Hertz 2012 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

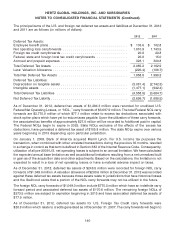

Plan Assets

We have a long-term investment outlook for the assets held in our Company sponsored plans, which is

consistent with the long-term nature of each plan’s respective liabilities. We have two major plans which

reside in the U.S. and the U.K.

The U.S. Plan, or the ‘‘Plan,’’ currently has a target asset allocation of 65% equity and 35% fixed income.

The equity portion of the Plan is invested in one passively managed S&P 500 index fund, one passively

managed U.S. small/midcap fund and one actively managed international portfolio. The fixed income

portion of the Plan is actively managed by a professional investment manager and is benchmarked to

the Barclays Long Govt/Credit Index. The Plan assumes an 7.6% rate of return on assets, which

represents the expected long-term annual weighted-average return for the Plan in total.

The U.K. Plan currently invests in a professionally managed Balanced Consensus Index Fund, which has

the investment objective of achieving a total return relatively equal to its benchmark. The benchmark is

based upon the average asset weightings of a broad universe of U.K. pension funds invested in pooled

investment vehicles and each of their relevant indices. The asset allocation as of December 31, 2012,

was 79% equity, 9% fixed income and 12% cash and cash equivalents. The U.K. Plan currently assumes

a rate of return on assets of 7.5%, which represents the expected long-term annual weighted-average

return.

The fair value measurements of our U.S. pension plan assets are based upon significant observable

inputs (Level 2) and relate to common collective trusts and other pooled investment vehicles consisting

of the following asset categories (in millions of dollars):

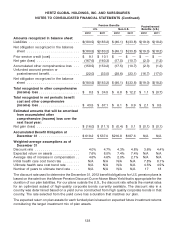

December 31,

Asset Category 2012 2011

Short Term Investments .......................................... $ 8.3 $ 11.6

Equity Securities:

U.S. Large Cap ............................................... 135.9 119.3

U.S. Mid Cap ................................................ 42.0 34.9

U.S. Small Cap ............................................... 31.6 27.5

International Large Cap ......................................... 109.3 89.0

Fixed Income Securities:

U.S. Treasuries ............................................... 67.5 53.2

Corporate Bonds ............................................. 83.8 68.7

Government Bonds ............................................ 4.4 4.1

Municipal Bonds .............................................. 9.1 9.5

Real Estate (REITs) ............................................. 6.5 5.4

Total fair value of pension plan assets ............................. $498.4 $423.2

Our U.K. Plan accounts for most of the $178.3 million in fair value of Non-U.S. plan assets. The fair value

measurements of our U.K. pension plan assets are based upon significant observable inputs (Level 2)

130