Hertz 2012 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC.

NOTES TO PARENT COMPANY FINANCIAL STATEMENTS

Note 1—Background and Basis of Presentation

Hertz Global Holdings, Inc., or ‘‘Hertz Holdings,’’ is the top-level holding company that conducts

substantially all of its business operations through its indirect subsidiaries. Hertz Holdings was

incorporated in Delaware on August 31, 2005 in anticipation of the December 21, 2005 acquisition by its

subsidiary, Hertz Investors, Inc., of the Hertz Corporation.

There are significant restrictions over the ability of Hertz Holdings to obtain funds from its indirect

subsidiaries through dividends, loans or advances. Accordingly, these condensed financial statements

have been presented on a ‘‘parent-only’’ basis. Under a parent-only presentation, the investments of

Hertz Holdings in its consolidated subsidiaries are presented under the equity method of accounting.

These parent-only financial statements should be read in conjunction with the consolidated financial

statements of Hertz Holdings included in this Annual Report under the caption ‘‘Item 8—Financial

Statements and Supplementary Data.’’ For a discussion of background and basis of presentation, see

Note 1 and Note 2 to the Notes to the consolidated financial statements included in this Annual Report

under the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

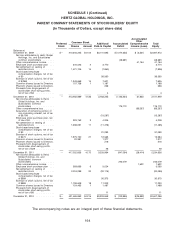

Return of Capital from subsidiary

We had presented in error the return of capital distributions from our subsidiary in the Statement of

operations as ‘‘Other income’’ for 2011 and 2010 resulting in an understatement of Loss before income

taxes of $23.0 million and $23.0 million, respectively and an overstatement of Net income of $23.0 million

and an understatement of Net loss of $23.0 million, respectively. Comprehensive income (loss) were

impacted by the same amount in for 2011 and 2010. In addition, the same amounts were deducted from

Accumulated deficit in the Statement of stockholders’ equity.

The Statement of operations, comprehensive income and stockholders’ equity have been revised by

reducing previously reported Net income for 2011 and increasing Net loss for 2010 by $23.0 million and

$23.0 million, respectively. There was no impact to the amounts reported as Accumulated deficit at

December 31, 2011 and 2010.

We had presented the cash flows from the return of capital from our subsidiary in the Statement of cash

flows for 2011 and 2010 as a component of cash flows from operating activities as it was included in Net

income. The classification of these amounts have been corrected so that they are presented as cash

flows from investing activities. For the year ended December 31, 2011, the impact of this revision was to

reduce Cash flows from operating activities by $23.0 million and increase Cash flows from investing

activities by $23.0 million. For the year ended December 31, 2010, the impact of this revision was to

reduce Cash flows from operating activities by $23.0 million and increase Cash flows from investing

activities by $23.0 million.

Note 2—Debt

Convertible Senior Notes

In May and June 2009, we issued $474.8 million in aggregate principal amount of 5.25% Convertible

Senior ;Notes due June 2014. Our Convertible Senior Notes may be convertible by holders into shares of

our common stock, cash or a combination of cash and shares of our common stock, as elected by us,

initially at a conversion rate of 120.6637 shares per $1,000 principal amount of notes, subject to

adjustment.

We have a policy of settling the conversion of our Convertible Senior Notes using a combination

settlement, which calls for settling the fixed dollar amount per $1,000 in principal amount in cash and

166