Hertz 2012 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

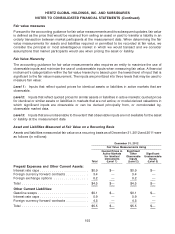

For borrowings with an initial maturity of 90 days or less, fair value approximates carrying value because

of the short-term nature of these instruments. For all other debt, fair value is estimated based on quoted

market rates as well as borrowing rates currently available to us for loans with similar terms and average

maturities (Level 2 inputs). The aggregate fair value of all debt at December 31, 2012 was

$16,493.1 million, compared to its aggregate unpaid principal balance of $15,473.8 million. The

aggregate fair value of all debt at December 31, 2011 was $11,832.5 million, compared to its aggregate

unpaid principal balance of $11,400.3 million.

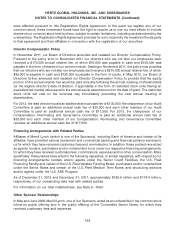

Note 15—Related Party Transactions

Relationship with Hertz Investors, Inc. and the Sponsors

Stockholders Agreement

In connection with the Acquisition, we entered into a stockholders agreement (as amended, the

‘‘Stockholders Agreement’’) with investment funds associated with or designated by the Sponsors.

Based on current share ownership of the Sponsors, the Stockholders Agreement contains agreements

that entitle investment funds associated with or designated by the Sponsors to nominate two nominees

of an investment fund associated with CD&R (one of whom shall serve as the chairman or, if the chief

executive officer is the chairman, the lead director), one nominee of investment funds associated with

Carlyle, and one nominee of an investment fund associated with Merrill Lynch. The Stockholders

Agreement also provides that our chief executive officer shall be designated as a director, unless

otherwise approved by a majority of the Sponsor Designees. In addition, the Stockholders Agreement

provides that one of the nominees of an investment fund associated with CD&R shall serve as the

chairman of the executive and governance committee and, unless otherwise agreed by this fund, as

Chairman of our Board of Directors or lead director.

The Stockholders Agreement grants to the investment funds associated with CD&R or to the board, with

the approval of the majority of the Sponsor Designees, the right to remove our chief executive officer. Any

replacement chief executive officer requires the consent of the investment funds associated with CD&R

as well as investment funds associated with at least one other Sponsor. It also contains restrictions on

the transfer of our shares, and provides for tag-along and drag-along rights, in certain circumstances.

The rights described above apply only for so long as the investment funds associated with the applicable

Sponsor maintain certain specified minimum levels of shareholdings in us.

The Stockholders Agreement limits the rights of the investment funds associated with or designated by

the Sponsors that have invested in our common stock and our affiliates, subject to several exceptions, to

own, manage, operate or control any of our ‘‘competitors’’ (as defined in the Stockholders Agreement).

The Stockholders Agreement may be amended from time to time in the future to eliminate or modify

these restrictions without our consent.

Registration Rights Agreement

On December 21, 2005, we entered into a registration rights agreement (as amended, the ‘‘Registration

Rights Agreement’’) with investment funds associated with or designated by the Sponsors. The

Registration Rights Agreement grants to certain of these investment funds the right, to cause us, at our

own expense, to use our best efforts to register such securities held by the investment funds for public

resale, subject to certain limitations. The exercise of this right is limited to three requests by the group of

investment funds associated with each Sponsor, except for registrations effected pursuant to Form S-3,

which are unlimited, subject to certain limitations, if we are eligible to use Form S-3. The secondary

offerings of our common stock in June 2007, May 2009, June 2009, March 2011 and December 2012

157