Hertz 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

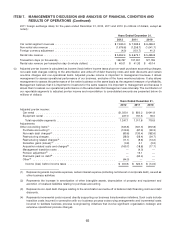

During the year ended December 31, 2012, in our European operations, we experienced a 3.1% decline

in transaction days and a 3.2% decline in RPD when compared to the year ended December 31, 2011.

Revenues from our U.S. off-airport operations represented $1,306.4 million, $1,198.6 million and

$1,079.8 million of our total car rental revenues in the years ended December 31, 2012, 2011 and 2010,

respectively. As of December 31, 2012, we have approximately 2,520 off-airport locations. Our strategy

includes selected openings of new off-airport locations, the disciplined evaluation of existing locations

and the pursuit of same-store sales growth. Our strategy also includes increasing penetration in the

off-airport market and growing the online leisure market, particularly in the longer length weekly sector,

which is characterized by lower vehicle costs and lower transaction costs at a lower RPD. Increasing our

penetration in these sectors is consistent with our long-term strategy to generate profitable growth.

When we open a new off-airport location, we incur a number of costs, including those relating to site

selection, lease negotiation, recruitment of employees, selection and development of managers, initial

sales activities and integration of our systems with those of the companies who will reimburse the

location’s replacement renters for their rentals. A new off-airport location, once opened, takes time to

generate its full potential revenues and, as a result, revenues at new locations do not initially cover their

start-up costs and often do not, for some time, cover the costs of their ongoing operations.

On September 1, 2011, Hertz acquired 100% of the equity of Donlen, a leading provider of fleet leasing

and management services for corporate fleets. For the year ended December 31, 2012 and for the four

months ended December 31, 2011 (period it was owned by Hertz), Donlen had an average of

approximately 150,800 and 137,000 vehicles under lease and management, respectively. Donlen

provides Hertz an immediate leadership position in long-term car, truck and equipment leasing and fleet

management. Donlen’s fleet management programs provide outsourced solutions to reduce fleet

operating costs and improve driver productivity. These programs include administration of preventive

maintenance, advisory services, and fuel and accident management along with other complementary

services. Additionally, Donlen brings to Hertz a specialized consulting and technology expertise that will

enable us to model, measure and manage fleet performance more effectively and efficiently.

As of December 31, 2012, our worldwide car rental operations had a total of approximately 10,270

corporate and licensee locations in approximately 150 countries in North America, Europe, Latin

America, Asia, Australia, Africa, the Middle East and New Zealand.

On November 19, 2012, Hertz acquired 100% of the equity of Dollar Thrifty, a car and truck rental and

leasing business. Dollar Thrifty had approximately 290 corporate locations in the United States and

Canada, with approximately 5,700 employees located mainly in North America. In addition to its

corporate operations, Dollar Thrifty had approximately 1,120 franchise locations in 83 countries. Dollar

Thrifty brings to Hertz an immediate leadership position in the value-priced rental vehicle market

generally appealing to leisure customers, including domestic and foreign tourists, and to small

businesses, government and independent business travelers.

Equipment Rental

HERC experienced higher rental volumes and pricing for the year ended December 31, 2012 compared

to the prior year as the industry continued its recovery in North America. The recovery has been led by

strong industrial performance, especially oil and gas related, and improvement in the construction

sector in part reflecting higher rental penetration. We continued to see growth in our specialty services

such as Pump & Power, Industrial Plant Services and Hertz Entertainment Services. Additionally, there

continue to be opportunities for 2013 as the uncertain economic outlook makes rental solutions

attractive to customers. Our European equipment rental business, which represents approximately 7%

56