Hertz 2012 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Forward-Looking Statements

Certain statements contained in this annual report to our stockholders are ‘‘forward-looking statements’’

within the meaning of the Private Securities Litigation Reform Act of 1995. These statements give our

current expectations or forecasts of future events and our future performance, and do not relate directly

to historical or current events or our historical or current performance. Most of these statements contain

words that identify them as forward-looking, such as ‘‘anticipate,’’ ‘‘estimate,’’ ‘‘expect,’’ ‘‘project,’’

‘‘intend,’’ ‘‘plan,’’ ‘‘believe,’’ ‘‘seek,’’ ‘‘will,’’ ‘‘may,’’ ‘‘opportunity,’’ ‘‘target,’’ ‘‘would,’’ ‘‘should,’’ ‘‘could,’’

‘‘forecast’’ or other similar words or expressions that relate to future events, as opposed to past or

current events.

Forward-looking statements are based on the then-current expectations, forecasts and assumptions of

our management in light of its experience in the industry, as well as its perceptions of historical trends,

current conditions, expected future developments and other factors that the Company believes are

appropriate in these circumstances. We believe these judgments are reasonable, but you should

understand that these statements are not guarantees of performance or results, and our actual results

could differ materially from those expressed in the forward-looking statements. For some of the factors

that could cause such differences, please see the section of our Annual Report on Form 10-K for the year

ended December 31, 2012, which is included in this annual report to our stockholders, under the

heading ‘‘Item 1A—Risk Factors,’’ the cautionary note regarding forward-looking statements appearing

in the section entitled ‘‘Introductory Note’’ in our Annual Report on Form 10-K, and our subsequent

reports filed with the SEC.

We caution you not to place undue reliance on the forward-looking statements. All such statements

speak only as of the date made and, except as required by law, we do not undertake any obligation to

update or revise publicly any forward-looking statements, whether as a result of new information, future

events or otherwise. All forward-looking statements attributable to us are expressly qualified in their

entirety by the cautionary statements contained herein.

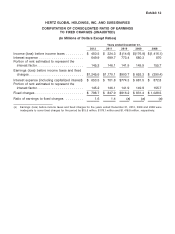

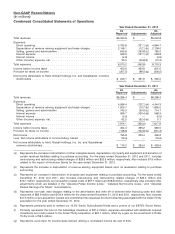

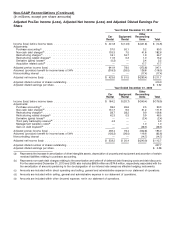

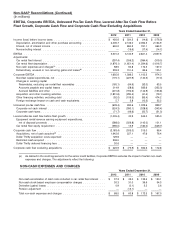

Management believes that adjusted pre-tax income, adjusted net income, adjusted diluted earnings per

share and Corporate EBITDA are useful in measuring the comparable results of the Company

period-over-period. The GAAP measures most directly comparable to Corporate EBITDA, adjusted

pre-tax income, adjusted net income and adjusted diluted earnings per share are (i) pre-tax income and

cash flows from operating activities, (ii) pre-tax income, (iii) net income, and (iv) diluted earnings per

share, respectively. Because of the forward-looking nature of the Company’s forecasted adjusted

pre-tax income, adjusted net income, adjusted diluted earnings per share and Corporate EBITDA,

specific quantifications of the amounts that would be required to reconcile forecasted cash flows from

operating activities, pre-tax income and net income are not available. The Company believes that there is

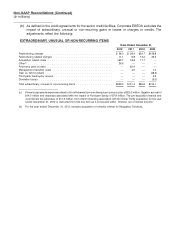

a degree of volatility with respect to certain of the Company’s GAAP measures, primarily related to fair

value accounting for its financial assets (which includes the Company’s derivative financial instruments),

its income tax reporting and certain adjustments made to arrive at the relevant non-GAAP measures,

which preclude the Company from providing accurate forecasted GAAP to non-GAAP reconciliations.

Based on the above, the Company believes that providing estimates of the amounts that would be

required to reconcile the range of the non-GAAP Corporate EBITDA, adjusted pre-tax income, adjusted

net income and adjusted diluted earnings per share to forecasted cash flows from operating activities,

pre-tax income, net income and diluted earnings per share would imply a degree of precision that would

be confusing or misleading to investors for the reasons identified above.