Hertz 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

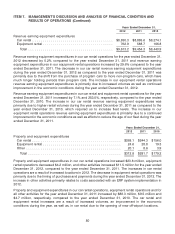

Our primary use of cash in investing activities is for the acquisition of revenue earning equipment, which

consists of cars and equipment. During the year ended December 31, 2012, we used $2,553.9 million

more cash for investing activities compared with the same period in 2011. The increase in the use of

funds was primarily due to the Dollar Thrifty acquisition along with other acquisitions during the year,

decreases in proceeds from the disposal of revenue earning equipment, a decrease in the

year-over-year change in restricted cash and cash equivalents and revenue earning equipment

expenditures during the year. As of December 31, 2012 and 2011, we had $571.6 million and

$308.0 million, respectively, of restricted cash and cash equivalents to be used for the purchase of

revenue earning vehicles and other specified uses under our fleet financing facilities, our Like Kind

Exchange Program, or ‘‘LKE Program,’’ and to satisfy certain of our self-insurance regulatory reserve

requirements. The increase in restricted cash and cash equivalents of $263.6 million from December 31,

2011 to December 31, 2012, primarily related to the acquisition of Dollar Thrifty.

During the year ended December 31, 2012, cash flows from financing activities increased by

$3,111.2 million compared with the same period in 2011. The increase was primarily related to the 2012

issuance of incremental Senior Notes and incurrence of incremental Term Loans related to the Dollar

Thrifty acquisition and higher payments of pre-funded debt associated with our Senior Note

redemptions in the prior year.

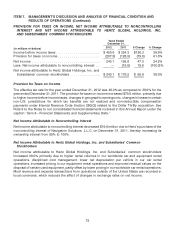

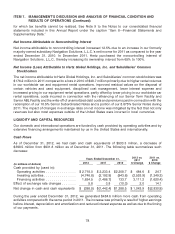

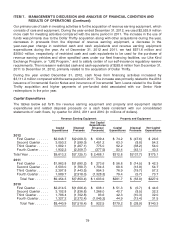

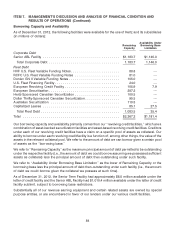

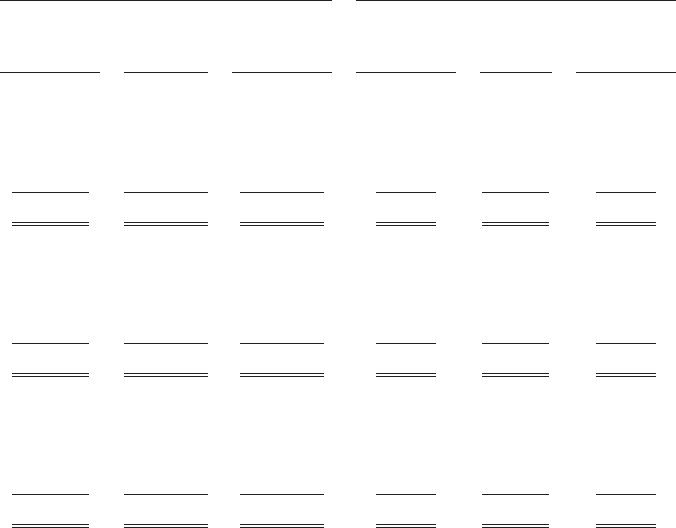

Capital Expenditures

The tables below set forth the revenue earning equipment and property and equipment capital

expenditures and related disposal proceeds on a cash basis consistent with our consolidated

statements of cash flows, by quarter for 2012, 2011 and 2010 (in millions of dollars).

Revenue Earning Equipment Property and Equipment

Net Capital

Expenditures

Capital Disposal (Disposal Capital Disposal Net Capital

Expenditures Proceeds Proceeds) Expenditures Proceeds Expenditures

2012

First Quarter ...... $2,648.7 $(2,009.3) $ 639.4 $ 74.2 $ (47.6) $ 26.6

Second Quarter .... 3,050.2 (1,599.0) 1,451.2 63.0 (8.8) 54.2

Third Quarter ...... 1,982.1 (1,207.1) 775.0 92.2 (38.2) 54.0

Fourth Quarter ..... 1,932.2 (2,309.7) (377.5) 83.4 (43.1) 40.3

Total Year .......... $9,613.2 $(7,125.1) $ 2,488.1 $312.8 $(137.7) $175.1

2011

First Quarter ...... $1,963.8 $(1,690.2) $ 273.6 $ 56.8 $ (14.5) $ 42.3

Second Quarter .... 3,503.0 (1,798.7) 1,704.3 68.6 (13.9) 54.7

Third Quarter ...... 2,397.8 (1,443.5) 954.3 76.9 (19.7) 57.2

Fourth Quarter ..... 1,589.7 (2,918.0) (1,328.3) 79.4 (5.7) 73.7

Total Year ....... $9,454.3 $(7,850.4) $ 1,603.9 $281.7 $ (53.8) $227.9

2010

First Quarter ...... $2,214.5 $(1,606.4) $ 608.1 $ 51.3 $ (6.7) $ 44.6

Second Quarter .... 3,102.8 (1,836.8) 1,266.0 40.7 (8.5) 32.2

Third Quarter ...... 1,796.4 (1,702.8) 93.6 42.3 (10.3) 32.0

Fourth Quarter ..... 1,327.2 (2,372.4) (1,045.2) 44.9 (13.4) 31.5

Total Year ....... $8,440.9 $(7,518.4) $ 922.5 $179.2 $ (38.9) $140.3

79