Hertz 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Putting it

All Together

In 2012, Hertz again delivered record financial perfor-

mance on a consolidated basis, and in the worldwide

car rental business. The equipment rental business

also delivered solid, improving results, despite weak

non-residential construction growth. We achieved

several critical objectives last year, as we put together

the pieces of our strategic puzzle, and we broke

customer and employee satisfaction records. We

expect to perform even better in 2013 and beyond

because of our:

• Diverse Global Portfolio

• Superior Growth Strategies

• Culture of Operational Excellence

• Leadership in Advanced Technology

• Commitment to Accelerating Cash Flow Generation

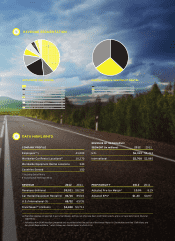

Diverse Global Portfolio

When 2012 began, Hertz was already the leading global

car rental brand with over 8,800 locations in approxi-

mately 150 countries. Upon completing the Dollar Thrifty

acquisition last November, the combined companies

have approximately 10,600 locations, and revenues

of almost $14 billion, including franchisees. Joining

forces with the Dollar and Thrifty brands enables Hertz

to compete on all fronts against the other multi-brand car

rental companies at major U.S. airports. We will also

deploy our new brands off-airport in the U.S., in Europe

and in other important global markets. Additionally,

Dollar and/or Thrifty will be offered as new options to

the customers and employees of our key travel and

corporate partners.

Superior Growth Strategies

Unlike most companies, Hertz has four $500 million-

plus businesses growing revenues at double-digit levels,

which are exceeding their industries’ growth levels as we

enter 2013. The first is the leisure brand of the U.S.

airport business, which, for Hertz, grew 25% last year.

Growth will accelerate with the addition of Dollar and

Thrifty, replacing the divested Advantage brand. Our

new brands have carved out a successful $1.5 billion-

plus business attracting cost-conscious weekend and

holiday travelers, especially in key travel markets such

as Florida and California.

The Hertz off-airport business in the U.S. continues to

expand rapidly, ending last year with more than 2,500

locations, while generating annual revenues of over

$1.3 billion. Its growth is attributable to several factors

including location expansion and our penetration into

the insurance replacement market, which grew 14% for

Hertz last year. Hertz continues to gain market share

in the $11 billion off-airport market.

Our fleet leasing and management company, Donlen,

which we acquired in 2011, grew revenues 16% in 2012.

Donlen is a leading fleet leasing option for mid to large

size U.S. businesses. Many companies also utilize

Donlen’s proprietary telematics and reporting capability

to measure and modify fleet performance in real time.

The equipment rental business (HERC) increased 2012

revenues more than 15% over 2011. Part of HERC’s rapid

growth is due to the successful integration of 11 small

acquisitions since 2010. These acquisitions give us entry

or further penetration into entertainment, pump &

power, and oil & gas production markets. Additionally,

HERC continues to grow in the industrial segment of

the equipment rental business, supporting factory

expansion and turnaround activity. There are signs that,

after a four-year recession, the non-residential con-

struction business could begin to recover in 2013, which

would provide additional stimulus to HERC’s growth.

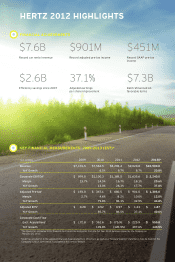

Culture of Operational Excellence

In 2007, we embarked on a mission to become the most

efficient company in our businesses. To date, we’ve

reduced costs by more than $2.6 billion, including

$483 million in 2012. We’ve also increased employee

productivity for 24 consecutive quarters, including the

2008–2009 recession when our revenues decreased

by almost 20%. We achieve operational excellence by

applying Lean/Six Sigma principles and practices to

field and support functions across the company. We

proceed location-by-location, at airport and equipment

rental stores worldwide, to further improve efficiency,

customer service and employee satisfaction by reengi-

neering key rental processes. And in the spirit of con-

tinuous improvement, the quest to be more efficient

will never end at Hertz.

Leadership in Advanced Technology

As mentioned earlier, Donlen is already the technology

leader in fleet leasing and management. Likewise, Hertz

is staking its claim as the technology leader in car rental.

We’ve created, via acquisition of Eileo, the leading

car sharing technology company based in Paris, and

DEAR HERTZ SHAREHOLDERS,

PAGE 2