Hertz 2012 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2012 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

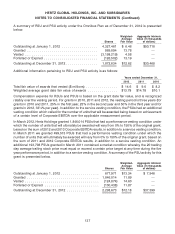

In addition to the 17.4 million shares underlying outstanding awards as of December 31, 2012, we had

16.9 million shares of our common stock available for issuance under the Omnibus Plan. The shares of

common stock to be delivered under the Omnibus Plan may consist, in whole or in part, of common

stock held in treasury or authorized but unissued shares of common stock, not reserved for any other

purpose.

Shares subject to any award granted under the Omnibus Plan that for any reason are canceled,

terminated, forfeited, settled in cash or otherwise settled without the issuance of common stock after the

effective date of the Omnibus Plan will generally be available for future grants under the Omnibus Plan.

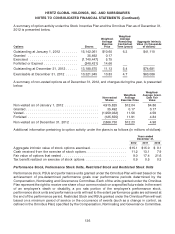

In March 2012, we granted 543,880 Restricted Stock Units, or ‘‘RSUs,’’ to certain executives and

employees at fair values ranging from $13.65 to $14.47, 747,423 Performance Stock Units, or ‘‘PSUs,’’ at

a fair value of $13.65, and 1,098,591 PSUs (referred to as Price Vesting Units, or ‘‘PVUs’’) at fair values

ranging from $10.13 to $11.26 under the Omnibus Plan. The PSUs have a performance condition under

which the number of units that will ultimately be awarded will vary from 0% to 150% of the original grant,

based on 2012 and 2013 Corporate EBITDA results. ‘‘EBITDA’’ means consolidated net income before

net interest expense, consolidated income taxes and consolidated depreciation (which includes

revenue earning equipment lease charges) and amortization. ‘‘Corporate EBITDA,’’ represents EBITDA

as adjusted for car rental fleet interest, car rental fleet depreciation and certain other items, as provided in

the applicable award agreements. Of the PVUs granted, one half will fully vest after three years if the

stock price appreciates 15% over the starting price established on March 2, 2012, and one half will fully

vest after four years if the stock price appreciates 25% over the starting price established on March 2,

2012. The starting price for the PVU awards is the average of the 20 trading day closing stock price

ending March 2, 2012. Partial attainment of the stock appreciation targets will result in partial vesting.

The achievement of the market condition for the PVUs is determined based on the average closing stock

price for the 20 trading day period ending March 6, 2015 and 2016, respectively. In May 2012, we

granted 146,301 RSUs at a fair value of $15.48, in August 2012, we granted 59,480 RSUs at a fair value of

$12.12, and in November 2012, we granted 24,713 RSUs at a fair value of $13.15. In November 2012, we

granted 35,492 non-qualified options with a strike price of $0.17 in exchange for 6,000 Dollar Thrifty

options with a strike price of $0.97.

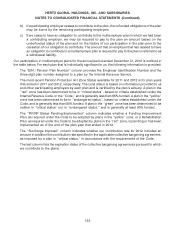

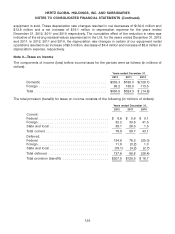

A summary of the total compensation expense and associated income tax benefits recognized under

our Prior Plans and the Omnibus Plan, including the cost of stock options, RSUs, and PSUs, is as follows

(in millions of dollars):

Years Ended December 31,

2012 2011 2010

Compensation expense .................................... $30.3 $ 31.0 $ 36.6

Income tax benefit ........................................ (11.7) (12.0) (14.2)

Total ................................................. $18.6 $ 19.0 $ 22.4

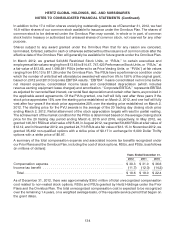

As of December 31, 2012, there was approximately $38.0 million of total unrecognized compensation

cost related to non-vested stock options, RSUs and PSUs granted by Hertz Holdings under the Prior

Plans and the Omnibus Plan. The total unrecognized compensation cost is expected to be recognized

over the remaining 1.4 years, on a weighted average basis, of the requisite service period that began on

the grant dates.

134