Holiday Inn 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BUSINESS REVIEW

Business review 7

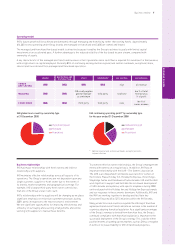

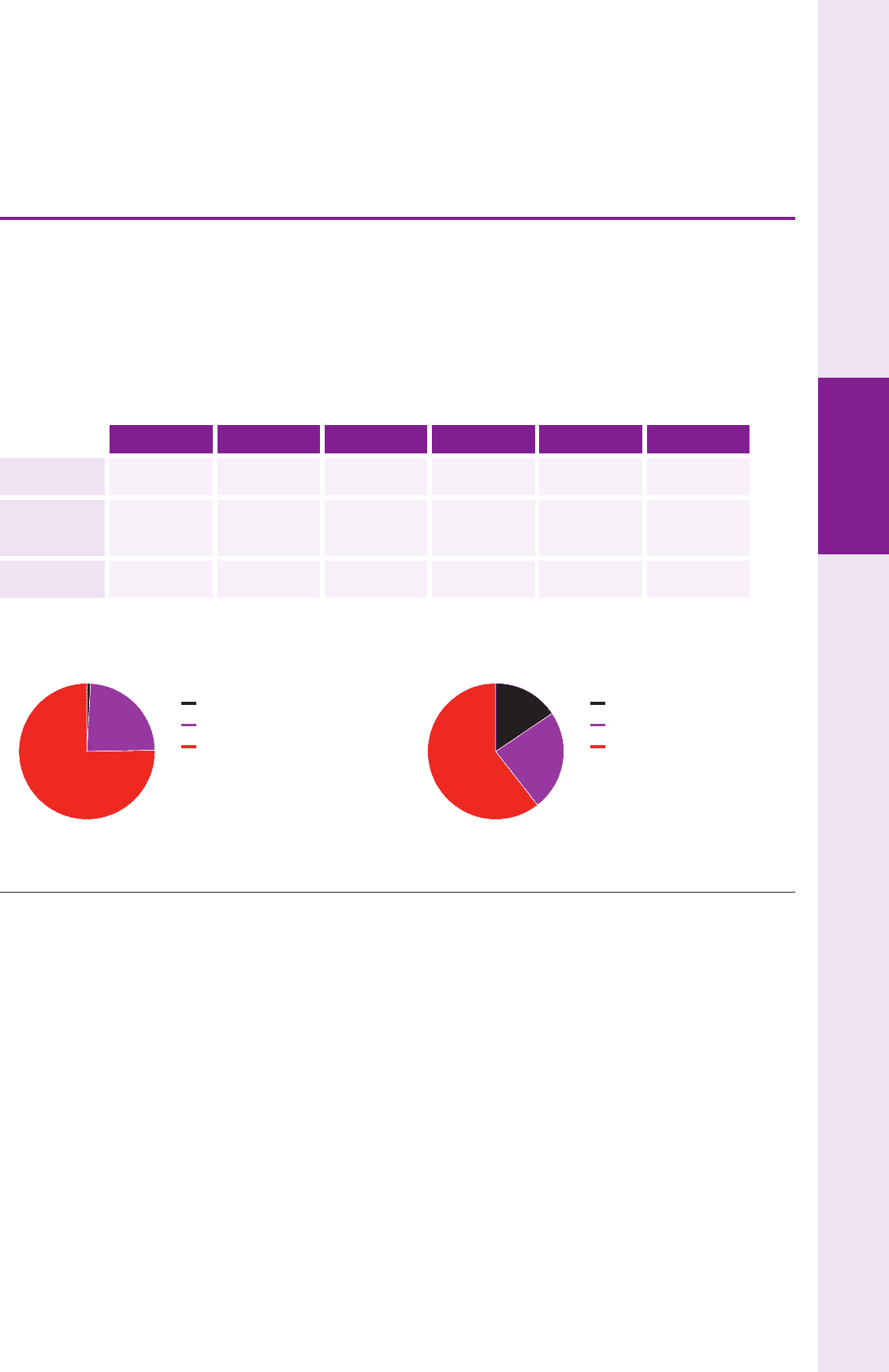

IHG global room count by ownership type

at 31 December 2008

IHG continuing operating profit* by ownership type

for the year ended 31 December 2008

* Before regional and central overheads, exceptional items,

interest and tax.

Owned and leased

Managed

Franchised

Owned and leased

Managed

Franchised

IHG’s future growth will be achieved predominantly through managing and franchising rather than owning hotels. Approximately

614,000 rooms operating under Group brands are managed or franchised and 5,600 are owned and leased.

The managed and franchised fee-based model is attractive because it enables the Group to achieve its goals with limited capital

investment at an accelerated pace. A further advantage is the reduced volatility of the fee-based income stream, compared with

ownership of assets.

A key characteristic of the managed and franchised business is that it generates more cash than is required for investment in the business,

with a high return on capital employed. Currently 85% of continuing earnings before regional and central overheads, exceptional items,

interest and tax is derived from managed and franchised operations.

Operating model

Business relationships

IHG has major relationships with hotel owners and indirect

relationships with suppliers.

IHG maintains effective relationships across all aspects of its

operations. The Group’s operations are not dependent upon any

single customer, supplier or hotel owner due to the extent of

its brands, market segments and geographical coverage. For

example, IHG’s largest third-party hotel owner controls less

than 4% of the Group’s total room count.

IHG’s relationships with its suppliers will be changing as we place

significant emphasis on revised procurement processes during

2009, partly in response to the macroeconomic environment.

We see significant opportunities for improving effectiveness and

efficiency of our buying and sourcing arrangements and will be

working with suppliers to realise these benefits.

To promote effective owner relationships, the Group’s management

meets with owners on a regular basis. In addition, IHG has an

important relationship with the IAHI – The Owners’ Association.

The IAHI is an independent worldwide association for owners of

the Crowne Plaza, Holiday Inn, Holiday Inn Express, Hotel Indigo,

Staybridge Suites and Candlewood Suites brands. IHG and the IAHI

work together to support and facilitate the continued development

of IHG’s brands and systems, with specific emphasis during 2008

on the relaunch of the Holiday Inn and Holiday Inn Express brands

and our response to the economic downturn. Additionally, IHG and

the IAHI are working together to develop and facilitate key

Corporate Responsibility (CR) initiatives within the IHG brands.

Many jurisdictions and countries regulate the offering of franchise

agreements and recent trends indicate an increase in the number of

countries adopting franchise legislation. As a significant percentage

of the Group’s revenue is derived from franchise fees, the Group’s

continued compliance with franchise legislation is important to the

successful deployment of the Group’s strategy. This could be either

positive in terms of opening up new markets such as China, or negative

in terms of increased liability for IHG in franchised properties.

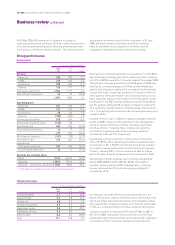

OWNED

AND LEASED

MANAGED

FRANCHISED

IHG

IHG

IHG

IHG

IHG

IHG

IHG

IHG usually supplies

general manager

as a minimum

third party

IHG

third party

third party

high

low/none

none

all revenue

fee % of total

revenue plus

% of profit

fee % of

rooms revenue

BRAND MARKETING AND

DISTRIBUTION STAFF OWNERSHIP IHG CAPITAL IHG REVENUE