Hertz 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

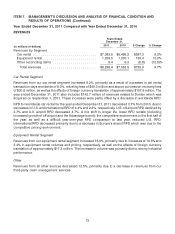

ADJUSTED PRE-TAX INCOME (LOSS)

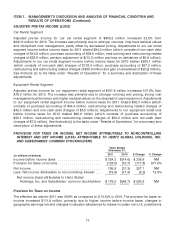

Car Rental Segment

Adjusted pre-tax income for our car rental segment of $850.2 million increased 32.5% from

$641.9 million for 2010. The increase was primarily due to stronger volumes, improved residual values

and disciplined cost management, partly offset by decreased pricing. Adjustments to our car rental

segment income before income taxes for 2011 totaled $94.5 million (which consists of non-cash debt

charges of $43.9 million, purchase accounting of $39.5 million, restructuring and restructuring related

charges of $23.6 million, pension adjustment of $(13.1) million and loss on derivatives of $0.6 million).

Adjustments to our car rental segment income before income taxes for 2010 totaled $200.1 million

(which consists of non-cash debt charges of $133.3 million, purchase accounting of $37.0 million,

restructuring and restructuring related charges of $30.0 million and gain on derivatives of $(0.2) million).

See footnote (c) to the table under ‘‘Results of Operations’’ for a summary and description of these

adjustments.

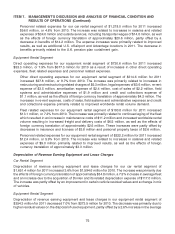

Equipment Rental Segment

Adjusted pre-tax income for our equipment rental segment of $161.6 million increased 107.2% from

$78.0 million for 2010. The increase was primarily due to stronger volumes and pricing, strong cost

management performance and higher residual values on the disposal of used equipment. Adjustments

to our equipment rental segment income before income taxes for 2011 totaled $92.3 million (which

consists of purchase accounting of $44.4 million, restructuring and restructuring related charges of

$42.4 million and non-cash debt charges of $5.5 million). Adjustments to our equipment rental loss

before income taxes for 2010 totaled $92.6 million (which consists of purchase accounting of

$50.1 million, restructuring and restructuring related charges of $35.0 million and non-cash debt

charges of $7.5 million). See footnote (c) to the table under ‘‘Results of Operations’’ for a summary and

description of these adjustments.

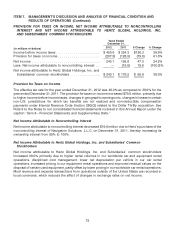

PROVISION FOR TAXES ON INCOME, NET INCOME ATTRIBUTABLE TO NONCONTROLLING

INTEREST AND NET INCOME (LOSS) ATTRIBUTABLE TO HERTZ GLOBAL HOLDINGS, INC.

AND SUBSIDIARIES’ COMMON STOCKHOLDERS

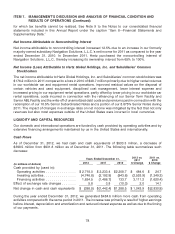

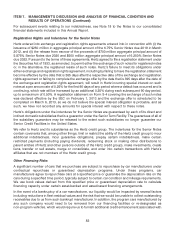

Years Ended

December 31,

2011 2010 $ Change % Change

(in millions of dollars)

Income before income taxes ...................... $324.3 $(14.6) $ 338.9 NM

Provision for taxes on income ...................... (128.5) (16.7) (111.8) 671.5%

Net income ................................... 195.8 (31.3) 227.1 NM

Less: Net income attributable to noncontrolling interest . . . (19.6) (17.4) (2.2) 12.5%

Net income (loss) attributable to Hertz Global

Holdings, Inc. and Subsidiaries’ common stockholders $ 176.2 $(48.7) $ 224.9 NM

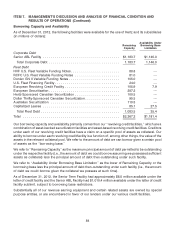

Provision for Taxes on Income

The effective tax rate for 2011 was 39.6% as compared to (113.8)% in 2010. The provision for taxes on

income increased $111.8 million, primarily due to higher income before income taxes, changes in

geographic earnings mix and changes in valuation allowances for losses in certain non-U.S. jurisdictions

77