Holiday Inn 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

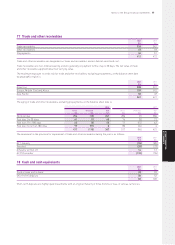

25 Share-based payments

Annual Bonus Plan

The IHG Annual Bonus Plan enables eligible employees, including

Executive Directors, to receive all or part of their bonus in the form

of shares together with, in certain cases, a matching award of free

shares of up to half the deferred amount. The bonus and matching

shares in the 2005 plan are deferred and released in three equal

tranches on the first, second and third anniversaries of the award

date. The bonus and matching shares in the 2006 and 2007 plans

are released on the third anniversary of the award date. Under the

2006 and 2007 plans a percentage of the award (Board members –

100% (2006 80%); other eligible employees – 50%) must be taken

in shares and deferred. Participants may defer the remaining

amount on the same terms or take it immediately in cash, in

which case it is not accounted for as a share-based payment.

Under the terms of the 2008 plan, a fixed percentage of the bonus

is awarded in the form of shares with no voluntary deferral and no

matching shares. The awards in all of the plans are conditional on

the participants remaining in the employment of a participating

company. Participation in the Annual Bonus Plan is at the

discretion of the Remuneration Committee. The number of shares

is calculated by dividing a specific percentage of the participant’s

annual performance related bonus by the middle market quoted

prices on the three consecutive dealing days immediately

preceding the date of grant. A number of executives participated

in the plan during the year and conditional rights over 661,657

(2007 675,515) shares were awarded to participants.

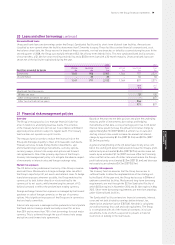

Long Term Incentive Plan

The Long Term Incentive Plan allows Executive Directors and

eligible employees to receive share awards, subject to the

satisfaction of a performance condition, set by the Remuneration

Committee, which is normally measured over a three year period.

Awards are normally made annually and, except in exceptional

circumstances, will not exceed three times salary for Executive

Directors and four times salary in the case of other eligible

employees. During the year, conditional rights over 5,060,509

(2007 3,538,535) shares were awarded to employees under

the plan. The plan provides for the grant of ‘nil cost options’

to participants as an alternative to conditional share awards.

Executive Share Option Plan

For options granted, the option price is not less than the market

value of an ordinary share, or the nominal value if higher. The

market value is the quoted price on the business day preceding the

date of grant, or the average of the middle market quoted prices

on the three consecutive dealing days immediately preceding

the date of grant. A performance condition has to be met before

options can be exercised. The performance condition is set by

the Remuneration Committee. The plan was not operated during

2008 and no options were granted in the year under the plan.

The latest date that any options may be exercised is 4 April 2015.

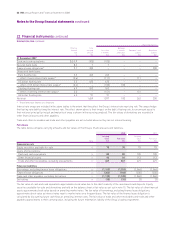

Sharesave Plan

The Sharesave Plan is a savings plan whereby employees contract

to save a fixed amount each month with a savings institution for

three or five years. At the end of the savings term, employees are

given the option to purchase shares at a price set before savings

began. The Sharesave Plan is available to all UK employees

(including Executive Directors) employed by participating Group

companies provided that they have been employed for at least one

year. The plan provides for the grant of options to subscribe for

ordinary shares at the higher of nominal value and not less than

80% of the middle market quotations of the ordinary shares on the

three dealing days immediately preceding the invitation date. The

plan was not operated during 2008 and no options were granted

in the year under the plan. The latest date that any options could

be exercised under the three-year plan was 29 February 2008

and under the five-year plan is 28 February 2010.

US Employee Stock Purchase Plan

The US Employee Stock Purchase Plan will allow eligible

employees resident in the US an opportunity to acquire Company

American Depositary Shares (ADSs) on advantageous terms. The

plan, when operational, will comply with Section 423 of the US

Internal Revenue Code of 1986. The option to purchase ADSs may

be offered only to employees of designated subsidiary companies.

The option price may not be less than the lesser of either 85%

of the fair market value of an ADS on the date of grant or 85% of

the fair market value of an ADS on the date of exercise. Options

granted under the plan must generally be exercised within 27

months from the date of grant. The plan was not operated during

2008 and at 31 December 2008 no options had been granted under

the plan.

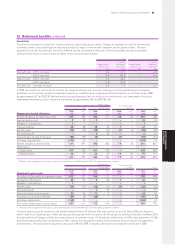

Former Six Continents Share Schemes

Under the terms of the separation of Six Continents PLC in 2003,

holders of options under the Six Continents Executive Share

Option Schemes were given the opportunity to exchange their

Six Continents PLC options for equivalent value new options over

IHG shares. As a result of this exchange, 23,195,482 shares were

put under option at prices ranging from 308.5p to 593.3p. The

exchanged options were immediately exercisable and are not

subject to performance conditions. During 2008, 159,254 (2007

1,358,791) such options were exercised and 113,024 shares lapsed

(2007 nil), leaving a total of 2,424,605 (2007 2,696,883) such options

outstanding at prices ranging from 308.5p to 466.7p. The latest

date that any options may be exercised is 3 October 2012.

Notes to the Group financial statements 87

GROUP FINANCIAL

STATEMENTS