Holiday Inn 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

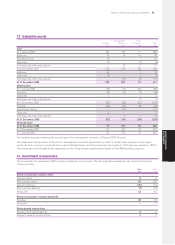

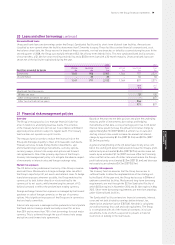

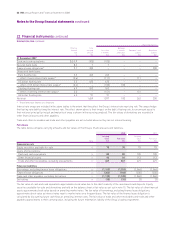

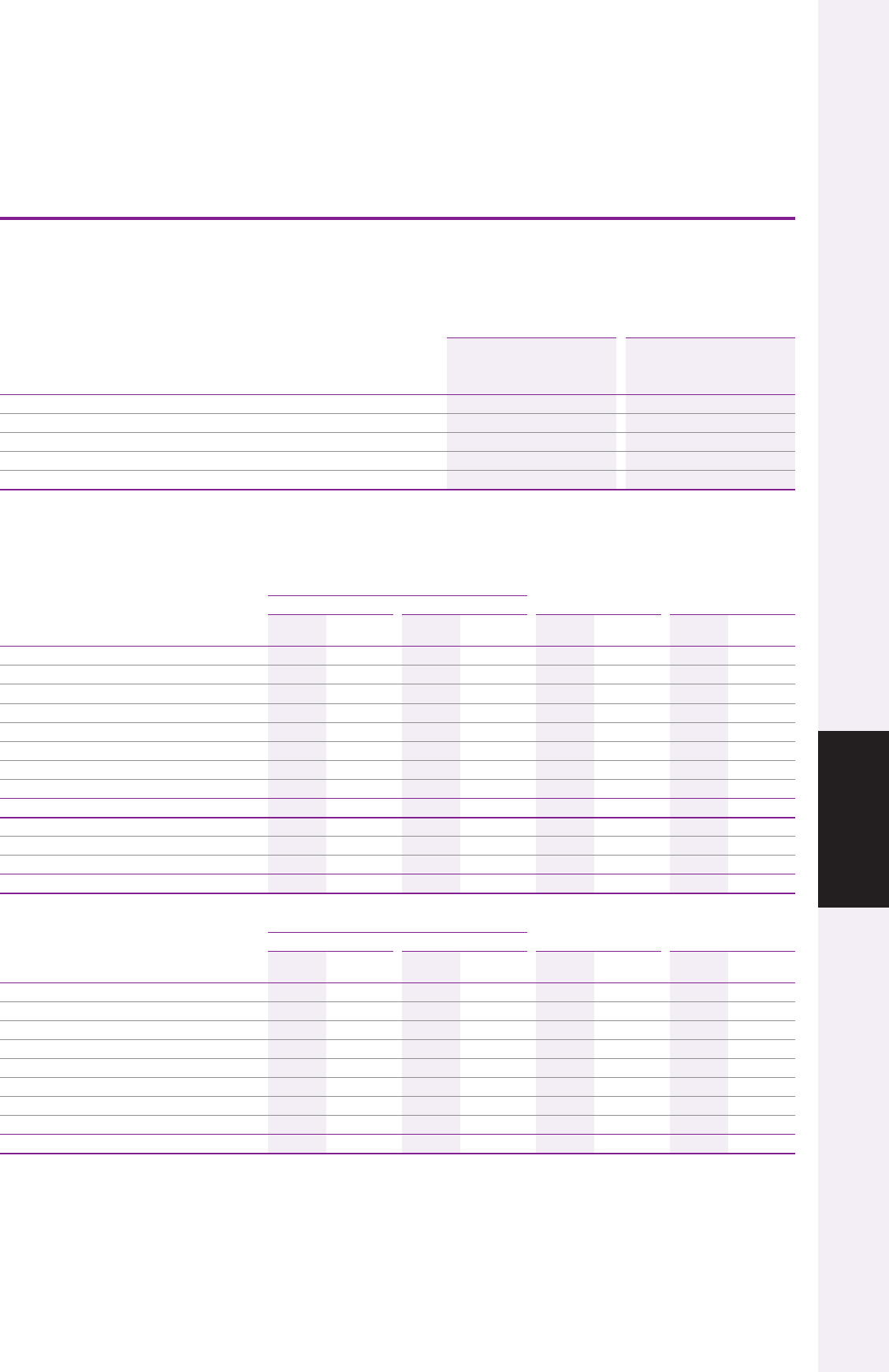

24 Retirement benefits continued

Sensitivities

The value of plan assets is sensitive to market conditions, particularly equity values. Changes in assumptions used for determining

retirement benefit costs and obligations may have a material impact on the income statement and the balance sheet. The main

assumptions are the discount rate, the rate of inflation and the assumed mortality rate. The following table provides an estimate

of the potential impact of each of these variables on the principal pension plans.

UK US

Increase/ Increase/

Higher/(lower) (decrease) Higher/(lower) (decrease)

pension cost in liabilities pension cost in liabilities

$m $m $m $m

Discount rate – 0.25% decrease 0.6 21.7 – 4.8

– 0.25% increase (0.4) (20.5) – (4.6)

Inflation rate – 0.25% increase 1.3 20.4 – –

– 0.25% decrease (1.2) (19.2) – –

Mortality rate – one year increase 0.6 7.9 – 6.1

In 2018, the healthcare cost trend rate reaches the assumed ultimate rate. A one percentage point increase/(decrease) in assumed

healthcare costs trend rate would increase/(decrease) the accumulated post-employment benefit obligations as of 31 December 2008

by approximately $1.7m (2007 $1.9m) and would increase/(decrease) the total of the service and interest cost components of net post-

employment healthcare cost for the period then ended by approximately $0.1m (2007 $0.1m).

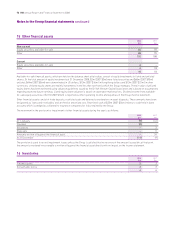

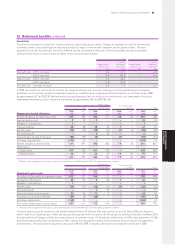

Pension plans Post-employment

UK US and other benefits Total

2008 2007 2008 2007 2008 2007 2008 2007

Movement in benefit obligation $m $m $m $m $m $m $m $m

Benefit obligation at beginning of year 597 585 184 175 20 20 801 780

Current service cost 910 1–––10 10

Members’ contributions 11––––11

Interest expense 30 30 10 10 1141 41

Benefits paid (12) (13) (12) (11) (1) (1) (25) (25)

Reclassification* ––510 ––510

Actuarial gain arising in the year (55) (31) (3) –(1) –(59) (31)

Exchange adjustments (159) 15 ––––(159) 15

Benefit obligation at end of year 411 597 185 184 19 20 615 801

Comprising:

Funded plans 377 550 141 139 ––518 689

Unfunded plans 34 47 44 45 19 20 97 112

411 597 185 184 19 20 615 801

* Relates to the recognition of the gross assets and obligations of the Netherlands (2007 Hong Kong) pension scheme.

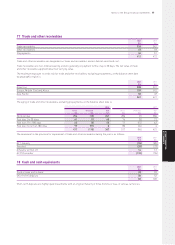

Pension plans Post-employment

UK US and other benefits Total

2008 2007 2008 2007 2008 2007 2008 2007

Movement in plan assets $m $m $m $m $m $m $m $m

Fair value of plan assets at beginning of year 611 527 144 111 ––755 638

Company contributions 30 54 320 1134 75

Members’ contributions 11––––11

Benefits paid (12) (13) (12) (11) (1) (1) (25) (25)

Reclassification* ––415 ––415

Expected return on plan assets 32 34 11 9––43 43

Actuarial loss arising in the year (57) (6) (38) –––(95) (6)

Exchange adjustments (168) 14 ––––(168) 14

Fair value of plan assets at end of year 437 611 112 144 ––549 755

* Relates to the recognition of the gross assets and obligations of the Netherlands (2007 Hong Kong) pension scheme.

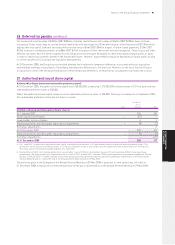

The most recent actuarial valuation of the InterContinental Hotels UK Pension Plan was carried out as at 31 March 2006 and showed a

deficit of £81m on a funding basis. Under the recovery plan agreed with the trustees, the Group aims to eliminate this deficit by March 2014

through additional Company contributions and projected investment returns. Of the agreed contributions of £40m, three payments of £10m

have been made and the final commitment of £10m is being met through the funding of the enhanced pension transfer arrangements

detailed below. The next actuarial valuation is due as at 31 March 2009. Company contributions are expected to be $14m in 2009.

Notes to the Group financial statements 85

GROUP FINANCIAL

STATEMENTS