Hertz 2012 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC.

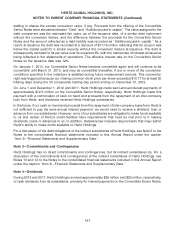

NOTES TO PARENT COMPANY FINANCIAL STATEMENTS (Continued)

settling in shares the excess conversion value, if any. Proceeds from the offering of the Convertible

Senior Notes were allocated between ‘‘Debt’’ and ‘‘Additional paid-in capital.’’ The value assigned to the

debt component was the estimated fair value, as of the issuance date, of a similar debt instrument

without the conversion feature, and the difference between the proceeds for the Convertible Senior

Notes and the amount reflected as a debt liability was recorded as ‘‘Additional paid-in capital.’’ As a

result, at issuance the debt was recorded at a discount of $117.9 million reflecting that its coupon was

below the market yield for a similar security without the conversion feature at issuance. The debt is

subsequently accreted to its par value over its expected life, with the market rate of interest at issuance

being reflected in the statements of operations. The effective interest rate on the Convertible Senior

Notes on the issuance date was 12%.

On January 1, 2013, our Convertible Senior Notes became convertible again and will continue to be

convertible until March 31, 2013, and may be convertible thereafter, if one or more of the conversion

conditions specified in the indenture is satisfied during future measurement periods. This conversion

right was triggered because our closing common stock price per share exceeded $10.77 for at least 20

trading days during the 30 consecutive trading day period ending on December 31, 2012.

On June 1 and December 1, 2012 and 2011, Hertz Holdings made semi-annual interest payments of

approximately $12.5 million on the Convertible Senior Notes, respectively. Hertz Holdings made this

payment with a combination of cash on hand and proceeds from the repayment of an inter-company

loan from Hertz, and dividends received Hertz Holdings subsidiaries.

In the future, if our cash on hand and proceeds from the repayment of inter-company loans from Hertz is

not sufficient to pay the semi-annual interest payment, we would need to receive a dividend, loan or

advance from our subsidiaries. However, none of our subsidiaries are obligated to make funds available

to us and certain of Hertz’s credit facilities have requirements that must be met prior to it making

dividends, loans or advances to us. In addition, Delaware law imposes requirements that may restrict

Hertz’s ability to make funds available to Hertz Holdings.

For a discussion of the debt obligations of the indirect subsidiaries of Hertz Holdings, see Note 5 to the

Notes to the consolidated financial statements included in this Annual Report under the caption

‘‘Item 8—Financial Statements and Supplementary Data.’’

Note 3—Commitments and Contingencies

Hertz Holdings has no direct commitments and contingencies, but its indirect subsidiaries do. For a

discussion of the commitments and contingencies of the indirect subsidiaries of Hertz Holdings, see

Notes 10 and 12 to the Notes to the consolidated financial statements included in this Annual Report

under the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

Note 4—Dividends

During 2012 and 2011, Hertz Holdings received approximately $25 million and $23 million, respectively,

of cash dividends from its subsidiaries, primarily for interest payments on the Convertible Senior Notes.

167