Hertz 2012 Annual Report Download - page 129

Download and view the complete annual report

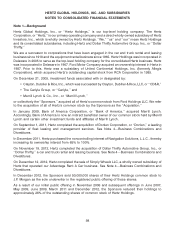

Please find page 129 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Other (income) expense, net includes the gains or losses from the sales of our operations or assets to

new and existing franchisees. Such gains or losses are included in operating income because they are

expected to be a recurring part of our business.

Recently Issued Accounting Pronouncements

In December 2011, the FASB issued Accounting Standards Update, or ‘‘ASU,’’ No. 2011-11, ‘‘Balance

Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities,’’ or ‘‘ASU 2011-11’’ to amend the

requirement for an entity to disclose information about offsetting and related arrangements to enable

users of its financial statements to understand the effect of those arrangements on its financial position.

An entity should provide the disclosures required by those amendments retrospectively for all

comparative periods presented. ASU 2011-11 is effective for annual reporting periods beginning on or

after January 1, 2013, and interim periods within those annual periods. We plan to adopt ASU 2011-11

on January 1, 2013, as required, but do not believe this guidance will have a significant impact on our

consolidated financial statements or financial statement disclosures.

In July 2012, the FASB issued ASU No. 2012-02, ‘‘Intangibles—Goodwill and Other (Topic 350): Testing

Indefinite-Lived Intangible Assets for Impairment,’’ or ‘‘ASU 2012-02’’ which states that an entity has the

option first to assess qualitative factors to determine whether the existence of events and circumstances

indicates that it is more likely than not that an indefinite-lived intangible asset is impaired. If, after

assessing the totality of events and circumstances, an entity concludes that it is not more likely than not

that the indefinite-lived intangible asset is impaired, then the entity is not required to take further action.

However, if an entity concludes otherwise, then it is required to determine the fair value of the indefinite-

lived intangible asset and perform the quantitative impairment test by comparing the fair value with the

carrying amount. This provision is effective for annual and interim impairment tests performed for fiscal

years beginning after September 15, 2012. This accounting guidance is not expected to have a material

impact on our consolidated financial statements or financial statement disclosures.

In February 2013, the FASB issued ASU No. 2013-02, ‘‘Comprehensive Income (Topic 220): Reporting of

Amounts Reclassified Out of Accumulated Other Comprehensive Income,’’ or ‘‘ASU 2013-02’’ which

requires disclosure of significant amounts reclassified out of accumulated other comprehensive income

by component and their corresponding effect on the respective line items of net income. This guidance

is effective for reporting periods beginning after December 15, 2012 and is not expected to have a

material impact on our consolidated financial statements or financial statement disclosures.

Note 3—Goodwill and Other Intangible Assets

We account for our goodwill and indefinite-lived intangible assets under ASC 350. Under ASC 350,

goodwill impairment is deemed to exist if the carrying value of goodwill exceeds its fair value. In addition,

ASC 350 requires that goodwill be tested at least annually using a two-step process. The first step is to

identify any potential impairment by comparing the carrying value of the reporting unit to its fair value.

We estimate the fair value of our reporting units using a discounted cash flow methodology. The cash

flows represent management’s most recent planning assumptions. These assumptions are based on a

combination of industry outlooks, views on general economic conditions, our expected pricing plans

and expected future savings generated by our ongoing restructuring activities. If a potential impairment

is identified, the second step is to compare the implied fair value of goodwill with its carrying amount to

measure the impairment loss. Those intangible assets considered to have indefinite useful lives,

including our trade name, are evaluated for impairment on an annual basis, by comparing the fair value

of the intangible assets to their carrying value. In addition, whenever events or changes in circumstances

indicate that the carrying value of intangible assets might not be recoverable, we will perform an

105