Hertz 2012 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DEFINITIONS AND NON-GAAP RECONCILIATIONS

Definitions and Use / Importance of Non-GAAP Measures

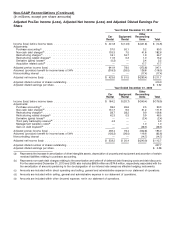

Adjusted Pre-Tax Income

Adjusted pre-tax income is calculated as income before income taxes plus non-cash purchase

accounting charges, non-cash debt charges relating to the amortization of debt financing costs and debt

discounts and certain one-time charges and non-operational items. Adjusted pre-tax income is

important to management because it allows management to assess operational performance of our

business, exclusive of the items mentioned above. It also allows management to assess the

performance of the entire business on the same basis as the segment measure of profitability.

Management believes that it is important to investors for the same reasons it is important to management

and because it allows them to assess the operational performance of the Company on the same basis

that management uses internally.

Adjusted Net Income

Adjusted net income is calculated as adjusted pre-tax income less a provision for income taxes derived

utilizing a normalized income tax rate (34% in 2012, 2011, 2010 and 2009) and noncontrolling interest.

The normalized income tax rate is management’s estimate of our long-term tax rate. Adjusted net

income is important to management and investors because it represents our operational performance

exclusive of the effects of purchase accounting, non-cash debt charges, one-time charges and items

that are not operational in nature or comparable to those of our competitors.

Adjusted Diluted Earnings Per Share

Adjusted diluted earnings per share is calculated as adjusted net income divided by, for 2012, 2011,

2010 and 2009, 448.2 million shares, 444.8 million shares, 410.0 million shares and 407.7 million shares,

respectively, which represents the weighted average diluted shares outstanding for the period. Adjusted

diluted earnings per share is important to management and investors because it represents a measure

of our operational performance exclusive of the effects of purchase accounting adjustments, non-cash

debt charges, one-time charges and items that are not operational in nature or comparable to those of

our competitors.

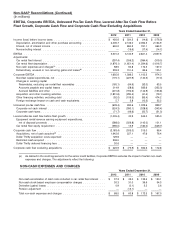

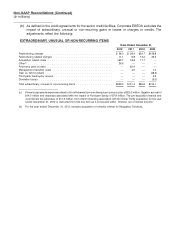

Earnings Before Interest, Taxes, Depreciation and Amortization (‘‘EBITDA’’) and Corporate EBITDA

EBITDA is defined as net income before net interest expense, income taxes and depreciation (which

includes revenue earning equipment lease charges) and amortization. Corporate EBITDA, as presented

herein, represents EBITDA as adjusted for car rental fleet interest, car rental fleet depreciation and

certain other items, as described in more detail in the accompanying tables.

Management uses EBITDA and Corporate EBITDA as operating performance and liquidity metrics for

internal monitoring and planning purposes, including the preparation of our annual operating budget

and monthly operating reviews, as well as to facilitate analysis of investment decisions, profitability and

performance trends. Further, EBITDA enables management and investors to isolate the effects on

profitability of operating metrics such as revenue, operating expenses and selling, general and

administrative expenses, which enables management and investors to evaluate our two business

segments that are financed differently and have different depreciation characteristics and compare our

performance against companies with different capital structures and depreciation policies. We also

present Corporate EBITDA as a supplemental measure because such information is utilized in the

calculation of financial covenants under Hertz’s senior credit facilities.

EBITDA and Corporate EBITDA are not recognized measurements under GAAP. When evaluating our

operating performance or liquidity, investors should not consider EBITDA and Corporate EBITDA in

isolation of, or as a substitute for, measures of our financial performance and liquidity as determined in

accordance with GAAP, such as net income or net cash provided by operating activities.