Hertz 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

for which tax benefits cannot be realized. See Note 9 to the Notes to our consolidated financial

statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’

Net Income Attributable to Noncontrolling Interest

Net income attributable to noncontrolling interest increased 12.5% due to an increase in our formerly

majority-owned subsidiary Navigation Solutions, L.L.C.’s net income for 2011 as compared to the year

ended December 31, 2010. In December 2011, Hertz purchased the noncontrolling interest of

Navigation Solutions, L.L.C., thereby increasing its ownership interest from 65% to 100%.

Net Income (Loss) Attributable to Hertz Global Holdings, Inc. and Subsidiaries’ Common

Stockholders

The net income attributable to Hertz Global Holdings, Inc. and Subsidiaries’ common stockholders was

$176.2 million in 2011 compared to a loss in 2010 of $48.7 million primarily due to higher rental volumes

in our worldwide car and equipment rental operations, improved residual values on the disposal of

certain vehicles and used equipment, disciplined cost management, lower interest expense and

increased pricing in our equipment rental operations, partly offset by lower pricing in our worldwide car

rental operations, costs incurred in connection with the refinancing of our Senior Term Facility and

Senior ABL Facility and the write-off of unamortized debt costs and premiums paid in connection with the

redemption of our 10.5% Senior Subordinated Notes and a portion of our 8.875% Senior Notes during

2011. The impact of changes in exchange rates on net income was mitigated by the fact that not only

revenues but also most expenses outside of the United States were incurred in local currencies.

LIQUIDITY AND CAPITAL RESOURCES

Our domestic and international operations are funded by cash provided by operating activities and by

extensive financing arrangements maintained by us in the United States and internationally.

Cash Flows

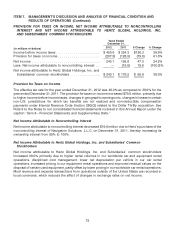

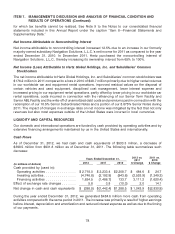

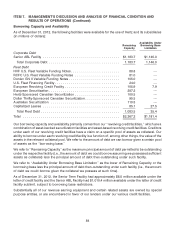

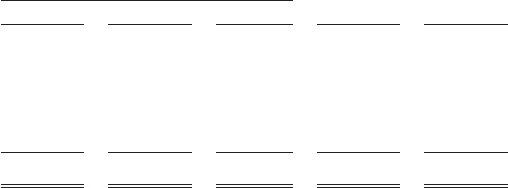

As of December 31, 2012, we had cash and cash equivalents of $533.3 million, a decrease of

$398.5 million from $931.8 million as of December 31, 2011. The following table summarizes such

decrease:

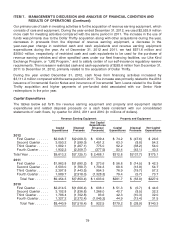

2012 vs. 2011 vs.

Years Ended December 31, 2011 2010

2012 2011 2010 $ Change $ Change

(in millions of dollars)

Cash provided by (used in):

Operating activities ............... $2,718.0 $ 2,233.4 $2,208.7 $ 484.6 $ 24.7

Investing activities ................ (4,746.8) (2,192.9) (943.6) (2,553.9) (1,249.3)

Financing activities ............... 1,624.5 (1,486.7) 133.7 3,111.2 (1,620.4)

Effect of exchange rate changes ....... 5.8 3.8 (10.3) 2.0 14.1

Net change in cash and cash equivalents $ (398.5) $(1,442.4) $1,388.5 $ 1,043.9 $(2,830.9)

During the year ended December 31, 2012, we generated $484.6 million more cash from operating

activities compared with the same period in 2011. The increase was primarily a result of higher earnings

before interest, depreciation and amortization and reduced interest expense as well as due to the timing

of our payments.

78