Holiday Inn 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE BOARD, SENIOR

MANAGEMENT AND

THEIR RESPONSIBILITIES

Remuneration report 45

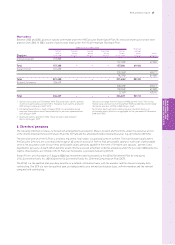

5 Long-term reward

Annual Bonus Plan (ABP)

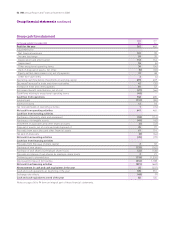

Messrs Cosslett, Porter and Solomons participated in the ABP during the year ended 31 December 2008. Messrs Cosslett and Solomons

are expected to receive an award on 23 February 2009. Matching shares are no longer awarded. Directors’ pre-tax share interests during

the year were:

ABP Value

ABP shares based

Awards vested on share

during Market during Market ABP price of

ABP the year price the year price Value Awards Planned 562p at

Awards held 1 Jan 2008 to Award per share 1 Jan 2008 to Vesting per share at vesting held at vesting 31 Dec 2008

Directors at 1 Jan 2008 31 Dec 2008 date at award 31 Dec 2008 date at vesting £ 31 Dec 2008 date £

Andrew Cosslett 28,87728.3.06 853.67p 28,877 10.3.08 780p 225,241 –

28,87828.3.06 853.67p 28,878 8.3.09 162,294

55,870326.2.07 1235p 55,870 26.2.10 313,989

71,287425.2.08 819.67p 71,287 25.2.11 400,633

Total 156,035 876,916

Stevan Porter 26,978116.3.05 653.67p 26,978 17.3.08 735p 198,2887–

18,53128.3.06 853.67p 18,531 10.3.08 780p 144,5427–

18,53028.3.06 853.67p 18,530 7.11.086542.5p 100,525 –

29,778326.2.07 1235p 29,778 7.11.086542.5p 161,546 –

35,743525.2.08 819.67p 35,743 7.11.086542.5p 193,906 –

Total –

Richard Solomons 29,021116.3.05 653.67p 29,021 17.3.08 735p 213,304 –

18,45928.3.06 853.67p 18,459 10.3.08 780p 143,980 –

18,45928.3.06 853.67p 18,459 8.3.09 103,740

35,757326.2.07 1235p 35,757 26.2.10 200,954

45,634825.2.08 819.67p 45,634 25.2.11 256,463

Total 99,850 561,157

Former Directors

Richard Hartman 29,447116.3.05 653.67p 29,447 17.3.08 735p 216,435 –

17,69828.3.06 853.67p 17,698 10.3.08 780p 138,044 –

17,69628.3.06 853.67p 17,696 28.3.089772.5p 136,702 –

51,281326.2.07 1235p 51,281 28.3.089772.5p 396,146 –

Total –

1 This award was based on 2004 financial year performance where

the performance measures were related to EPS, EBIT and personal

performance. Total shares held include matching shares.

2 This award was based on 2005 financial year performance where

the performance measures were related to EPS, EBIT and personal

performance. Total shares held include matching shares.

3 This award was based on 2006 financial year performance where

the performance measures were related to EPS and EBIT. Total shares

held include matching shares.

4 This award was based on 2007 financial year performance where the

performance measures were related to Group EBIT and net annual rooms

additions. The bonus target was 50% of base salary. Andrew Cosslett was

awarded 33% for Group EBIT performance and 19.5% for net annual rooms

additions. Andrew Cosslett’s total bonus was therefore 52.5% of his base

salary. One matching share was awarded for every two bonus shares earned.

5 This award was based on 2007 financial year performance where the

performance measures were related to Americas’ EBIT and net annual

rooms additions. The bonus target was 50% of base salary. Stevan Porter

was awarded 25.75% for Americas’ EBIT performance and 19.5% for net

annual rooms additions. Stevan Porter’s total bonus was therefore 45.25%

of his base salary. One matching share was awarded for every two bonus

shares earned. Stevan Porter also received a cash payment of £3,550.52

in lieu of dividends relating to bonus shares.

6 In accordance with Plan rules, Stevan Porter’s ABP shares held at 1 January

2008 and awarded during 2008 (in respect of 2007 performance), and which

were due to vest from 2009 onwards, vested early at the discretion of the

Remuneration Committee, following his death on 7 August 2008. The value

of these entitlements was calculated as at 7 November 2008. A cash

payment of £1,525.06 in lieu of dividends relating to bonus shares was paid

to his estate. The shares will be transferred to Mr Porter’s estate following

completion of UK probate in due course.

7 The value of Stevan Porter’s shares at vesting includes £31,130 that was

chargeable to UK income tax.

8 This award was based on 2007 financial year performance where the

performance measures were related to Group EBIT and net annual rooms

additions. The bonus target was 50% of base salary. Richard Solomons was

awarded 33% for Group EBIT performance and 19.5% for net annual rooms

additions. Richard Solomons’ total bonus was therefore 52.5% of his base

salary. One matching share was awarded for every two bonus shares earned.

9 At the discretion of the Remuneration Committee, all of Richard Hartman’s

shares vested six months after his retirement date of 25 September 2007.