Holiday Inn 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

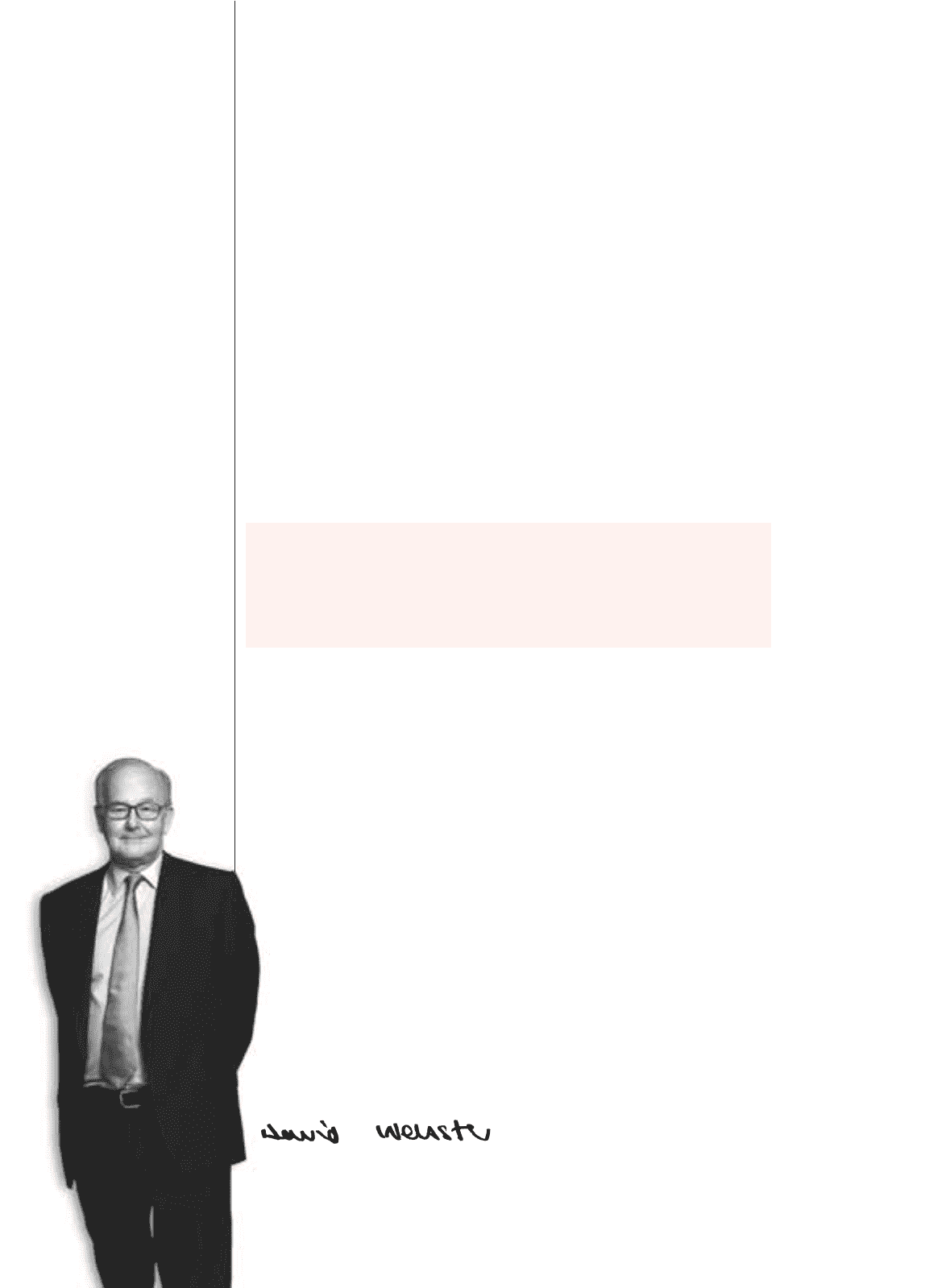

Dear shareholder

PERFORMANCE

Our continuing revenue increased 5 per cent to $1.9 billion, with continuing operating

profit before exceptional items of $535 million, up 13 per cent. Adjusted continuing

earnings per share increased 26 per cent from 93.8 cents to 117.8 cents. We had a

$132 million exceptional charge in the year. This consisted of $35 million in relation

to the Holiday Inn relaunch; $19 million of cost savings-related severance charges;

$96 million of non-cash asset impairments, reflecting the poorer trading environment

expected in 2009; and other items including gains on asset sales, which netted to an

$18 million credit.

The Board is recommending that the final dividend for 2008 is maintained at 29.2 cents

per share, taking the full-year dividend to 41.4 cents per share, up 2 per cent on 2007.

This converts to a sterling full-year dividend of 26.6 pence, up 29 per cent over 2007.

REPORTING CURRENCY

We changed the reporting currency of our Group accounts from sterling to US dollars

with our 2008 half-year results. This means we can reflect better the Group’s profile

of revenues and operating profits which are largely US dollar-based. Dividends are now

determined in US dollars and converted into sterling immediately before announcement.

BOARD AND EXECUTIVE COMMITTEE

Stevan Porter 1954–2008

We were all deeply saddened by the loss of Steve Porter,

a Board member and President of the Americas, who passed

away in August 2008 after a short illness. Under Steve’s inspired

leadership the Americas region has been established as a

dominant force. He is greatly missed.

We must thank Richard Solomons, Finance Director, for taking on the additional

role of leading the Americas region when Steve became seriously ill in July. Richard

did an outstanding job, ensuring a smooth transition to Jim Abrahamson, who was

appointed as our new President of the Americas in January this year. Jim joined IHG

from Global Hyatt Corporation, where he was Head of Development, The Americas.

Two of our Non-Executive Directors, Sir David Prosser and Robert Larson, retired

from the Board in May and December 2008, respectively. I thank them for their

excellent service and contribution. George Turner became Company Secretary in

January 2009, taking over from Richard Winter who retires in April 2009. I thank

Richard for his service over the past 15 years and wish him well for the future.

FINANCIAL POSITION AND SHAREHOLDER RETURNS

We continue with our prudent approach to managing our balance sheet. We

successfully refinanced our debt facilities in May 2008, and have lowered our

overall net debt position by $400 million to $1.3 billion. During the year, we

continued with our existing share buyback programme, taking the total funds

returned since March 2004 to more than £3.5 billion. We have deferred the

remaining £30 million of the buyback programme in order to preserve cash

and maintain the strength of our balance sheet.

OUTLOOK

Our solid performance in 2008 can be attributed to the exceptional efforts of

all our people. Trading will undoubtedly be tough in 2009, but our strong balance

sheet, resilient business model, great brands and excellent management team,

led by Andy Cosslett, give me continued confidence in the future for the Group.

David Webster

Chairman

2IHGAnnual Report and Financial Statements 2008

Chairman’s statement

“2008 was a good

year for IHG.

We grew both

sales and profits,*

outperforming the

industry in all our

major markets,

and we have

been preparing

the business

for a tougher

environment

in 2009.”

* Before exceptional items.