Hertz 2012 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

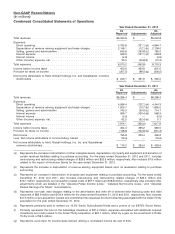

Non-GAAP Reconciliations (Continued)

(In millions)

Condensed Consolidated Statements of Operations

Year Ended December 31, 2010

As As

Reported Adjustments Adjusted

Total revenues ............................................ $7,562.5 $ — $7,562.5

Expenses:

Direct operating .......................................... 4,283.4 (128.6)(a) 4,154.8

Depreciation of revenue earning equipment and lease charges ............ 1,868.1 (14.3)(b) 1,853.8

Selling, general and administrative .............................. 664.5 (36.2)(c) 628.3

Interest expense ......................................... 773.4 (182.6)(d) 590.8

Interest income .......................................... (12.3) — (12.3)

Total expenses ............................................ 7,577.1 (361.7) 7,215.4

Income (loss) before income taxes ............................... (14.6) 361.7 347.1

Provision for taxes on income .................................. (16.7) (101.3)(e) (118.0)

Net income (loss) .......................................... (31.3) 260.4 229.1

Less: Net income attributable to noncontrolling interest .................. (17.4) — (17.4)

Net income (loss) attributable to Hertz Global Holdings, Inc. and Subsidiaries’

common stockholders ...................................... $ (48.7) $ 260.4 $ 211.7

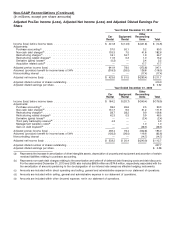

Year Ended December 31, 2009

As As

Revised Adjustments Adjusted

Total revenues ............................................. $7,101.5 $ — $7,101.5

Expenses:

Direct operating .......................................... 4,086.8 (170.6)(a) 3,916.2

Depreciation of revenue earning equipment and lease charges ............. 1,933.8 (14.3)(b) 1,919.5

Selling, general and administrative ............................... 642.0 (61.6)(c) 580.4

Interest expense .......................................... 680.3 (171.9)(d) 508.4

Interest income ........................................... (16.0) — (16.0)

Other (income) expense, net .................................. (48.5) 48.5(f) —

Total expenses ............................................ 7,278.4 (369.9) 6,908.5

Income (loss) before income taxes ................................ (176.9) 369.9 193.0

(Provision) benefit for taxes on income ............................. 62.1 (127.7)(e) (65.6)

Net income (loss) ........................................... (114.8) 242.2 127.4

Less: Net income attributable to noncontrolling interest ................... (14.7) — (14.7)

Net income (loss) attributable to Hertz Global Holdings, Inc. Inc. and Subsidiaries’

common stockholders ...................................... $(129.5) $ 242.2 $ 112.7

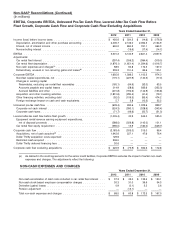

(a) Represents the increase in amortization of other intangible assets, depreciation of property and equipment and accretion of

certain revalued liabilities relating to purchase accounting. For the years ended December 31, 2010 and 2009, also includes

restructuring and restructuring related charges of $52.6 million, $99.6 million, respectively.

(b) Represents the increase in depreciation of revenue earning equipment based upon its revaluation relating to purchase

accounting.

(c) Represents an increase in depreciation of property and equipment relating to purchase accounting. For the years ended

December 31, 2010 and 2009, also includes restructuring and restructuring related charges of $15.3 million and

$53.7 million, respectively. Also includes other adjustments which are detailed in the ‘‘Adjusted Pre-Tax Income (Loss),

Adjusted Net Income (Loss) and Adjusted Diluted Earnings Per Share’’ reconciliations.

(d) Represents non-cash debt charges relating to the amortization and write off of deferred debt financing costs and debt

discounts of $182.6 million and $171.9 million for the years ended December 31, 2010 and 2009, respectively. Those

amounts include $68.9 million and $74.6 million, respectively, of amortization expense associated with the de-designation of

our interest rate swaps as effective hedging instruments.

(e) Represents a provision for income taxes derived utilizing a normalized income tax rate of 34%.

(f) Represents a gain (net of transaction costs) recorded in connection with the buyback of portions of our Senior Notes and

Senior Subordinated Notes during the year ended December 31, 2009.