Hertz 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238

|

|

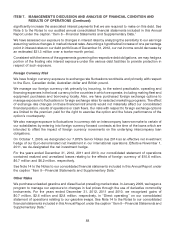

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

Statements and Supplementary Data.’’ Our 2012 worldwide pre-tax pension expense is $34.7 million,

which represents an increase of $13.4 million from 2011. The increase in expense compared to 2011 is

primarily due to lower expected rates of return in 2012, lower discount rates at the end of 2011 compared

to 2010 and a curtailment gain in the U.K. recorded in 2011.

The funded status (i.e., the dollar amount by which the projected benefit obligations exceeded the

market value of pension plan assets) of our U.S. qualified plan, in which most domestic employees

participate, improved as of December 31, 2012, compared with December 31, 2011 because asset

values increased due to gains in the securities markets. We contributed $38.4 million to our U.S. pension

plan during 2012. We expect to contribute between $20 million and $30 million to our U.S. plan during

2013. The level of 2013 and future contributions will vary, and is dependent on a number of factors

including investment returns, interest rate fluctuations, plan demographics, funding regulations and the

results of the final actuarial valuation.

We participate in various multiemployer pension plans. In the event that we withdraw from participation

in one of these plans, then applicable law could require us to make an additional contribution to the plan,

and we would have to reflect that as an expense in our consolidated statements of operations and as a

liability on our consolidated balance sheet. The amount that we would be required to pay to the plan is

referred to as a withdrawal liability. Our withdrawal liability for any multiemployer plan would depend on

the extent of the plan’s funding of vested benefits. One multiemployer plan in which we participated had

significant underfunded liabilities and we withdrew from that plan in December 2012. Several of our

remaining multiemployer plans have underfunded liabilities. Such underfunding may increase in the

event other employers become insolvent or withdraw from the applicable plan or upon the inability or

failure of withdrawing employers to pay their withdrawal liability. In addition, such underfunding may

increase as a result of lower than expected returns on pension fund assets or other funding deficiencies.

For a discussion of the risks associated with our pension plans, see ‘‘Item 1A—Risk Factors’’ in this

Annual Report.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

See ‘‘Item 7—Management’s Discussion and Analysis of Financial Condition and Results of

Operations—Market Risks’’ included elsewhere in this Annual Report.

90