Hertz 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

Financing

Our primary liquidity needs include servicing of corporate and fleet related debt, acquisitions, the

payment of operating expenses and purchases of rental vehicles and equipment to be used in our

operations. Our primary sources of funding are operating cash flows, cash received on the disposal of

vehicles and equipment, borrowings under our asset-backed securitizations and our asset-based

revolving credit facilities and access to the credit markets generally.

As of December 31, 2012, we had $15,448.6 million of total indebtedness outstanding. Cash paid for

interest during the year ended December 31, 2012, was $560.0 million, net of amounts capitalized.

Accordingly, we are highly leveraged and a substantial portion of our liquidity needs arise from debt

service on our indebtedness and from the funding of our costs of operations, capital expenditures and

acquisitions.

Our liquidity as of December 31, 2012 consisted of cash and cash equivalents, unused commitments

under our Senior ABL Facility and unused commitments under our fleet debt. For a description of these

amounts, see Note 5 to the Notes to our consolidated financial statements included in this Annual Report

under caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

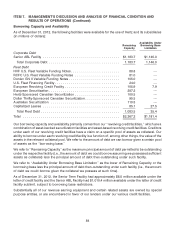

Maturities

The aggregate amounts of maturities of debt for each of the twelve-month periods ending December 31

(in millions of dollars) are as follows:

2013 ........ $6,218.8 (including $5,718.7 of other short-term borrowings*)

2014 ........ $1,122.1

2015 ........ $1,894.1

2016 ........ $ 267.1

2017 ........ $ 219.2

After 2017 .... $5,752.5

* Our short-term borrowings as of December 31, 2012 include, among other items, the amounts outstanding under

the Senior ABL Facility, HVF U.S. Fleet Variable Funding Notes, RCFC U.S. Fleet Variable Funding Notes, Donlen

GN II Variable Funding Notes, U.S. Fleet Financing Facility, European Revolving Credit Facility, European

Securitization, Hertz-Sponsored Canadian Securitization, Dollar Thrifty-Sponsored Canadian Securitization,

Australian Securitization, Brazilian Fleet Financing Facility and Capitalized Leases. These amounts are reflected as

short-term borrowings, regardless of the facility maturity date, as these facilities are revolving in nature and/or the

outstanding borrowings have maturities of three months or less. Short-term borrowings also include the Convertible

Senior Notes which became convertible on January 1, 2012 and remain as such through March 31, 2013. As of

December 31, 2012, short-term borrowings had a weighted average interest rate of 2.1%.

We believe that cash generated from operations and cash received on the disposal of vehicles and

equipment, together with amounts available under various liquidity facilities will be adequate to permit us

to meet our debt maturities over the next twelve months.

From time to time we evaluate our alternatives for the retirement or refinancing of the Convertible Senior

Notes at or prior to their maturity on June 1, 2014. Such alternatives could include, without limitation,

exchange offers, privately negotiated or market repurchases or exchanges or the discharge of any

remaining Convertible Senior Notes at maturity, and the consideration could consist of cash, Hertz

Holdings common stock or a combination of cash and common stock. No assurance can be given as to

the terms or timing of any such transaction.

81