Hertz 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

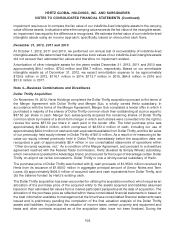

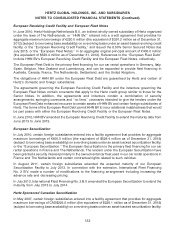

(2) References to our ‘‘Senior Notes’’ include the series of Hertz’s unsecured senior notes set forth in the table below. As of December 31, 2012

and December 31, 2011, the outstanding principal amount for each such series of the Senior Notes is also specified below.

Outstanding Principal (in millions)

December 31, December 31,

Senior Notes 2012 2011

8.875% Senior Notes due January 2014 ............ $ — $ 162.3

7.875% Senior Notes due January 2014 ............ — 276.3(e213.5)

7.50% Senior Notes due October 2018 ............. 700.0 700.0

6.75% Senior Notes due April 2019 ............... 1,250.0 1,000.0

5.875% Senior Notes due October 2020 ............ 700.0 —

7.375% Senior Notes due January 2021 ............ 500.0 500.0

6.25% Senior Notes due October 2022 ............. 500.0 —

$3,650.0 $2,638.6

(3) As of December 31, 2012 and 2011, $40.6 million and $65.5 million, respectively, of the unamortized corporate discount relates to the 5.25%

Convertible Senior Notes.

(4) Maturity reference is to the ‘‘expected final maturity date’’ as opposed to the subsequent ‘‘legal maturity date.’’ The expected final maturity date

is the date by which Hertz and investors in the relevant indebtedness expect the relevant indebtedness to be repaid. The legal final maturity

date is the date on which the relevant indebtedness is legally due and payable.

(5) RCFC U.S. ABS Program and the Dollar Thrifty-Sponsored Canadian Securitization represent fleet debt acquired in connection with the Dollar

Thrifty acquisition on November 19, 2012.

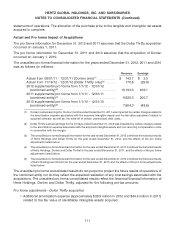

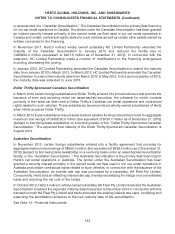

Maturities

The aggregate amounts of maturities of debt for each of the twelve-month periods ending December 31

(in millions of dollars) are as follows:

2013 ........ $6,218.8 (including $5,718.7 of other short-term borrowings*)

2014 ........ $1,122.1

2015 ........ $1,894.1

2016 ........ $ 267.1

2017 ........ $ 219.2

After 2017 .... $5,752.5

* Our short-term borrowings as of December 31, 2012 include, among other items, the amounts outstanding under

the Senior ABL Facility, HVF U.S. Fleet Variable Funding Notes, RCFC U.S. Fleet Variable Funding Notes, Donlen

GN II Variable Funding Notes, U.S. Fleet Financing Facility, European Revolving Credit Facility, European

Securitization, Hertz-Sponsored Canadian Securitization, Dollar Thrifty-Sponsored Canadian Securitization,

Australian Securitization, Brazilian Fleet Financing Facility and Capitalized Leases. These amounts are reflected as

short-term borrowings, regardless of the facility maturity date, as these facilities are revolving in nature and/or the

outstanding borrowings have maturities of three months or less. Short-term borrowings also include the Convertible

Senior Notes which became convertible on January 1, 2012 and remain as such through March 31, 2013. As of

December 31, 2012, short-term borrowings had a weighted average interest rate of 2.1%.

We are highly leveraged and a substantial portion of our liquidity needs arise from debt service on our

indebtedness and from the funding of our costs of operations, acquisitions and capital expenditures. We

believe that cash generated from operations and cash received on the disposal of vehicles and

equipment, together with amounts available under various liquidity facilities will be adequate to permit us

to meet our debt maturities over the next twelve months.

115