Holiday Inn 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE BOARD, SENIOR

MANAGEMENT AND

THEIR RESPONSIBILITIES

Remuneration report 47

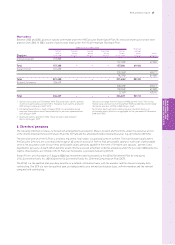

1 Options exercisable at 31 December 2008. Executive share options granted

in 2004 are exercisable up to April 2014. Executive share options granted in

2005 are exercisable up to April 2015.

2 Following Stevan Porter’s death in August 2008, his outstanding vested

executive share options are all exercisable by his personal representatives

until 6 August 2009.

3 Sharesave options granted in 2003. These are exercisable between

March and August 2009.

Option prices range from 420.50p to 619.83p per IHG share. The closing

market value share price on 31 December 2008 was 562.00p and the range

during the year was 447.50p to 865.00p per share.

No Director exercised options during the year; therefore there is no

disclosable gain by Directors in aggregate for the year ended 31 December

2008 (2007 £nil).

Share options

Between 2003 and 2005, grants of options were made under the IHG Executive Share Option Plan. No executive share options have been

granted since 2005. In 2003, a grant of options was made under the IHG all-employee Sharesave Plan.

Ordinary shares under option Weighted

Options Granted Lapsed Exercised Options average

held at during during during held at option Option

Directors 1 Jan 2008 the year the year the year 31 Dec 2008 price (p) price (p)

Andrew Cosslett 157,300

157,3001619.83

Total 157,300 – – – 157,300 619.83

Stevan Porter 321,630

225,2602494.17

96,3702619.83

Total 321,630 – – – 321,6302531.82

Richard Solomons 334,639

230,3201494.17

100,5501619.83

3,7693420.50

Total 334,639 – – – 334,639 531.10

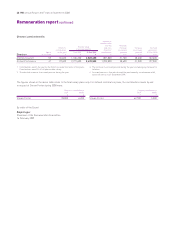

6 Directors’ pensions

The following information relates to the pension arrangements provided for Messrs Cosslett and Solomons under the executive section

of the InterContinental Hotels UK Pension Plan (the IC Plan) and the unfunded InterContinental Executive Top-Up Scheme (ICETUS).

The executive section of the IC Plan is a funded, registered, final salary, occupational pension scheme. The main features applicable to

the Executive Directors are: a normal pension age of 60; pension accrual of 1⁄30th of final pensionable salary for each year of pensionable

service; life assurance cover of four times pensionable salary; pensions payable in the event of ill health; and spouses’, partners’ and

dependants’ pensions on death. When benefits would otherwise exceed a member’s lifetime allowance under the post-April 2006 pensions

regime, these benefits are limited in the IC Plan, but the balance is provided instead by ICETUS.

Stevan Porter, until his death on 7 August 2008, had retirement benefits provided via the 401(k) Retirement Plan for employees

of Six Continents Hotels Inc. (401(k)) and the Six Continents Hotels Inc. Deferred Compensation Plan (DCP).

The 401(k) is a tax qualified plan providing benefits on a defined contribution basis, with the member and the relevant company both

contributing. The DCP is a non-tax qualified plan, providing benefits on a defined contribution basis, with the member and the relevant

company both contributing.