Hertz 2012 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

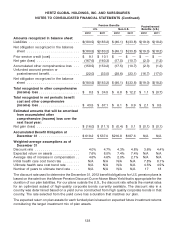

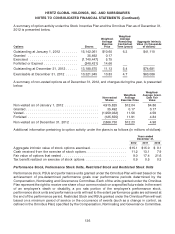

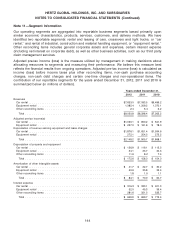

A summary of RSU and PSU activity under the Omnibus Plan as of December 31, 2012 is presented

below.

Weighted- Aggregate Intrinsic

Average Value (In thousands

Shares Fair Value of dollars)

Outstanding at January 1, 2012 .................. 4,327,461 $ 6.46 $50,718

Granted ................................... 869,894 13.78 —

Vested .................................... (3,198,219) 4.58 —

Forfeited or Expired ........................... (126,502) 13.19 —

Outstanding at December 31, 2012 ................ 1,872,634 $12.62 $30,468

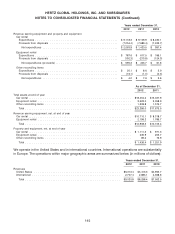

Additional information pertaining to RSU and PSU activity is as follows:

Years ended December 31,

2012 2011 2010

Total fair value of awards that vested ($ millions) ................ $ 14.6 $ 9.6 $ 8.2

Weighted average grant date fair value of awards ............... $13.78 $14.78 $10.1

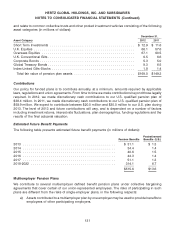

Compensation expense for RSUs and PSUs is based on the grant date fair value, and is recognized

ratably over the vesting period. For grants in 2010, 2011 and 2012, the vesting period is three years (for

grants in 2010 and 2011, 25% in the first year, 25% in the second year and 50% in the third year and for

grants in 2012, 331⁄3% per year). In addition to the service vesting condition, the PSUs had an additional

vesting condition which called for the number of units that will be awarded being based on achievement

of a certain level of Corporate EBITDA over the applicable measurement period.

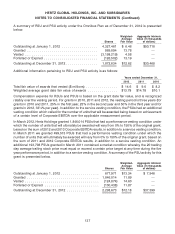

In March 2012, Hertz Holdings granted 1,846,014 PSUs that had a performance vesting condition under

which the number of units that will ultimately be awarded will vary from 0% to 150% of the original grant,

based on the sum of 2012 and 2013 Corporate EBITDA results, in addition to a service vesting condition.

In March 2011 we granted 499,515 PSUs that had a performance vesting condition under which the

number of units that will ultimately be awarded will vary from 0% to 150% of the original grant, based on

the sum of 2011 and 2012 Corporate EBITDA results, in addition to a service vesting condition. An

additional 193,798 PSUs granted in March 2011 contained a market condition whereby the 20 trading

day average trailing stock price must equal or exceed a certain price target at any time during the five

year performance period, in addition to a service vesting condition. A summary of the PSU activity for this

grant is presented below.

Weighted- Aggregate Intrinsic

Average Value (In thousands

Shares Fair Value of dollars)

Outstanding at January 1, 2012 ................... 677,971 $13.34 $ 7,946

Granted .................................... 1,846,014 11.89 —

Vested ..................................... (124,874) 14.60 —

Forfeited or Expired ........................... (100,438) 11.87 —

Outstanding at December 31, 2012 ................ 2,298,673 $12.18 $37,399

137