Holiday Inn 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 IHG Annual Report and Financial Statements 2008

Business review continued

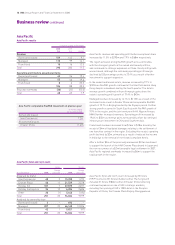

Asia Pacific

Asia Pacific results

12 months ended 31 December

2008 2007 %

$m $m change

Revenue

Owned and leased 159 145 9.7

Managed 113 99 14.1

Franchised 18 16 12.5

Total 290 260 11.5

Operating profit before exceptional items

Owned and leased 43 36 19.4

Managed 55 46 19.6

Franchised 86 33.3

106 88 20.5

Regional overheads (38) (25) (52.0)

Total 68 63 7.9

Asia Pacific comparable RevPAR movement on previous year

12 months ended

31 December 2008

Owned and leased

InterContinental 7.2%

All ownership types

Greater China (1.6)%

Asia Pacific revenue and operating profit before exceptional items

increased by 11.5% to $290m and 7.9% to $68m respectively.

The region achieved strong RevPAR growth across all brands,

with the strongest growth in the owned and leased portfolio,

and continued its strategic expansion in China. Good profit growth

was achieved, although the continuing operating profit margin

declined by 0.8 percentage points to 23.4% as a result of further

investment to support expansion.

In the owned and leased estate, revenue increased by 9.7% to

$159m as RevPAR growth continued at the InterContinental Hong

Kong despite a slowdown during the fourth quarter. The hotel’s

revenue growth combined with profit margin gains drove the

estate’s operating profit growth of 19.4% to $43m.

Managed revenue increased by 14.1% to $113m as a result of the

increased room count in Greater China and comparable RevPAR

growth of 10.7% in Beijing boosted by the Olympic period. Further

strong growth occurred in South East Asia with RevPAR growth of

9.9% in the region, and the joint venture with All Nippon Airways

(ANA) further increased revenues. Operating profit increased by

19.6% to $55m as revenue gains were partially offset by continued

infrastructure investment in China and Southern Asia.

Franchised revenues increased from $16m to $18m driven by the

receipt of $4m of liquidated damages relating to the settlement of

one franchise contract in the region. Excluding this receipt, operating

profit declined by $2m, primarily as a result of reduced fee income

in India due to the removal of non-brand compliant hotels.

After a further $5m of the previously announced $10m investment

to support the launch of the ANA Crowne Plaza brand in Japan and

the non-recurrence of a $2m favourable legal settlement in 2007,

Asia Pacific regional overheads increased by $6m to support the

rapid growth in the region.

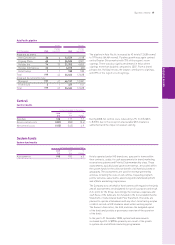

Hotels Rooms

Change Change

At 31 December 2008 over 2007 2008 over 2007

Analysed by brand

InterContinental 40 315,398 1,272

Crowne Plaza 66 11 21,529 3,578

Holiday Inn 101 727,875 2,017

Holiday Inn Express 24 13 6,206 3,606

Other 20 (1) 5,646 (494)

Total 251 33 76,654 9,979

Analysed by ownership type

Owned and leased 2–693 –

Managed 207 32 66,140 10,026

Franchised 42 19,821 (47)

Total 251 33 76,654 9,979

Asia Pacific hotel and room count increased by 33 hotels

(9,979 rooms) to 251 hotels (76,654 rooms). The net growth

included 31 hotels (9,806 rooms) in Greater China reflecting

continued expansion in one of IHG’s strategic markets,

including the opening of IHG’s 100th hotel in the People’s

Republic of China, the Crowne Plaza Beijing Zhongguancun.

Asia Pacific hotel and room count