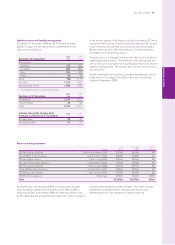

Business review continued