Hertz 2012 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

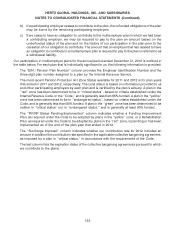

Brazilian Fleet Financing Facility

As of December 31, 2012, our Brazilian operating subsidiary is party to certain local financing

arrangements, which are collateralized by certain of its assets, which we refer to as the ‘‘Brazilian Fleet

Financing Facility.’’

In June 2012, Hertz caused its Brazilian operating subsidiary to amend the Brazilian Fleet Financing

Facility to extend the maturity date from June 2012 to February 2013.

See Note 18—Subsequent Events.

Capitalized Leases

References to the ‘‘Capitalized Leases’’ include the capitalized lease financings outstanding in the

United Kingdom, or the ‘‘U.K. Leveraged Financing,’’ Australia, The Netherlands and the United States.

The amount available under the U.K. Leveraged Financing, which is the largest portion of the Capitalized

Leases, as of December 31, 2012 was £195 million (the equivalent of $314.0 million as of December 31,

2012).

Restricted Net Assets

As a result of the contractual restrictions on Hertz’s or its subsidiaries’ ability to pay dividends (directly or

indirectly) under various terms of our debt, as of December 31, 2012, the restricted net assets of our

subsidiaries exceeded 25% of our total consolidated net assets.

Registration Rights

Hertz entered into exchange and registration rights agreements entered into in connection with (i) the

issuance of $250 million in aggregate principal amount of the 6.75% Senior Notes due 2019 in March

2012, and (ii) the release from escrow of the proceeds of $700 million aggregate principal amount of

5.875% Senior Notes due 2020 and $500 million aggregate principal amount of 6.250% Senior Notes

due 2022. Pursuant to the terms of these agreements, Hertz agreed to file a registration statement under

the Securities Act of 1933, as amended, to permit either the exchange of such notes for registered notes

or, in the alternative, the registered resale of such notes. Hertz’s failure to meet its obligations under

either exchange and registration rights agreement, including by failing to have the registration statement

become effective by the date that is 365 days after the respective date of the exchange and registration

rights agreement or failing to complete the exchange offer by the date that is 395 days after the date of

the exchange and registration rights agreement, will result in Hertz incurring special interest on such

notes at a per annum rate of 0.25% for the first 90 days of any period where a default has occurred and is

continuing, which rate will be increased by an additional 0.25% during each subsequent 90 day period,

up to a maximum of 0.50%. A registration statement on Form S-4 covering the exchange of such notes

was declared effective by the SEC on February 1, 2013 and the exchange offer is scheduled to be

completed on March 6, 2013, so we do not believe the special interest obligation is probable, and as

such, we have not recorded any amounts for special interest with respect to these notes.

Financial Covenant Compliance

Under the terms of our Senior Term Facility and Senior ABL Facility, we are not subject to ongoing

financial maintenance covenants; however, under the Senior ABL Facility, failure to maintain certain

levels of liquidity will subject the Hertz credit group to a contractually specified fixed charge coverage

124