Hertz 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 1. BUSINESS (Continued)

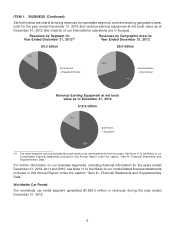

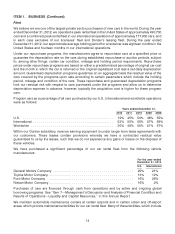

rental transactions in our U.S. and international operations derived from business and leisure rentals and

from airport and off-airport rentals.

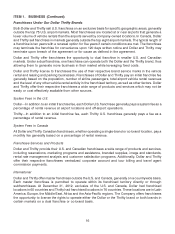

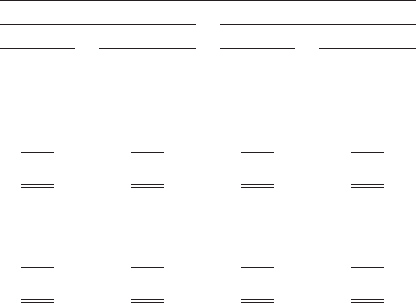

Year ended December 31, 2012

U.S. International

Revenues Transactions Revenues Transactions

Type of Car Rental

By Customer:

Business ............................... 42% 44% 55% 58%

Leisure ................................ 58 56 45 42

100% 100% 100% 100%

By Location:

Airport ................................. 70% 73% 49% 57%

Off-airport .............................. 30 27 51 43

100% 100% 100% 100%

Customers who rent from us for ‘‘business’’ purposes include those who require cars in connection with

commercial activities, the activities of governments and other organizations or for temporary vehicle

replacement purposes. Most business customers rent cars from us on terms that we have negotiated

with their employers or other entities with which they are associated, and those terms can differ

substantially from the terms on which we rent cars to the general public. We have negotiated

arrangements relating to car rental with many large businesses, governments and other organizations,

including most Fortune 500 companies.

Customers who rent from us for ‘‘leisure’’ purposes include not only individual travelers booking

vacation travel rentals with us but also people renting to meet other personal needs. Leisure rentals,

generally, are longer in duration and generate more revenue per transaction than do business rentals,

although some types of business rentals, such as rentals to replace temporarily unavailable cars, have a

long average duration. Also included in leisure rentals are rentals by customers of U.S. and international

tour operators, which are usually a part of tour packages that can also include air travel and hotel

accommodations. Business rentals and leisure rentals have different characteristics and place different

types of demands on our operations. We believe that maintaining an appropriate balance between

business and leisure rentals is important to the profitability of our business and the consistency of our

operations. Following our acquisition of Dollar Thrifty, we expect U.S. airport leisure business as a

percentage of our worldwide car rental revenue to increase.

Our business and leisure customers rent from both our airport and off-airport locations. Demand for

airport rentals is correlated with airline travel patterns, and transaction volumes generally follow

enplanement and GDP trends on a global basis. Customers often make reservations for airport rentals

when they book their flight plans, which make our strong relationships with travel agents, associations

and other partners (e.g., airlines) a key competitive advantage in generating consistent and recurring

revenue streams.

Off-airport rentals typically involve people wishing to rent cars closer to home for business or leisure

purposes, as well as those needing to travel to or from airports. This category also includes people who

have been referred by, or whose rental costs are being wholly or partially reimbursed by, insurance

companies because their cars have been damaged. In order to attract these renters, we must establish

agreements with the referring insurers establishing the relevant rental terms, including the arrangements

made for billing and payment. While we estimate our share of the insurance replacement rental market

12