Holiday Inn 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

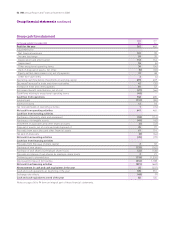

Notes to the Group financial statements 63

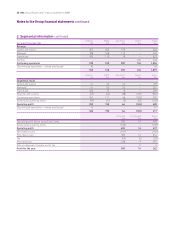

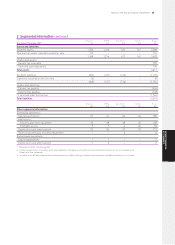

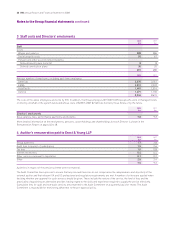

2 Segmental information continued

Americas EMEA Asia Pacific Central Group

Year ended 31 December 2008 $m $m $m $m $m

Assets and liabilities

Segment assets 1,031 957 613 189 2,790

Non-current assets classified as held for sale 209 1 – – 210

1,240 958 613 189 3,000

Unallocated assets:

Current tax receivable 36

Cash and cash equivalents 82

Total assets 3,118

Segment liabilities (638) (470) (159) – (1,267)

Liabilities classified as held for sale (4) – – – (4)

(642) (470) (159) – (1,271)

Unallocated liabilities:

Current tax payable (374)

Deferred tax payable (117)

Loans and other borrowings (1,355)

Total liabilities (3,117)

Americas EMEA Asia Pacific Central Group

$m $m $m $m $m

Other segmental information

Continuing operations:

Capital expenditurea12 7 13 76 108

Additions to:

Property, plant and equipment 43 2 10 36 91

Intangible assets 7 – 2 40 49

Depreciation and amortisationb31 35 26 20 112

Impairment losses 75 21 – – 96

a Comprises purchases of property, plant and equipment, intangible assets and associates and other financial assets as included in the

Group cash flow statement.

b Included in the $112m of depreciation and amortisation is $32m relating to administrative expenses and $80m relating to cost of sales.

GROUP FINANCIAL

STATEMENTS