Holiday Inn 2008 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BUSINESS REVIEW

Business review 15

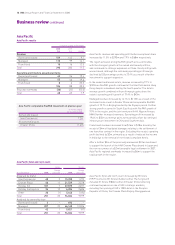

Hotels Rooms

Change Change

At 31 December 2008 over 2007 2008 over 2007

Analysed by brand

InterContinental 64 220,836 824

Crowne Plaza 89 17 20,729 3,403

Holiday Inn 332 (3) 53,039 197

Holiday Inn Express 186 421,564 2,184

Staybridge Suites 22272 272

Hotel Indigo 1164 64

Other 11203 203

Total 675 24 116,707 7,147

Analysed by ownership type

Owned and leased 4(1) 1,446 (228)

Managed 179 841,185 2,112

Franchised 492 17 74,076 5,263

Total 675 24 116,707 7,147

During 2008, EMEA hotel and room count increased by 24 hotels

(7,147 rooms) to 675 hotels (116,707 rooms). The net room growth

included the opening of 10,118 rooms (62 hotels), up 27% on 2007

resulting from hotels entering the system after the high signing

levels in 2006 and 2007, and the removal of 38 hotels (2,971 rooms),

including the removal of a portfolio of franchised Holiday Inn

Express hotels in the UK. System growth was led by openings in the

UK of 21 hotels (2,460 rooms). Further significant growth occurred

in the Middle East, with 11 hotel openings (2,767 rooms), compared

to four hotel openings (1,013 rooms) in 2007. Holiday Inn Express

was the largest contributor of room openings, adding over 36%

of the region’s total. Two new brands were introduced to the region

during the year with the opening of Staybridge Suites hotels in

Liverpool and Cairo and the Hotel Indigo London Paddington which

opened in December 2008.

EMEA hotel and room count

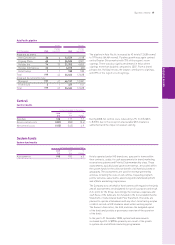

EMEA pipeline

Hotels Rooms

Change Change

At 31 December 2008 over 2007 2008 over 2007

Analysed by brand

InterContinental 28 47,062 1,102

Crowne Plaza 25 –7,287 989

Holiday Inn 50 (1) 10,204 658

Holiday Inn Express 57 (19) 7,790 (1,976)

Staybridge Suites 12 21,431 202

Other 1–90 –

Total 173 (14) 33,864 975

Analysed by ownership type

Managed 83 13 19,596 4,393

Franchised 90 (27) 14,268 (3,418)

Total 173 (14) 33,864 975

The pipeline in EMEA decreased by 14 hotels, but increased by

975 rooms, to 173 hotels (33,864 rooms). The growth included

13,348 room signings, with continued strong demand for IHG

brands in the Middle East, which accounted for 43% of the region’s

room signings. Across the region, all brands recorded positive

signing levels, with demand particularly focused in the midscale

sector which represented 46% of room signings. The demand for

the extended stay brand, Staybridge Suites, continued with signings

in line with 2007, reflecting confidence from our owners in the

extended stay model imported from the Americas region.