Holiday Inn 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8IHGAnnual Report and Financial Statements 2008

Business review continued

Where we compete

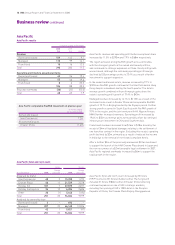

Key performance indicators Current status and

Strategic priorities (KPIs) 2008 developments 2009 priorities

To accelerate profitable

growth of our core

business in the largest

markets where the

Group currently has

scale and also in key

global cities. Seek

opportunities to leverage

our scale in new

business areas.

• Progress against the following 2008

growth targets, set in June 2005:

– 50,000-60,000 net rooms growth;

– 125 hotels in China; and

– 15-25 net InterContinental

hotel additions.

• 2008 growth targets accomplished,

with exception of China where we

reached 112 hotels. (Target expected

to be exceeded during early 2009);

• International launch of Hotel Indigo

– first one open in London, UK and

one signed in Shanghai, People’s

Republic of China;

• Holiday Inn Club Vacations

(franchise timeshare) conceived

and launched; and

• 81% of pipeline focused on core

strategic countries.

• Continue international roll-out of

Staybridge Suites and Hotel Indigo;

• Execute growth strategies in agreed

scale markets;

• Continue to focus on rapid and

successful opening of pipeline

hotels; and

• Seek ways to leverage scale and

build improved strategic position

during the economic downturn.

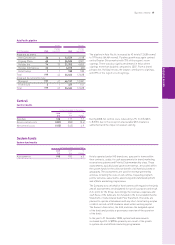

Strategy

IHG’s ambition

IHG seeks to deliver enduring top quartile shareholder returns,

when measured against a broad global hotel peer group, by

focusing on its core purpose of creating Great Hotels Guests Love.

We measure success in three ways:

• Total Shareholder Returns. (For the three-year period of 2006

to 2008, IHG was third among its peers);

• Rooms Growth – rooms added to our brands at a rate faster

than competitors. (In 2008 we grew by 5.9% against an average

of 4.3% for our main competitors); and

• a basket of specific key performance indicators (KPIs) aimed

at delivering our core purpose, cascaded to the hotel level.

Successful performance against various combinations of these,

and other, metrics drives payment of a significant percentage

of senior management discretionary remuneration.

IHG’s strategy

Our strategy has seen significant development through 2008 as we

moved to make our core purpose a reality. We have taken a hard

look at our operations and capabilities to focus on what really

matters most to deliver Great Hotels Guests Love. We have backed

this up with a major effort to align our people and measure the most

important drivers, resulting in a clear, target-based programme

within our hotels to motivate teams and guide behaviours.

Our strategy now encompasses two key aspects:

• where we choose to compete; and

• how we will win when we compete.

The Group’s underlying ‘Where’ strategy is that IHG will grow a portfolio

of differentiated hospitality brands in select strategic countries and

global key cities to maximise our scale advantage. The ‘How’ aspect

of our strategy flows from our core purpose and our research at the

hotel level as to what really makes a difference for guests.

In support of our overall strategy there are now five key priorities –

one ‘Where we compete’ and four ‘How we win’: