Holiday Inn 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 IHG Annual Report and Financial Statements 2008

24 Retirement benefits continued

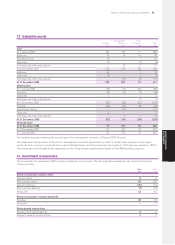

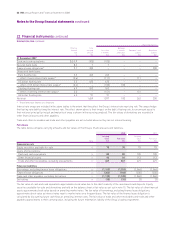

The assets and liabilities of the schemes and the amounts recognised in the Group balance sheet are:

Pension plans Post-employment

UK US and other benefits Total

2007 2007

2008 restated* 2008 2007 2008 2007 2008 restated*

$m $m $m $m $m $m $m $m

Schemes in surplus

Fair value of plan assets 437 611 16 15 ––453 626

Present value of benefit obligations (377) (550) (13) (10) ––(390) (560)

Surplus in schemes 60 61 35––63 66

Asset restriction** (23) (17) ––––(23) (17)

Retirement benefit assets 37 44 35––40 49

Schemes in deficit

Fair value of plan assets ––96 129 ––96 129

Present value of benefit obligations (34) (47) (172) (174) (19) (20) (225) (241)

Retirement benefit obligations (34) (47) (76) (45) (19) (20) (129) (112)

Total fair value of plan assets 437 611 112 144 ––549 755

Total present value of benefit obligations (411) (597) (185) (184) (19) (20) (615) (801)

* Restated for IFRIC 14 (see page 56).

** Relates to tax that would be deducted at source in respect of a refund of the surplus.

The ‘US and other’ surplus of $3m relates to a defined benefit pension scheme in Hong Kong. Included within the ‘US and other’ deficit

is $1m relating to a defined benefit pension plan in the Netherlands.

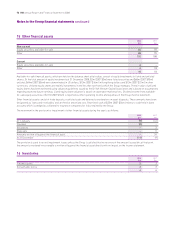

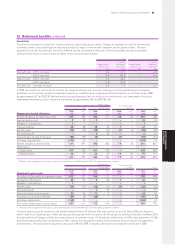

Assumptions

The principal financial assumptions used by the actuaries to determine the benefit obligation are:

Pension plans Post-employment

UK US benefits

2008 2007 2008 2007 2008 2007

%%%%%%

Wages and salaries increases 4.5 4.9 ––4.0 4.0

Pensions increases 3.0 3.4 ––––

Discount rate 5.6 5.5 6.2 5.8 6.2 5.8

Inflation rate 3.0 3.4 ––––

Healthcare cost trend rate assumed for next year 9.5 10.0

Ultimate rate that the cost trend rate trends to 5.0 5.0

Mortality is the most significant demographic assumption. In respect of the UK plans, the specific mortality rates used are in line with

the PA92 medium cohort tables, with age rated down by one year, implying the following life expectancies at retirement. In the US,

life expectancy is determined by reference to the RP-2000 healthy tables.

Pension plans

UK US

2008 2007 2008 2007

Years Years Years Years

Current pensioners at 65a– male 23 23 18 18

– female 26 26 20 20

Future pensioners at 65b– male 24 24 18 18

– female 27 27 20 20

a Relates to assumptions based on longevity (in years) following retirement at the balance sheet date.

b Relates to assumptions based on longevity (in years) relating to an employee retiring in 2028.

The assumptions allow for expected increases in longevity.

Notes to the Group financial statements continued