Holiday Inn 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the parent company financial statements and Statement of Directors’ responsibilities 99

PARENT COMPANY

FINANCIAL STATEMENTS

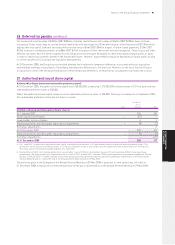

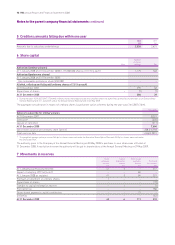

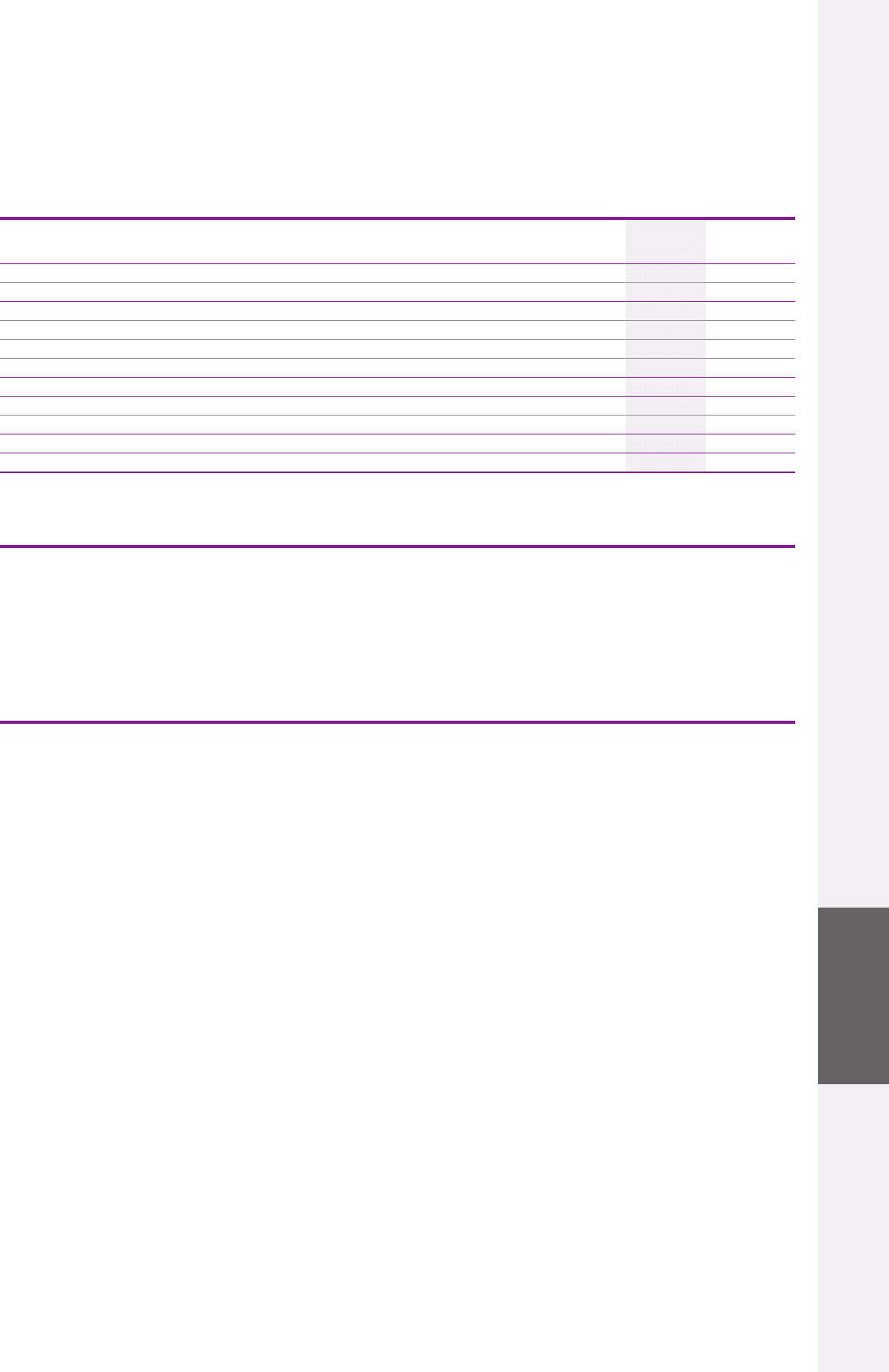

8 Reconciliation of movements in shareholders’ funds

2008 2007

restated*

£m £m

Earnings available for shareholders 186 111

Dividends (62) (773)

124 (662)

Issue of ordinary shares 116

Repurchase of ordinary shares (71) (81)

Share-based payments capital contribution 27 30

Net movement in shareholders’ funds 81 (697)

Opening shareholders’ funds as previously reported 343 1,070

Impact of adopting UITF 44 (note 1) 84 54

Opening shareholders’ funds as restated 427 1,124

Closing shareholders’ funds 508 427

* Restated following the adoption of UITF 44 (note1).

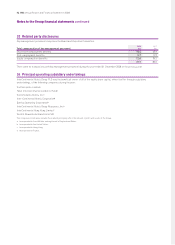

9 Profit and dividends

Profit on ordinary activities after tax amounts to £186m (2007 £111m).

A final dividend, declared in the previous year, of 14.9p (2007 13.3p) per share was paid during the year, amounting to £44m (2007 £47m).

A special interim dividend was paid in 2007 of 200.0p per share, amounting to £709m. An interim dividend of 6.4p (2007 5.7p) per share was

paid during the year, amounting to £18m (2007 £17m). A final dividend of 20.2p (2007 14.9p) per share, amounting to £58m (2007 £44m),

is proposed for approval at the Annual General Meeting. The proposed final dividend is payable on shares in issue at 27 March 2009.

The audit fee for both years was borne by a subsidiary undertaking.

10 Contingencies

Contingent liabilities of £1,345m (2007 £840m) in respect of guarantees of the liabilities of subsidiaries have not been provided for in the

financial statements.

In relation to the parent company

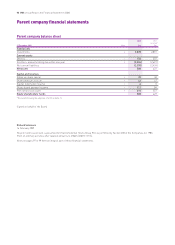

financial statements

The following statement, which should be read in conjunction

with the independent auditor’s report, is made with a view to

distinguishing for shareholders the respective responsibilities

of the Directors and of the auditor in relation to the Company

financial statements.

The Directors are responsible for preparing the parent company

financial statements and Remuneration Report in accordance with

applicable United Kingdom law and United Kingdom Generally

Accepted Accounting Practice (UK GAAP).

The Directors are required to prepare Company financial

statements for each financial year which present fairly the financial

position of the Company and the financial performance of the

Company for that period.

The Directors consider that, in preparing the Company financial

statements, the Company has used appropriate accounting

policies, consistently applied and supported by reasonable and

prudent judgements and estimates, and that all applicable

accounting standards have been followed. The Company financial

statements have been prepared on a going concern basis as the

Directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future.

The Directors have responsibility for ensuring that the Company

keeps accounting records which disclose with reasonable accuracy

the financial position of the Company and which enable them to

ensure that the Company financial statements comply with the

Companies Act 1985.

The Directors have general responsibility for taking such steps

as are reasonably open to them to safeguard the assets of the

Company and to prevent and detect fraud and other irregularities.

Statement of Directors’ responsibilities