Holiday Inn 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18 IHG Annual Report and Financial Statements 2008

Business review continued

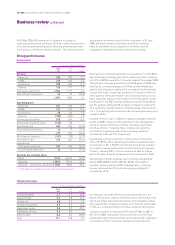

Other financial information

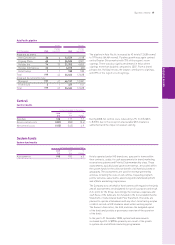

Exceptional operating items

Exceptional operating costs of $132m consisted of:

•$35m in relation to the Holiday Inn relaunch;

• $19m of cost savings-related severance costs;

• $96m of non-cash asset impairment reflecting the poorer

trading environment expected in 2009; and

• other items including gains on asset sales, which netted

to an $18m credit.

Exceptional operating items are treated as exceptional by reason

of their size or nature and are excluded from the calculation of

adjusted earnings per share in order to provide a more meaningful

comparison of performance.

Net financial expenses

Net financial expenses increased from $90m in 2007 to $101m

in 2008. Average net debt levels in 2008 were higher than 2007

primarily as a result of the payment of the special dividend of

£709m in June 2007. Net debt levels remained stable in the first

half of 2008, reducing slightly in the second half of the year.

Financing costs included $12m (2007 $21m) of interest costs

associated with Priority Club Rewards where interest is charged

on the accumulated balance of cash received in advance of the

redemption points awarded. Financing costs in 2008 also included

$18m (2007 $18m) in respect of the InterContinental Boston

finance lease.

Taxation

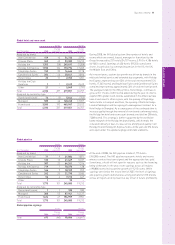

The effective rate of tax on the combined profit from continuing and

discontinued operations, excluding the impact of exceptional items,

was 23% (2007 22%). By also excluding the impact of prior year

items, which are included wholly within continuing operations, the

equivalent tax rate would be 39% (2007 36%). This rate is higher

than the UK statutory rate of 28% due mainly to certain overseas

profits (particularly in the US) being subject to statutory rates

higher than the UK statutory rate, unrelieved foreign taxes and

disallowable expenses.

Taxation within exceptional items totalled a credit of $42m

(2007 $60m) in respect of continuing operations. This represented,

primarily, the release of exceptional provisions relating to tax

matters which were settled during the year, or in respect of which

the statutory limitation period had expired, together with tax relief

on exceptional costs.

Net tax paid in 2008 totalled $2m (2007 $138m) including $3m

(2007 $64m) in respect of disposals. Tax paid is lower than the

current period income tax charge, primarily due to the receipt of

refunds in respect of prior years, together with provisions for tax

for which no payment of tax has currently been made.

Earnings per share

Basic earnings per share in 2008 was 91.3¢, compared with 144.7¢

in 2007. Adjusted earnings per share was 120.9¢, against 97.2¢ in

2007. Adjusted continuing earnings per share was 117.8¢, 25.6%

up on last year.

Dividends

The Board has proposed a final dividend per share of 29.2¢ (20.2p).

With the interim dividend per share of 12.2¢ (6.4p), the full-year

dividend per share for 2008 will total 41.4¢ (26.6p).

Share price and market capitalisation

The IHG share price closed at £5.62 on 31 December 2008, down

from £8.84 on 31 December 2007. The market capitalisation of the

Group at the year end was £1.6bn.

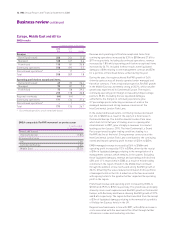

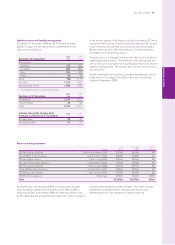

Cash flow

In response to the challenging economic environment the Group

increased its focus on cash management during 2008. In the year,

$641m of cash was generated from operating activities, an increase

of $176m on 2007. Overall, net debt decreased by $386m to

$1,273m with the other key elements of the cash flow being:

• proceeds from the disposal of hotels and investments of $86m;

• capital expenditure of $108m; and

• $139m returned to shareholders as part of the fourth share

buyback programme.

As part of the focus on cash management the remaining £30m of

the fourth £150m share buyback programme has been deferred.